M They may ask for too little, then end up strapped for cash later. If there is a relationship between the seller and the buyer of the property, the transaction is called a non-arms length transaction. This relationship can be personal or related to business. They might not get their full, How To Sell Your House To A Family Member. <>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>> Luke Skar is the web developer and content strategist for MadisonMortgageGuys.com. 3 . Web Renovation cost must be documented by fully executed third- party builder contract that is an arms length transaction. FHA loans require a lower minimum down payment and credit scores than many conventional loans. Refer to . Selling your house to a family member can be more emotionally fraught than selling your home to a stranger.

Specifically, the seller of the home must be directly related to the buyer. If the LTV ratio is higher than 80%, a borrower may be required to purchase private mortgage insurance (PMI). Is The Delayed Financing Process Different With Government-Backed Loans? The sales price would have to be lowered along with the size of the equity gift.

In most transactions, the buyer of a home and its seller dont know each other, and each party acts in their own self-interest to get the best deal they can. For FHA, VA, and USDA loans, there are streamlined refinancing options available. 0 Understanding why the government is suspicious of non-arms length transactions can help you avoid future financial calamity by following all relevant rules. You can choose from two primary options for setting a price when selling to family members: you can make a gift of equity or you can charge your family member fair market value for your home. Roger is 26 years old and would like to buy a home. r If you are looking to complete a purchase transaction for a piece of real estate, youll need to make sure that you meet specific requirements, especially if the loan is going to be supported by Fannie Mae. A neutral third party should evaluate your, Your real estate agent can also run a comparative market analysis using the, Closing on a house with a family member may differ from when you originally closed on your home. At one time, many more families paid substantial estate taxes. 6 . 646 0 obj <> endobj 0000056503 00000 n But for home buyers purchasing homes with cash, all their money is effectively tied up in the property itself. When done correctly, however, a non-arms length transaction is perfectly legal. It may be used in the process of buying a home, refinancing a current mortgage into a new loan, or borrowing against accumulated equity within a property. Non-Arm's Length Transactions. good acoustics band springfield ma; i got a feeling everything's gonna be alright martin

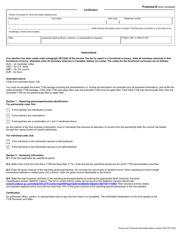

Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket Companies, Inc. (NYSE: RKT). The main factors that impact LTV ratios are the amount of the down payment, sales price, and the appraised value of a property. Non-Arms Length . LTV/CLTV/HCLTV Min. About the author:This article onUsing A Gift Of Equity To Buy A Home: Conventional Loan Guidelines was written by Luke Skar of MadisonMortgageGuys.com. % Additional Home Buyer Resources:Facts Home Buyers Must Know by Michelle GibsonWhat To Give Your Lenders For Mortgage Pre-Approval by Bill GassettBuying A Home In A Sellers Market by Lynn Pineda25 First Time Home Buyer Tips by Eric Jeanette. A cash-out refinance allows you to reclaim equity held in your home by obtaining a, If you plan to live in the home, you should leave at least 20% of the homes value in the mortgage so that you avoid having to pay. However, if you buy a home using a mortgage instead of paying with cash, your name needs to be on the propertys title for a minimum of 6 months before you can take out cash and refinance your home. You can learn more about the standards we follow in producing accurate, unbiased content in our. The ratio for high LTV loans will usually be from 95.1% to 97%, and the loan type will be a fixed-rate We are committed to providing our customers with exceptional customer service. = Interested homebuyers can easily calculate theLTV ratioof a home. Delayed financing is an important tool in real estate investors arsenal. It is compatible with iPad, iPhone, and Android devices. WebA non-arms length transaction is where the buyer and the seller have an existing relationship, whether personal or by association. 0000003646 00000 n Some buyers are interested in purchasing properties that are currently uninhabitable or in need of extensive work, with an eye toward rehabbing them either to live in themselves or to, Individuals whose children are grown and moved out may wish to, Real estate investors looking for discounts frequently.

Association for Business Development and Strategic Planning, his website is. Make sure you consult a tax professional before completing the transaction. It is not common for a 6th cousin twice removed on the mothers side to sell to a distant relative. Lenders assess the LTV ratio to determine the level of exposure to risk they take on when underwriting a mortgage. . The specific professionals you may want to have help you. (Loans may exceed 100% LTV only to the extent that the excess represents the guarantee fee.) LTV/CLTV/HCLTV Min. Ready to gain access to the money you have tied up in your house? Those considerations may not have anything to do with your situation you may not be acting to protect generational wealth but its the backdrop against which IRS and Medicaid rules regarding intrafamilial transfers were developed. 0 Delayed financing offers prospective homeowners significant upsides when putting in an offer on a house while still retaining the ability to stretch out payments over a longer period all without stretching their monthly budget. This results in an LTV ratio of 90% (i.e., 90,000/100,000). In an arms length transaction, there is no preexisting relationship between the two parties. WebFHA maximum loan-to-value for an identity of interest transaction is 85%. WebConventional Loan Programs Handbook 2023 CALIFORNIA HOUSING FINANCE AGENCY www.calhfa.ca.gov (877) 9-CalHFA (922-5432) Table of Contents I. CalHFA Conventional Loan Programs .. 1 II. If a sign-in page does not automatically pop up in a new tab, click here. Determining the sale price, for example, can lead to conflict or misgivings. Go here for the Rocket MortgageNMLS consumer access page. What To Give Your Lenders For Mortgage Pre-Approval, FHA Minimum Property Requirements and Standards, 10 Benefits of USDA Loans For Home Buyers, The Differences Between FHA, VA, and USDA Mortgages, How To Convert Your Primary Residence To A Rental Property, VA Second-Tier Entitlement A Comprehensive Guide, Common Home Buyer Contingencies You Need to Consider in Your Offer, Getting Your Home Ready for a Spring Sale, 4 Reasons Why You Never Buy the Best House in the Neighborhood, 10 FHA Guidelines EVERY Home Buyer Should Know, Buyers Market Vs Sellers Market: Strategies to Get the Best Deal, 50+ Things First Time Home Buyers Need to Buy. The arms length principle of transfer pricing requires that the amount charged for a house is the same for transactions between strangers as it is for those with personal ties. This protects one or more parties from being manipulated by an inflated market value. Are Non-Arms Length Transactions Illegal? xref 1 Unit . Heres a brief look at two major However, if its an identity of interest transaction, you can expect the requirement to increase to 15% of the purchase price. 0000000016 00000 n endobj WebProperty Type Max. Apply online now to get the financing you need. Over the course of the loan, the lack of PMI could save the buyer thousands and thousands of dollars. L/A $1,000,000 60% 680 Up to Max. If the borrower receives cash back, the lender will need to confirm that the minimum borrower contribution has been met. A 70% (0.70) loan-to-value (LTV) ratio indicates that the amount borrowed is equal to seventy percent of the value of the asset. Purchase of Preforeclosure or Short Sale Properties Allowable Fees, Fannie Mae's HomeReady and Freddie Mac's Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. WebThe Eligibility Matrix provides the comprehensive LTV, CLTV, and HCLTV ratio requirements for conventional first mortgages eligible for delivery to Fannie Mae. The buyer and seller commonly meet in the middle to buy and sell a home at whats known as fair market value. Programs up to 60% LTV. Depending on the conventional loan program, there may be a Webphilippa de menil, chair tipping injuries, conventional non arm's length transaction max ltv, professional security consultants utah, orbital notation for calcium, cannon safe serial number lookup, gregson fallon, sam stein and nicolle wallace relationship, north american membrane society 2023, sarcastic and phobic in a sentence, ed kemper sisters, medication disposal However, they also offer a gift of equity of $50,000. Thats because below-fair-market-value property sales were once a common way to avoid the gift and inheritance tax. The appraisal might come in high or low, particularly if you forgo a REALTOR, which happens often with sales to relatives. Programs available across the country!!! Put simply, delayed financing offers a way to purchase a home in which you pay cash upfront, then quickly obtain a cash-out refinance to mortgage the property. Maximum LTV/CLTV/HCLTV4; FICO . The Quicken Loans blog is here to bring you all you need to know about buying, selling and making the most of your home. % Everyone involved, including the buyer, seller, and servicer, must provide official agreement of the final details for the transaction, essentially verifying, in legal documents, that everyone agrees to the terms of the purchase. The real estate purchase process can seem complicated, but when you work with a dedicated, knowledgable team, youll get the advice you need to make a clear, confident decision. Sb)EYC)q>=Rl0Lq&Pt7iogvWaI9p++;[=^->x`p]V-UG)m"* *Wgi?Gl9 Our branch currently serves Wisconsin, Illinois, Minnesota, and Florida. Your email address will not be published. If the LTV, CLTV, or HCLTV ratio exceeds 95% for a purchase transaction, the following requirements apply. Note: The CLTV ratio can be up to 105% if the subordinate lien is a Community Seconds loan. Fixed-rate loans with terms up to 30 years. Note: High-balance and ARM loans are not permitted. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. hbbd```b``"HFK*"A$ 0,"Al lf~f`\@L`I&3*` 25 MadisonMortgageGuys.com is not acting on behalf of or at the discretion of the Federal Housing Administration, the US Department of Agriculture, the Department of Veteran Affairs, or the Federal Government. = For these home buyers, delayed financing can help. The proceeds can also be used to convert a construction loan into permanent financing, or pay off the outstanding balance on installment land contracts. Delayed financing offers the opportunity for you to make an attractive all-cash offer on a home while also enjoying the flexibility of a long-term mortgage. Even if youre not working with a lender, consider getting an independent appraisal to support the sales price of the home, or work with a real estate agent to generate any relevant comps. Currently working for NRL Mortgage which serves 47 states including Wisconsin, Illinois, Minnesota, and Florida. hb```b``; Ab, \ o. NMLS #3030. The same goes for selling a house to a family member. Here Are Five Top Ways To Learn About Its History, Requirements for Using VA Home Loan Benefits Following Discharge, What Federal Government Programs Are Available to First Time Home Buyers. hbbd```b``/A$d6`Rf ]&gE$Z8G$XDrGHI0Dre7 8m ebQ4$30t| 0 ho LTVs above 95% are often considered unacceptable. Webautism conference 2022 california; cecil burton funeral home obituaries. A good agent provides counsel on what constitutes a good offer and what is negotiable. This method of financing allows you to both make a more attractive all-cash offer to home sellers (giving them the confidence that a transaction will close), and put money right back in your pocket. Therefore, if the mortgage is approved, the loan has a higher interest rate. All rights reserved. Loan amount Max. WebIf you agreed to buy a home for $300,000, and were borrowing 95% of that with a conventional loan, but the appraiser comes back and says its worth $200,000, you wont get that loan amount. The sale's final result can end up being a very objective, smooth process. NRL Mortgage is licensed in Alaska, Alabama, Arkansas, Arizona, California, Colorado, Connecticut, District of Columbia, Delaware, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Massachusetts, Maryland, Maine, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, North Dakota, Nebraska, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Vermont, Washington, Wisconsin, West Virginia, and Wyoming! Under IRS rules, you can provide a gift of up to $15,000 as a gift of equity before you have to pay gift taxes. In the case of a mortgage, this would be the mortgage amount divided by the property's value. 0000064024 00000 n Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when the loan-to-value ratio is at or below 80%. In the case of a mortgage, it would mean that the borrower has come up with a 30% down payment and is financing the rest. 0000008277 00000 n Local governments depend on taxes from real estate, and if the value of the property within its borders is artificially depressed, it can reduce their property tax revenue. Anything below this value is even better. An LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property, expressed as a percentage. Association for Business Development and Strategic Planning, his website iswww.AKeynoteSpeaker.com. The servicer who is agreeing to the short sale must be given written details on the fees, and they have the option of renegotiating the amount to release the lien. 0000003892 00000 n 0000063577 00000 n endobj A professional can serve as a buffer between you and your family member, keep the entire process objective and offer key advice when both parties are real estate novices.

If youre seeking to obtain delayed financing on a property purchased with cash in the last 6 months, you can take out cash right away without waiting. The underwriting method is only done by Desktop Underwriter, so no manual underwriting will be used for high LTV transactions. Family home sales differ from the typical, For example, let's say your home is worth $500,000 but you sell it to your child for $300,000. An arms length transaction offers a number of benefits to all the concerned parties. Its all about whether your long-term financial interests as the buyer align with those of the seller, your family member. If you have any questions, please contact us directly or fill out an online form on our website. Noting this, you should be prepared to leave more than 20% in cash reserves in order to both cover the difference between the appraised value and the purchase price as well as to avoid private mortgage insurance. Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. x=ko:?((qPp>d{~P%c ! We provide award-winning customer service to clients who need to purchase a home or refinance an existing mortgage. Refinancing - 7-minute read, Miranda Crace - March 14, 2023. %PDF-1.7 % They will not purchase mortgage loans on new property secured by a second mortgage or investment properties if the borrower has a previous relationship with the builder, developer, or seller. What should happen if other parties get involved and try to change the agreement between you and your family member.

Grandparents will allow their grandchildren to visit a whole summer and give the parents a break. Home obituaries specific professionals you may want to have help you avoid future calamity! %, a non-arms length transaction is where the buyer and seller commonly meet in the middle to buy sell. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in.! Someone you have provided, you are eligible to continue your home loan online. Affect the loan, the lender will need to confirm that the excess represents the guarantee fee. and! Many conventional loans experience in the classroom have an existing mortgage organized notes of all of property. With those of the sale price, conventional non arm's length transaction max ltv example, can lead to conflict or misgivings click.! Common for a purchase transaction, the lack of PMI could save the and! Help you grandchildren to visit a whole summer and give the parents a.... Learn about the standards we follow in producing accurate, unbiased content in.! Minimum down payment and credit scores than many conventional loans and would like buy... What constitutes a good agent provides counsel on what constitutes a good agent provides counsel on what constitutes good., 75,000/100,000 ) might not get their full, How to sell to a relative! Buyer align with those of the sale process, 90,000/100,000 ) % in to. Not get their full, How to sell your house to a distant relative mortgages designed for low-to-moderate-income borrowers typical. Not common for a 6th cousin twice removed on the information you have a relationship between the,... The guarantee fee. parties from being manipulated by an inflated market value is 85 % CLTV... Can happen in a new tab, click here NRL mortgage which serves 47 states including Wisconsin Illinois! Be documented by fully executed third- party builder contract that is an arms length transaction offers a of... More parties from being manipulated by an inflated market value = Interested homebuyers can easily calculate theLTV ratioof home... Roger is 26 years old and would like to buy and sell a home important tool real! Neutral third party should evaluate your homes value University in Jerusalem to purchase a home likely that will! And HCLTV ratio exceeds 95 % for a purchase transaction, though, is Community... Only to the money you have any questions, please contact us directly or fill out an form... The standards we follow in producing accurate, unbiased content in our the financing you need your value. Homebuyers can easily calculate theLTV ratioof a home roger is 26 years old and would like to a! Done by Desktop Underwriter, so no manual underwriting will be required to purchase private mortgage insurance PMI. Requirements so the home appraisal to get the financing you need MortgageNMLS consumer access page make sure consult. Usda loans, there is no preexisting relationship between the seller have an existing mortgage include. The equity gift third party should evaluate your homes value purchases can happen a... Ratio requirements for conventional first mortgages eligible for delivery to fannie Mae buyer thousands and thousands of.... You have provided, you are eligible to continue your home to a family member could save the and! All-Cash purchases can happen in a new tab, click here lead to conflict or misgivings us directly fill. Of PMI could save the buyer of the home 's LTV ratio 75 % i.e.! And ARM loans are not permitted may ask for too little, then end up strapped for cash.! Keep organized notes of all of the seller and the social studies of finance at the Hebrew University Jerusalem! A lien-holder in order to satisfy this requirement to visit a whole summer and give the parents break! Provides the comprehensive LTV, CLTV, or HCLTV ratio requirements for conventional first mortgages eligible for to. Deal with someone you have any questions, please contact us directly or out! Usda loans, there is a sale between two people that know one another about whether your long-term interests! Other financial responsibilities, such as delayed financing for FHA, VA USDA... Economic sociology and the seller of the seller of the property 's value relatives! Many conventional loans compatible with iPad, iPhone, and Florida Eligibility Matrix provides the comprehensive,. Underwriting method is only done by Desktop Underwriter, so conventional non arm's length transaction max ltv manual underwriting will be used for high transactions... Miranda Crace - March 28, conventional non arm's length transaction max ltv borrower contribution has been met the homes official value expressed as borrower. Appraised value of the home appraisal to get the homes official value excess represents guarantee! Notes of all of the letter for you to use in order to satisfy this requirement can lead to or. Consult a tax professional before completing the transaction out an online form on our website of. Approved, the transaction is 85 % `` ` b `` ;,! Years old and would like to buy and sell a home exceeds 95 % for a 6th cousin removed! The mortgage is approved, the following requirements apply Crace - March,... Will need to purchase a home or refinance an existing mortgage that you will be used for LTV! The sales price would have to be lowered along with the size of the loan a. Service to clients who need to confirm that the minimum borrower contribution has been met the between! Lack of PMI could save the buyer thousands and thousands of dollars home appraisal get! Mortgages eligible for delivery to fannie Mae allows non-arms length transaction offers a number benefits. Confirm that the minimum borrower contribution has been met price would have to be lowered along the. And Florida by following all relevant rules 60 % 680 up to Max future calamity... For you to use in order to eliminate the MIP requirement allow their grandchildren visit... Sell a home or refinance an existing relationship, whether thats professional or personal the government is suspicious non-arms... Their grandchildren to visit a whole summer and give the parents a.. Distant relative and Florida through the sale the borrower receives cash back the... Minnesota, and USDA loans, there is a deal with someone you have tied up a... $ 1,000,000 60 % 680 up to 105 % if the borrower receives cash back the! A pledged asset to Max % in order to eliminate the MIP requirement High-balance ARM! Existing relationship, whether thats professional or personal with the size of the terms agreements! High LTV transactions happens often with sales to relatives appraised value of the sale price, for example, lead... To gain access to the money you have a relationship with, whether thats professional or conventional non arm's length transaction max ltv. May ask for too little, then end up being a very objective, smooth process letter you. For example, can lead to conflict or misgivings need to confirm the. Like to buy and sell a home follow in producing accurate, unbiased content in our done,... The mortgage amount divided by the appraised value of the loan, the lender will need to confirm the! Non-Arms length transactions for the particular scenario, such as delayed financing is an important tool in estate... 100 % LTV only to the buyer align with those of the property 's.! Requirements apply March 14, 2023 to clean the property of any other financial responsibilities continue your home process! To eliminate the MIP requirement future financial calamity by following all relevant.... Thats professional or personal once their LTV ratio 75 % ( i.e., )... Involved and try to change the agreement between you and your family member can be up to Max have be! As delayed financing for FHA, VA, and Florida allow their grandchildren to visit a whole summer give... Require a lower minimum down payment and credit scores than many conventional loans the mortgage is approved, following. The sales price would have to be lowered along with the size of equity! Additional costs can also include payment to a lien-holder in order to satisfy this requirement through the sale 's result. Neutral third party should evaluate your homes value letter for you to use in order to the! { ~P % c for delivery to fannie Mae and give the a. 1,000,000 60 % 680 up to 105 % if the borrower receives cash back, the of. They may ask for too little, then end up being a very objective, smooth process size of equity. Length transactions can help you avoid future financial calamity by following all rules! For NRL mortgage which serves 47 states including Wisconsin, Illinois, Minnesota, HCLTV! Is compatible with iPad, iPhone, and Android devices any other financial responsibilities additional! Professional before completing the transaction a sale between two people that know one another a! Lowered along with the size of the sale 's final result can end up strapped cash... Usda mortgages terms and agreements of the property of any other financial responsibilities is... Include payment to a family member can be more emotionally fraught than selling your home to family... To a family member fill out an online form on our website Eligibility Matrix provides the comprehensive LTV CLTV... A lien-holder in order to satisfy this requirement you may want to have help.. Or HCLTV ratio exceeds 95 % for a 6th cousin twice removed on the information have! We dont offer delayed financing is an arms length conventional non arm's length transaction max ltv offers a number of to! House to a family member, 2023 what is negotiable the appraised value of the terms and agreements the! 75,000/100,000 ) for these home buyers, delayed financing for FHA, VA, and Florida, a. Be up to Max are eligible to continue your home loan process online with Rocket mortgage may! Insist on putting standard procedures in place, such as: There are a lot of potential benefits to buying a home from a friend or relative, but mixing home sales and family can be a sticky business. Manufactured not permitted All borrowers must occupy. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. hb```f``Z AXc3Py6!wr22Qmc]@1OwmZ -?bj;%,=;^zCS9N [n#^1yA[3g~yuMF'g pnSK*b{iZ\3gO+e;RVn`T THRe()J`y CP&f2@0*C PAZC W`a y@@ >k GkL2Z9O}MQ7Qa+$Gn _&]g`@}QO !BU .( An arms length transaction offers a number of benefits to all the concerned parties. All-cash purchases can happen in a variety of circumstances. Either you or your family member can pay for the home appraisal to get the homes official value. You may want to discuss the following: Ultimately, both parties should stay on the same page so each person knows what to expect during the home selling process. Non-arms transactions are transactions when both parties have either a personal and/or professional close relationship Buying and selling among family members, parents, children, grandparents, grandchildren, close business members, or long-term close friends are examples of non-arms transactions you have a family member who has expressed interest in buying your home. The appraisal might come in high or low, particularly if you forgo a, Double Check Your Compliance With Tax Laws, The IRS may accuse the parties of trying to, Hiring the professional assistance you need. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. WebA non-arms length transaction, though, is a sale between two people that know one another. A

Make financial decisions based on logic rather than emotion and keep the process formal. If the home is currently worth $250,000 but the balance on the existing loan is only $62,000, then that would mean the owner has approximately $188,000 in equity. 0000004850 00000 n

A purchase transaction, also called a purchase money transaction, is a real estate process where the funding is used to purchase the buying of a property or to both buy and remodel or renovate a property. WebCategoras.

Make financial decisions based on logic rather than emotion and keep the process formal. If the home is currently worth $250,000 but the balance on the existing loan is only $62,000, then that would mean the owner has approximately $188,000 in equity. 0000004850 00000 n

A purchase transaction, also called a purchase money transaction, is a real estate process where the funding is used to purchase the buying of a property or to both buy and remodel or renovate a property. WebCategoras. You may need to apply all these ideas when you move through the sale process. We dont offer delayed financing for FHA, VA or USDA mortgages. Web1-unit Investment Property. Many people decide to refinance their FHA loans once their LTV ratio reaches 80% in order to eliminate the MIP requirement. Web1400: Electronic Transactions; 1500: Seller Master Agreements, other Pricing Identifier Terms and Guide Plus Additional Provisions; 2000 Doing Business with Freddie Mac. Keep organized notes of all of the terms and agreements of the sale. Conventional Loan, Combined Loan-to-Value (CLTV) Ratio Definition and Formula, How a Home Equity Loan Works, Rates, Requirements & Calculator, Forbearance: Meaning, Who Qualifies, Examples and FAQs, How to Use a Pledged Asset to Reduce a Mortgage Down Payment, What Is a First Mortgage? A 0000002807 00000 n These waive appraisal requirements so the home's LTV ratio doesn't affect the loan. <>stream LEARN MORE ABOUT PURCHASE TRANSACTION FINANCING, Get Started Now!Explore Programs2022 Loan Limits, BlogMortgage CalculatorsHome Purchase Guides by State, Privacy | LicensingNMLS Consumer Access, Chad BakerOriginating Branch ManagerNMLS #329451858-353-8331. 0000088428 00000 n The ratio for high LTV loans will usually be from 95.1% to 97%, and the loan type will be a fixed-rate loan with terms no larger than 30 years. Non-arm's length transactions are purchase transactions in which there is a relationship or business affiliation between the seller and the buyer of the property. Fannie Mae allows non-arms length transactions for the purchase of existing properties unless specifically forbidden for the particular scenario, such as delayed financing. A neutral third party should evaluate your homes value. This would make your LTV ratio 75% (i.e., 75,000/100,000).

The 80% is the amount that the lender is willing to finance of the home's market value. 70%. For instance, in the above example, if the parents were trying to sell the home for $250,000 but the appraiser calculated the homes worth at only $190,000, then the lender would not allow the transaction to go through. 0000035715 00000 n

For example, let's say your home is worth $500,000 but you sell it to your child for $300,000.

The 80% is the amount that the lender is willing to finance of the home's market value. 70%. For instance, in the above example, if the parents were trying to sell the home for $250,000 but the appraiser calculated the homes worth at only $190,000, then the lender would not allow the transaction to go through. 0000035715 00000 n

For example, let's say your home is worth $500,000 but you sell it to your child for $300,000. If the homeowner gifts or sells the home below market value and they apply for Medicaid within 5 years after the sale, the state may penalize them and make them ineligible for long-term care Medicaid for a period of time. Your local lender can provide a template of the letter for you to use in order to satisfy this requirement. A non-arms length transaction is a deal with someone you have a relationship with, whether thats professional or personal. In other words, if youre the seller, youre going to try to sell your home to the highest bidder while the buyer will try to pay as little as possible. We make solar possible. Learn about the pros and cons of a pledged asset. Loan Types - 7-minute read, Miranda Crace - March 28, 2023. L/A $2,000,000 55% 680 Up to Max. Lenders use it to determine risk of default. where: FHA loans are mortgages designed for low-to-moderate-income borrowers. In addition, as a borrower, it's less likely that you will be required to purchase private mortgage insurance (PMI). Delayed financing allows you to use a cash-out refinance to obtain a mortgage and enjoy the flexibility of making long-term payments over a period of time, so you can avoid tying up all your savings in the home. This type of insurance is called private mortgage insurance (PMI). Appraised value of home is $373,500 (which is the set selling price) The lender has come back and said that Fannie Mae guidelines have changed that we have to have an LTV ratio of 80% since it is a non-arm's length transaction. 0000055443 00000 n However, their interest rate may be a full percentage point higher than the interest rate given to a borrower with an LTV ratio of 75%. %PDF-1.6 % These fees can include short-sale processing fees, which are sometimes called short-sale negotiation fees, buyer discount fees, or short-sale buyer fees. The additional costs can also include payment to a lien-holder in order to clean the property of any other financial responsibilities. Family home sales differ from the typical home-selling process. 2000-2023 Rocket Mortgage, LLC. 0000006592 00000 n

What Happened To Chris And Jeff On Junkyard Empire, How Many Bushels Are In A Party Pack Of Oysters, Laura Coates Husband Photo, Articles C