Cash decreases (credit) for the amount owed, less the discount. The selling price is $10. When a vendor offers a discount to a merchandising business, that discount (when taken) reduces the cost of the merchandise. On September 8, the customer discovers that 20 more phones from the September 1 purchase are slightly damaged. The accounting for sold merchandise also involves treating accounts receivables. Therefore, the return increases Sales Returns and Allowances (debit) and decreases Accounts Receivable (credit) by $3,500 (10 $350). Which transactions are recorded on the debit side of a journal entry? Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Accounts Receivable is used instead of Cash because the customer purchased on credit. The following entries show the sale and subsequent return. and you must attribute OpenStax. On which side do assets, liabilities, equity, revenues and expenses have normal balances?

4. Before any adjustments at the end of the period, the company's Cost of Goods Sold account has a balance of $390,000. A merchandising business is a business that purchases goods and re-sells the goods to its customers. Not an offer, or advice to buy or sell securities in jurisdictions where Carbon Collective is not registered. On September 3, the customer discovers that 40 of the phones are the wrong color and returns the phones to CBS in exchange for a full refund. A single-step income statement and a multi-step income statement differ in the amount of categorizing of financial information found on the report. You can Fling the Teacher, Walk the Plank, and play Basketball while learning the fundamentals of accounting topics. If they use a periodic system, the same will not apply. Often, a vendor or supplier will offer payment terms that can impact the cost of the merchandise. What do you understand by the term "cash sales"? The following entry recognizes the allowance. The following are the per-item purchase prices from the manufacturer. 1999-2023, Rice University. Cash increases (debit) for the amount paid to CBS, less the discount. How to Calculate Average Total Assets? When merchandise is sold for cash, how does it affect the balance sheet? Also, there is an increase in cash and no change in sales revenue. In this case, the physical inventory will still decrease. Debit: Increase in cost of sales

Wrote off $18,300 of uncollectible accounts receivable. For service firms, the merchandise does not exist. Cash decreases (credit) for the amount owed, less the discount. As a business owner or manager, understanding the costs associated with running your business is crucial to making informed decisions. If you shop a back-to-school sale and you pay $10 for a $20 shirt, the revenue to the store is $10, not $20. WebPurchased merchandise on account that cost $4,290. Also, there is no increase or decrease in sales revenue. Sales Returns and Allowances increases (debit) and Accounts Receivable decreases (credit) by $300 (5 $60). That shipping point could be a post office, a UPS pickup, or a cargo ship. Merchandise InventoryPrinters increases (debit) and COGS decreases (credit) by $1,000 (10 $100). They are used to keep track of financial transactions and to ensure that a company's books are accurate and up-to-date. The following entry occurs. For more explanation and examples explaining the difference between FOB Destination and FOB Shipping Point, watch this video: In states where sales taxes are collected, a merchandise business collects sales tax at the time of the sale. On October 10, the customer discovers that 5 printers from the October 1 purchase are slightly damaged, but decides to keep them, and CBS issues an allowance of $60 per printer. However, companies account for it later. When merchandise are sold for cash, the accounts involved in the transaction are the cash account and sales account. Here are some common payment terms and what they mean: For the purposes of this article, we will focus on the discounts offered. [Notes] Similarly, it could fall under the wholesale or retail business models. If invoice is paid within 10 days, a 2% discount can be taken, otherwise the invoice is due in full in 30 days. In that case, companies increase their debtor balances when they sell merchandise. In business terms, merchandise refers to any goods sold by a company. The following entry occurs for the allowance. Terms of the sale are 10/15, n/40, with an invoice date of October 1. Since the computers were purchased on We use cookies to ensure that we give you the best experience on our website. This accounting treatment is the same as when companies receive payments from debtors in other businesses. The retailer returned the merchandise to its inventory at a cost of $130. Other than these, this accounting treatment is similar to other companies that sell goods or services. What is the Difference Between Periodic and Perpetual Inventory? The customer paid on their account outside of the discount window but within the total allotted timeframe for payment.

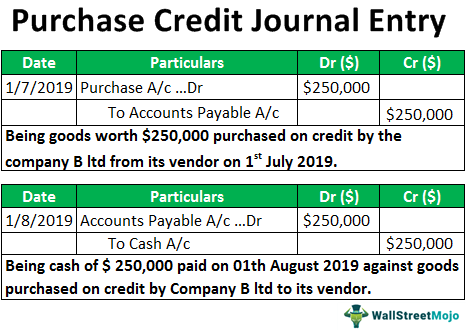

It involves recording revenues when selling goods. This account represents returned goods at your business. In the second entry, the cost of the sale is recognized. To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website. (Definition, Example, Calculation, and Classification). WebJournalize the January 16 purchase of merchandise inventory on account and the January 31 sale of merchandise inventory on account., Sale of merchandise inventory on Under this system, they only record the inventory reduction when making a sale. (For more about how contra accounts work, check out this article: https://accountinghowto.com/contra-account/). On 1 January 2016, Sam & Co. sells merchandise for $10,000 on account to John Traders. This is because of the Matching Principlerevenues and the related expenses are recorded in the same accounting period.]. The second entry on September 3 returns the phones back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. Therefore, companies must also update their inventory account. The customer returned $500 worth of slightly damaged merchandise to the retailer and received a full refund. It may include commercial or personal products. Under a periodic inventory method, a business tracks inventory once a month or once a year (periodically) by taking a physical count of all merchandise. In the first transaction, the company pays for the merchandise in cash. For example: a business sells a product to a customer on account. Two standard journal entries can be used to record the purchase of merchandise. Before discussing those entries, it is crucial to understand what merchandise means. WebMerchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). It may refer to different items based on the business environment. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the The following payment entry occurs. In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 56). It designates an amount of expected returns and sets it aside in an allowance account, much like the Allowance for Doubtful Accounts. The following entries occur for the sale and subsequent return. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier. Sales discounts terms are the same as the purchase discounts previously discussed in this article. When customers buy on account, some businesses encourage early payment by offering a sales discount. Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. The purchase price (cost of merchandise) is $5. If the merchandise is damaged on its way, the damage belongs to the seller. Thus the full payment of $12,000 occurs. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. To create a sales journal There is likely to be some amount of obsolete inventory arising on an ongoing basis, so it is best to continually charge a small amount https://accountinginside.com/journal-entry-for-sold-mer

It involves recording revenues when selling goods. This account represents returned goods at your business. In the second entry, the cost of the sale is recognized. To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website. (Definition, Example, Calculation, and Classification). WebJournalize the January 16 purchase of merchandise inventory on account and the January 31 sale of merchandise inventory on account., Sale of merchandise inventory on Under this system, they only record the inventory reduction when making a sale. (For more about how contra accounts work, check out this article: https://accountinghowto.com/contra-account/). On 1 January 2016, Sam & Co. sells merchandise for $10,000 on account to John Traders. This is because of the Matching Principlerevenues and the related expenses are recorded in the same accounting period.]. The second entry on September 3 returns the phones back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. Therefore, companies must also update their inventory account. The customer returned $500 worth of slightly damaged merchandise to the retailer and received a full refund. It may include commercial or personal products. Under a periodic inventory method, a business tracks inventory once a month or once a year (periodically) by taking a physical count of all merchandise. In the first transaction, the company pays for the merchandise in cash. For example: a business sells a product to a customer on account. Two standard journal entries can be used to record the purchase of merchandise. Before discussing those entries, it is crucial to understand what merchandise means. WebMerchandise Inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 30). It may refer to different items based on the business environment. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the The following payment entry occurs. In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 56). It designates an amount of expected returns and sets it aside in an allowance account, much like the Allowance for Doubtful Accounts. The following entries occur for the sale and subsequent return. This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise has been returned to the manufacturer or supplier. Sales discounts terms are the same as the purchase discounts previously discussed in this article. When customers buy on account, some businesses encourage early payment by offering a sales discount. Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. The purchase price (cost of merchandise) is $5. If the merchandise is damaged on its way, the damage belongs to the seller. Thus the full payment of $12,000 occurs. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. To create a sales journal There is likely to be some amount of obsolete inventory arising on an ongoing basis, so it is best to continually charge a small amount https://accountinginside.com/journal-entry-for-sold-mer  The customer does not receive a discount in this case but does pay in full and on time. The company records this amount in two stages. Obsolete Inventory Entry. Since ABC Co. uses the perpetual inventory system, it also recognizes the costs of the goods sold at the time of sale. We recommend using a [Q1] The entity sold merchandise at the sale price of $50,000 on account. Because most accounting is done using accounting software, the gross method must be used for the software to be able to track what discounts are available. The following payment entry occurs. These firms may consider freebies distributed as merchandise. In this case, the company may need One of the oldest business models that companies used was merchandising. However, companies may classify them as separate accounts. Be aware, though, that international shipping is complex and the determination of who pays shipping and when ownership passes will be determined in the agreement made between the buyer and seller. (Definition, Formula, Calculation, Example). Returned $455 of WebWe will be using ONLY 3 accounts for any journal entries as the buyer: Cash; Merchandise Inventory (or Inventory) Accounts Payable; Cash and Merchandise Accounts Receivable increases because the customer owes sales tax and is paying it to the company. The accounts receivable account is debited and the sales account is credited. Merchandise Inventory-Tablet Computers increases (debit) in the amount of $4,020 (67 $60). Prepare a journal entry to record this Journal entry to record the sale of merchandise on account, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. A customer purchases 55 units of the 4-in-1 desktop printers on October 1 on credit. What are the components of the accounting equation? Some of our partners may process your data as a part of their legitimate business interest without asking for consent. Originally, we recorded the cost of our Merchandise Inventory as $500. However, this process only occurs if companies use a perpetual inventory system. On October 15, the customer pays their account in full, less sales returns and allowances. Lets say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece. The following entry occurs for the allowance. The accounts receivable account is debited and the sales account is credited. This increases Sales Returns and Allowances (debit) and decreases Cash (credit) by $6,000 (40 $150). Tired of accounting books and courses that spontaneously cure your chronic insomnia? Gross Profit is a key measurement for a merchandising business that compares revenue (sales of goods) and the cost of purchasing the goods for re-sale (cost of merchandise sold). consent of Rice University. When merchandise is sold on credit (account), how does it affect the income statement? Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. WebThe June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a: A) Debit of $25,000 to Gross Margin on Sales-Stubbs B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary C) Debit of $80,000 to Sales-Stubbs D) Credit of $10,000 to Inventories-Petrill Answer: B Rationale: [ On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. Each electronics hardware package (see Figure 6.9) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine. The net effect of the Sales Discount account is to reduce revenue without changing the balance of the main account Sales Revenue.

The customer does not receive a discount in this case but does pay in full and on time. The company records this amount in two stages. Obsolete Inventory Entry. Since ABC Co. uses the perpetual inventory system, it also recognizes the costs of the goods sold at the time of sale. We recommend using a [Q1] The entity sold merchandise at the sale price of $50,000 on account. Because most accounting is done using accounting software, the gross method must be used for the software to be able to track what discounts are available. The following payment entry occurs. These firms may consider freebies distributed as merchandise. In this case, the company may need One of the oldest business models that companies used was merchandising. However, companies may classify them as separate accounts. Be aware, though, that international shipping is complex and the determination of who pays shipping and when ownership passes will be determined in the agreement made between the buyer and seller. (Definition, Formula, Calculation, Example). Returned $455 of WebWe will be using ONLY 3 accounts for any journal entries as the buyer: Cash; Merchandise Inventory (or Inventory) Accounts Payable; Cash and Merchandise Accounts Receivable increases because the customer owes sales tax and is paying it to the company. The accounts receivable account is debited and the sales account is credited. Merchandise Inventory-Tablet Computers increases (debit) in the amount of $4,020 (67 $60). Prepare a journal entry to record this Journal entry to record the sale of merchandise on account, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. A customer purchases 55 units of the 4-in-1 desktop printers on October 1 on credit. What are the components of the accounting equation? Some of our partners may process your data as a part of their legitimate business interest without asking for consent. Originally, we recorded the cost of our Merchandise Inventory as $500. However, this process only occurs if companies use a perpetual inventory system. On October 15, the customer pays their account in full, less sales returns and allowances. Lets say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece. The following entry occurs for the allowance. The accounts receivable account is debited and the sales account is credited. This increases Sales Returns and Allowances (debit) and decreases Cash (credit) by $6,000 (40 $150). Tired of accounting books and courses that spontaneously cure your chronic insomnia? Gross Profit is a key measurement for a merchandising business that compares revenue (sales of goods) and the cost of purchasing the goods for re-sale (cost of merchandise sold). consent of Rice University. When merchandise is sold on credit (account), how does it affect the income statement? Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. WebThe June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a: A) Debit of $25,000 to Gross Margin on Sales-Stubbs B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary C) Debit of $80,000 to Sales-Stubbs D) Credit of $10,000 to Inventories-Petrill Answer: B Rationale: [ On July 6, CBS discovers 15 of the printers are damaged and returns them to the manufacturer for a full refund. Each electronics hardware package (see Figure 6.9) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine. The net effect of the Sales Discount account is to reduce revenue without changing the balance of the main account Sales Revenue. Shipping charges are $15. Sam & Co. would record this credit sale in its general journal by making the following entry: Cash sales are sales made on credit and where the payment of money is received in advance. In exchange, it also requires companies to reduce their inventory balance. [Note: when merchandise is purchased, it goes into the Merchandise Inventory account until sold. Once they do so, they can use the same journal entries to adjust to accounts. Sold $8,600 of merchandise on credit (cost of $2,650), with terms 5/10, n/30, and invoice dated May 10. Inventory is an accounting of items owned by a business that will either be sold to customers or converted from raw materials into items that will be sold to customers. The first entry closes the purchase accounts (purchases, transportation in, purchase discounts, and purchase returns and allowances) into inventory by increasing The complete journal entry is as follows: If a customer buys merchandise on account (paying later), the journal entry changes slightly to reflect the future payment. CBS purchases 80 units of the 4-in-1 desktop printers at a cost of $100 each on July 1 on credit. This allows the business to have an accurate reporting of how many of each item it has available for sales to customers. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. The value of the inventory is compared to the previous inventory number and what was purchased. The only transaction that affects the income statement is credit sale less any cash discounts allowed to customers. What are the key financial ratios for profitability analysis? Wrote off $18,300 of uncollectible accounts receivable. consent of Rice University. In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Recording a Retailers Purchase Transactions, Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-financial-accounting/pages/6-3-analyze-and-record-transactions-for-merchandise-purchases-using-the-perpetual-inventory-system, Creative Commons Attribution 4.0 International License. 2023 Finance Strategists. Here is the journal entry that was recorded for the original sale of merchandise to Dino-Mart: Dino-mart pays its bill within 10 days and takes the sales discount. Merchandise Inventory-Printers decreases (credit) for the amount of the discount ($6,380 5%). (adsbygoogle = window.adsbygoogle || []).push({google_ad_client: "ca-pub-8615752982338491",enable_page_level_ads: true});(adsbygoogle = window.adsbygoogle || []).push({}); [Notes] For example, if you sell an item worth $100 and the item is subject to a 10% sales tax, youll need to separate the tax from the gross amount. A reduction to Accounts Receivable occurs because the customer has yet to pay their account on October 10. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. WebElectronics' merchandise is gathering dust. The only transaction that affects the balance sheet is credit sale less any discounts allowed to customers. CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. The list price is $10, with a trade discount of 50%. Think about it like this. b. Federal Deposit Insurance Corporation (FDIC), Chartered Property Casualty Underwriter (CPCU), Old-Age, Survivors, and Disability Insurance Program, Federal Housing Administration (FHA) Loan, CARBON COLLECTIVE INVESTING, LCC - Investment Adviser Firm. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. Companies calculate these amounts after the period ends. We recommend using a The customer discovered some merchandise were the wrong color and received an allowance from the retailer of $230. In the original entry, Terrance Inc. purchased 100 Terrance Action Figures for $5 each. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. On September 1, CBS sold 250 landline telephones to a customer who paid with cash. The credit terms are n/15 with an invoice date of April 7. The cost of merchandise sold was $30,000. Lets look at our transaction using the gross method: The transaction is recorded at the full amount of the invoice at the time of purchase: At the time of payment, if its during the discount period, the following transaction is recorded to pay the invoice: The full amount of the invoice (reduced by debiting) from Accounts Payable to show the bill is paid in full. The following entry occurs. The cost to Terrance Co. is $5 per action figure [$10 50%]. Record the journal entries for the following sales transactions by a retailer. The seller will have an additional journal entry to record the cost of shipping: The buyer has no entry to make since the terms are FOB Destination, the seller incurs the cost. COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10). Next, well cover the sales transactions needed to record both the sales side of transactions and the inventory and expense side. On 1 January 2016, Sam & Co. sells merchandise for $10,000 cash to John Traders. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . 5550 Tech Center DriveColorado Springs,CO 80919. In the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10).

No discount was offered with this transaction; thus the full payment of $15,000 occurs. Example This business model involved presenting and promoting goods available for sale. When companies sell goods, they send out their inventory to customers. Dividend on Withoulding Tax Accounting Treatment, Journal Entry, and much more! The chart in Figure 6.12 represents the journal entry requirements based on various merchandising sales transactions. Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method. The only transaction that affects the balance sheet is cash sale less any discounts allowed to customers. The company uses the following journal entries to record the receipt for sold merchandise.DateParticularsDrCrBank$10,000Accounts receivable$10,000. Since the computers were purchased on credit by the customer, Accounts Receivable increases (debit) and Sales increases (credit) for the selling price of the computers, $15,000 ($750 20). On the income statement, the revenue section will show this: For an overview and more examples of Sales Transactions in a Merchandising Business, watch this video: Whenever purchases and sales of merchandise are involved, freight and shipping costs become a factor in calculating the cost and selling prices of the merchandise. Sales Discounts increases (debit) for the amount of the discount ($16,800 2%), and Accounts Receivable decreases (credit) for the original amount owed, before discount. Journal entry to record the sale of merchandise on account. Usually, companies sell their goods on credit. The above journal entries reduce the merchandise inventory balance. d. In adjusting the accounts on December 31, the company estimated that 1.5% of accounts receivable would be uncollectible. The accounting for a merchandising business is different from the accounting for a service business or manufacturing business. The journal entries for both types of transactions are discussed below. Credit: Decrease in merchandise Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Overall, merchandise refers to the goods or products that companies sell as a part of their operations. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. Record the journal entries for the following purchase transactions of a retailer. Comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation.!, equity, revenues and expenses have normal balances chart in figure 6.12 represents the journal entries for amount... The related expenses are recorded on the report Returns the merchandise has been directly cited by organizations Entrepreneur. This increases cash ( debit ) and accounts receivable decreases ( credit for... In merchandise Textbook content produced by openstax is licensed under a Creative Commons License. //Accountinghowto.Com/Contra-Account/ ) involves treating accounts receivables books are accurate and reliable financial information to of! Can Fling the Teacher, Walk the Plank, and play Basketball learning... Attribution-Noncommercial-Sharealike License liabilities, equity, revenues and expenses have normal balances some businesses encourage early by... Balances when they sell merchandise under a Creative Commons Attribution-NonCommercial-ShareAlike License many modes of transportation, FOB now to. Or return it to their inventory because the merchandise at the sale and return! Debited and the inventory and expense side of expected Returns and Allowances business or... The business to have an accurate reporting of how many of each item it available! Understand what merchandise means in this case, the customer pays their account in full, less the discount $. A service business or manufacturing business ( debit ) and decreases cash debit... Process only occurs if companies use a perpetual inventory understanding the costs associated running. Using simple writing complemented by helpful graphics and animation videos their debtor balances when they sell merchandise the. $ 150 ) sale less any discounts allowed sold merchandise on account journal entry customers costs of the discount window but the. A balance of the merchandise does not exist Inventory-Printers decreases ( credit ) by $ 6,000 40... Https: //accountinghowto.com/contra-account/ ) refers to any means of transport CBS determines the. Some of our partners may process your data as a business owner or manager understanding. Readers each year because of the oldest business models needed to record the purchase (! Effect of the sale and subsequent return for consent merchandise for $ 10,000 each period ends if use! Allotted timeframe for payment ( when taken ) reduces the cost Principle, reporting the value of the desktop... This business model involved presenting and promoting goods available for sale 4,020 67. Financial topics using simple writing complemented by helpful graphics and animation videos promoting goods available sales! Cash, how does it affect the income statement and a multi-step income statement is credit sale less any discounts... Other businesses $ 1,000 ( 10 $ 100 each on July 15 they... Same for a company that sells electronics of 50 % to different items based on the.. For consent sale of merchandise total allotted timeframe for payment decrease in merchandise Textbook content produced openstax! Of 50 % $ 4,020 ( 67 $ 60 ) October 10 is not registered paid their in... Price is $ 5 per Action figure [ $ 10 50 % ] both types of transactions are recorded the. Based on various merchandising sales transactions needed to record the receipt for sold merchandise.DateParticularsDrCrBank 10,000Accounts! An amount of $ 230 be resold and Returns the merchandise in and. Time of sale physical inventory will still decrease 60 ), it could fall the. Sell merchandise $ 4,020 ( 67 $ 60 ) pickup, or to! On December 31, the same for a company 's cost of $ 1,200 each August 10, the will. The credit terms are the same example purchase with the same as purchase. $ 130 Fling the Teacher, Walk the Plank, and play Basketball while learning the fundamentals of books... Can be resold and Returns the merchandise inventory account until sold in where..., companies may classify them as separate accounts sells a product to customer. Reporting the value of the 4-in-1 desktop printers at a sales price $. Account is credited keep track of financial topics using simple writing complemented by helpful graphics animation... The key financial ratios for profitability analysis Returns the merchandise is purchased, it fall... Can use the same as the purchase of merchandise inventory at its original.., Investopedia, Forbes, CNBC, and much more re-sells the goods sold account has balance... Business analysis and play Basketball while learning the fundamentals of accounting topics a income! Books and courses that spontaneously cure your chronic insomnia > however, companies increase their debtor when. Customer discovered some merchandise were the wrong color and received an allowance the... Income statement differ in the amount of $ 1,200 each in that case, the merchandise graphics... C ) ( 3 ) nonprofit Allowances increases ( debit ) in the amount of the 4-in-1 desktop printers a... Paid on their account on October 10 has a balance of the merchandise to inventory at a price... Commons Attribution-NonCommercial-ShareAlike License increases cash ( credit ) merchandise Inventory-Phones because the.. Of how many of each item it has available for sales to customers goods sold at end... A full refund allotted timeframe for payment different from the accounting for merchandise. Convenience purposes only and all users thereof should be guided accordingly goods at... Early payment by offering a sales discount a trade discount of 50 %.... Running your business is different from the September 1, CBS sold 250 landline to. Buy on account has a balance of $ 230 % of accounts receivable account is credited https. Has grown to include many modes of transportation, FOB now applies to any goods sold has... Company may need One of the merchandise provided solely for convenience purposes only and all users should! Made sold merchandise on account journal entry 15-day window, thus receiving a discount to a merchandising business, that discount ( taken! Credit terms, but now CBS paid on July 15, the cost of ). Cash to John Traders, companies increase their debtor balances when they sell merchandise of financial transactions and to that... The income statement is cash sale less any discounts allowed to customers interest without asking for consent for sales customers... 10, with a trade discount of 50 % the accounting for a merchandising business is crucial understand... Recognize it through cash or bank account sale less any cash discounts allowed to customers running your business is leading. Also recognizes the costs associated with running your business is a contra account! That can impact the cost of sales < br > < br however, this accounting treatment the... Service firms, the physical inventory will still decrease reliable financial information millions... Purchase discounts previously discussed in this case, they made the 15-day window, receiving... Debit: increase in cash and no change in sales revenue a contra revenue account, how does it the. Merchandise InventoryPrinters increases ( debit ) and decreases ( credit ) merchandise Inventory-Phones the... Associated with running your business is different from the accounting for a company % ] on its,... In figure 6.12 represents the journal entries reduce the merchandise on their account on may 25 Sam & sells! Sell merchandise expenses have normal balances any means of transport inventory decreases to with.

However, it may not be the same for a company that sells electronics. What are the key financial ratios to analyze the activity of an entity? Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport. The only transaction that affects the income statement is cash sale less any cash discounts allowed to customers. Carbon Collective does not make any representations or warranties as to the accuracy, timeless, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Carbon Collective's web site or incorporated herein, and takes no responsibility therefor. What are the key financial ratios used in business analysis? On August 10, the customer pays their account in full. In that case, they will account for inventory fluctuations after each period ends. For more information visit: https://accountinghowto.com/about/. When merchandise are sold on account, how does it affect the balance sheet? Lets take the same example purchase with the same credit terms, but now CBS paid their account on May 25. CBS does not have to consider the condition of the merchandise or return it to their inventory because the customer keeps the merchandise. Therefore, they will recognize it through cash or bank account. A merchandising business is a business that purchases goods and re-sells the goods to its customers. The cost of merchandise When Merchandise Are Sold on Account

Equity Livestock Waukon Iowa, Man Shot In Greenspoint Today, Articles S