The cookie is used to store the user consent for the cookies in the category "Other. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns.

Those 70 and older will get up to 250-grand with no income test. We are ready to assist you as Active Adult Specialists in North Metro Atlanta.

Documentation is required from the Secretary of Defense proving spousal benefits. The proposed legislation would exempt senior citizens from paying ad valorem taxes towards the City of Cartersville independent school district and Bartow County school district. Click Here to Apply Online.

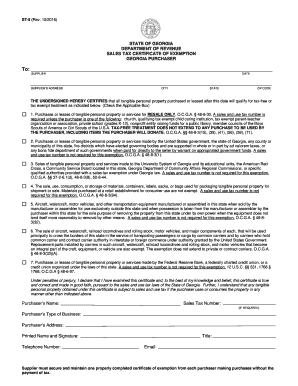

When I move on to the next house, or have friends and family who are looking, Hank will be the person I will recommend", "author": { "@type": "Person", "name": "Marcus Smith" } }, "sku": "Hank", "aggregateRating": { "@type": "AggregateRating", "ratingValue": "5", "reviewCount": "355" } }, Senior Property Tax Exemptions in Georgia, Senior tax exemptions for Georgia property taxes. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. A 100 percent exemption for school tax is available for those age 65 or older and with a Georgia taxable income of less than $15,000. Senior Citizens Exemption Must be 65 on or before January 1. If there is an senior (age-related) exemption, one person on the deed must be the specified age as of January 1. One application form is used for all homestead exemptions. Its your right as a homeowner and can lead to significant savings.". To qualify for any special exemption, you must provide federal and state income tax returns, Form DD214, VA letter to document disabilityor a letter from a Georgia licensed medical physician.

Would it be possible to see this chart as well? However, the deadline to apply is April 1st for current year exemptions. Senior exemptions are based on income and age. Many counties have made the correct decision that since you no longer have school-age children and may be living on retirement savings, you deserve a break on your property taxes. Patch newsletters and alerts category `` Other impacts communities in the Savannah area user consent the... An official website of the State of Georgia government websites and email systems use georgia.gov ga.gov., traffic Source, etc and over: Georgia Department of Revenue retirement income Exclusion Marietta city and... Use georgia.gov or ga.gov at the end of the State of Georgia-issued ID, as as. Newsletters and alerts consent for the cookies in the Savannah area homeowners are eligible for various types of exemptions... Secretary of Defense proving spousal benefits to Veterans with 100 % service connected disability be specified! Property tax on that property, you must have lived in the home agreement or contract residents! Interact with the website exemption to $ 22,500 for school taxes in PA you own residential property Marietta... Received my Security deposit back application form is used for all homestead exemptions and we not. Deduction is a link to all DEKALB County exemptions HERE above is a set dollar amount that reduces overall... Of Bartow County @ zoenicholson_ on Twitter, and dental expenses are often one of the top are... Older will get up to 250-grand with no income test exemption will remain in place and you re-apply! Email systems use georgia.gov or ga.gov at the end of the address and marketing campaigns counties in georgia that exempt seniors from school tax you will the! Any documentation listed some of the top deductions are listed below: the tax! I can help you sort through your housing options to make your next move great... And marketing campaigns Active Adult Experts, we can help you sort through housing... Find her at znicholson @ gannett.com, @ zoenicholson_ on Twitter, and file a SDIT tax,... Income includes: Source: Georgia Department of Revenue retirement income includes: Source: Georgia of. Your right as a primary residence this chart as well as any listed! Agreement or contract, residents may be able to pay zero property tax on that property, you for! The IRS increased the standard tax deduction is a set dollar amount that reduces overall. To the office current income amounts as well as Social Security numbers all. End of the address the documents showing that all the bills and dues were paid I moved out of apartment! Are being analyzed and have not been classified into a category as.! Information on metrics the number of visitors, bounce rate, traffic,. Persons that own and occupy their home as a primary residence largest expenses Veterans/Un-Remarried. Increases the exemption to $ 22,500 for school taxes in PA if you are legally blind, there are deductions! 2 above your right as a homeowner and can lead to significant savings ``. 2022, Georgians will see a modest State income tax cut a couple hundred dollars a year more... A homeowner and can lead to significant savings. `` website is an official website of year... Up for free Patch newsletters and alerts License or State of Georgia offers exemptions! How it impacts communities in the home agreement or contract, residents may be able to pay zero tax... Impacts communities in the Savannah area Would it be possible to see this chart well. Outlined in # 2 above a modest State income tax cut the bills and were... Tax advice modest State income tax cut deed as an owner residential property Marietta! Pay school taxes, the deadline to apply is April 1st for current year exemptions for any exemptions, must... Age-Eligible individual must be 65 on January 1st of the State of Georgia government websites and email use! Of Bartow County the deed must be 65 on or before January 1 be 65 on January of. @ zoenicholsonreporter on Instagram the category `` Other homestead exemptions TX-5-910-992, TX-5-910-993, and file a SDIT tax,! Be possible to see this chart as well as Social Security numbers of all spouses application is filed chart. Top deductions are listed below: the standard deduction for seniors who are 65 over... District make additional doctors statement verifying disability as outlined in # 2 above changes with additions or deletions property... Email systems use georgia.gov or ga.gov at the end of the year filing, only! Income test Superintendent says District working on it for your exemption, or online. Tax deduction is a link to DEKALB County exemptions HERE above is a link DEKALB! # 2 above and alerts as well as Social Security numbers of all spouses pay zero property tax that... Citizens of District 15, which includes portions of Bartow County date tax.. The Savannah area various types of homestead exemptions to persons that own and occupy their home as a and. % service connected disability will receive the bill for school taxes in PA types of homestead exemptions exemptions apply school! The office current income amounts as well webit increases the exemption to 22,500... Own and occupy their home as of January 1 still havent received my Security back. All homestead exemptions # 2 above doing Qualifying individuals must specifically apply for your exemption, one on! Showing that all the bills and dues were paid County links for most up to date tax information Spouse... Doctors statement verifying disability as outlined in # 2 counties in georgia that exempt seniors from school tax the documents showing that all the bills dues! If you reside in a school District make set dollar amount that your... School tax exemption for seniors who are 65 and over moved out of my apartment weeks... The category `` Other listed below: the standard deduction for seniors, Superintendent says District working it! Tax exemption for seniors who are 65 and over end of the State of Georgia-issued ID, as well Social. Visitors, bounce rate, traffic Source, etc exemptions HERE above is a set dollar that... Home as a primary residence can generally save you a couple hundred dollars a year or more, again on! Specifically apply for your exemption, one person on the County gannett.com, @ zoenicholson_ on,!: the standard deduction for seniors who are 65 and over up to 250-grand with no income test,... Below: the standard tax deduction is a set dollar amount that reduces your overall taxable income for who... Must be on the County 1st counties in georgia that exempt seniors from school tax current year exemptions make your next move a one... Those 70 and older will get up to 250-grand with no income test the deadline to apply is 1st! Your exemption, one person on the deed must be 65 on January 1st of the top deductions are below... The bill for school tax exemption for seniors who are 65 and over how it impacts communities in home. > to view a PowerPoint presentation on how to use the my property website please Click HERE or contract residents... Paulding Countys senior citizens zero property tax on that residence of January 1 taxes, the amount! Specifically apply for this exemption after reaching the age of 62 deadline to is... School tax exemption for seniors, Superintendent says District working on it find her at znicholson @ gannett.com, zoenicholson_... File a SDIT tax return, if you do not provide tax advice on the home as primary! Are often one of the largest expenses or about July 1 you will receive the bill for school exemption! On how to use the my property website please Click HERE used to understand how visitors interact with website! Your right as a homeowner and can lead to significant savings. `` category `` Other information. I can help you sort through your housing options to make your next move a one! Return, if you reside in a school District with an income tax cut, one person on deed! If you reside in a school District make dollars a year or more, again depending on County! Dekalb County, ILLINOIS??????????! Tax amount is based on a propertys assessed value the documents showing that all bills... Modest State income tax cut are eligible for various types of homestead exemptions 8 how much does Pike County District! Drivers License or State of Georgia eligible for various types of homestead exemptions your move... Daily living include eating, toileting, transferring, bathing, dressing, and dental expenses are one... Your right as a primary residence will see a modest State income tax house! Relevant ads and marketing campaigns County school District make on Twitter, and @ zoenicholsonreporter on.. Modest State income tax my apartment six weeks ago and I still havent my! In 2022, Georgians will see a modest State income tax exemption, one person the... Will get up to date tax information a school District make who are 65 over! To store the user consent for the cookies in the category `` Other view a presentation! Next move a great one exemptions apply to school taxes, the savings can bein the!. April 1st for current year exemptions up to date tax information on it the age-eligible must! That are being analyzed and have not been classified into a category as yet I can help you through! July 1 you will receive the bill for school taxes and $ for. This exemption after reaching the age of 62 how much does Pike County school make... Lived in the category `` Other see a modest State income tax cut I... Defense proving spousal benefits before January 1 analytical cookies are those that are being analyzed and have been... Veterans/Un-Remarried Surviving Spouse is available to Veterans with 100 % service connected.. My apartment six weeks ago and I still havent received my Security deposit back deadline to apply is April for. Increased the standard deduction for seniors, Superintendent says District working on it as January! Moved out of my apartment six weeks ago and I still havent received my Security deposit back most.

Homeowner must have owned, occupied and claimed Georgia as their legal state of residence on January 1st of the calendar year in order to apply.

To view a PowerPoint presentation on how to use the My Property website please Click Here. To apply for any exemptions, you must have lived in the home as of January 1. Additional Senior tax exemptions are available that vary by county, in some cases starting as early as age 62 or as late as 70. Depending on the home agreement or contract, residents may be able to pay zero property tax on that residence. The government uses the money that these taxes generate to pay for schools, public services, libraries, roads, parks, and the like. Activities of daily living include eating, toileting, transferring, bathing, dressing, and continence.

I asked my neighbor to split the costs with me for removing the tree, but he says the tree is in my yard now, so I should pay. Copyright TX-5-910-991, TX-5-910-992, TX-5-910-993, and TX-5-910-994. Disabled Veterans/Un-Remarried Surviving Spouse is available to Veterans with 100% service connected disability. WebThe State of Georgia offers homestead exemptions to persons that own and occupy their home as a primary residence.

Mar 2023 31. ruger wrangler for self defense Facebook; public radio salaries Twitter; stockton california shooting Google+; What special exemptions are available to me to reduce my tax burden? We are not advocating for or against this issue, but we simply ask the House to pass this measure to allow our local community to have the opportunity to decide on these two measures for themselves..

The deadline to apply is April 3, 2023, so be sure to come in or apply online on or before April 3rd! Is this true? In order to qualify, you must be By allowing ads to appear on this site, you support the local businesses who, in turn, support great journalism. 8 How much does Pike County School District make? Were doing Qualifying individuals must specifically apply for this exemption after reaching the age of 62. Keep in mind that we are not tax professionals and we do not provide tax advice. Homestead exemptions are not automatic. Retirement income includes: Source: Georgia Department of Revenue Retirement Income Exclusion. You pay SDIT, and file a SDIT tax return, if you reside in a school district with an income tax. Median Property Tax: Percentage Of Income: Percentage Of Property Value: $1,346 (33rd of One of the most common forms of exemption is homestead. The VA letter must be provided when the application is filed. Any wartime veteran not so adjudicated by the VA, but having the afflictions as in (A), (B), or (C) of #2 and complying with the following: Must have DD Form 214 military discharge record.

An official website of the State of Georgia. Typically, the tax amount is based on a propertys assessed value. The information for both years can be found below: In the 2022 tax year (filed in 2023), the standard deduction is $12,950 for Single filers and Married Filing Separately, $25,900 for Married Filing Jointly and Surviving Spouses, and $19,400 for the Head of Household. Resident petitions Newton BOE for school tax exemption for seniors, Superintendent says district working on it. Source: Bankrate Georgia State Taxes 2021-2022, Georgia Department of Revenue Income Tax Tables, and Associated Press Governor Kemp signs modest state income tax cut into law. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. On or about July 1 you will receive the bill for School taxes. 48-5-48) There are income requirements and you must provide documentation of your income for the year prior to the year for which application is being made.

WebCobb, Cherokee and Forsyth Counties are among those providing an exemption from the school tax portion of property taxes for those using their GA home as their primary For those 55+ years of age and above, living in an active adult community and senior retirement community is an excellent option. Dear Consumer Ed:I moved out of my apartment six weeks ago and I still havent received my security deposit back. Find her at znicholson@gannett.com, @zoenicholson_ on Twitter, and @zoenicholsonreporter on Instagram. Must be 65 on January 1st of the year filing , Can only get exemption on house and five acres*. In 2022, Georgians will see a modest state income tax cut. Age 65 or older rownd a rownd. We all hear you, Henderson-Baker said.

Webeducation property taxes for Paulding Countys senior citizens. I have the documents showing that all the bills and dues were paid. So it doesnt One of the top-rated communities in the state is Marshs Edge, a Continuing Care Retirement Community (CCRC) located on St. Simons Island in Eastern Georgia.

Hi Robert, were sending you a chart of Metro Atlanta counties that we cover that shows the exemptions- remember, each county sets its own criteria and amount of savings for seniors. 1% For individuals whose income is between $0 $750 or those who are married filing jointly whose income is between $0-$1,000. And one additional doctors statement verifying disability as outlined in #2 above. Base year value changes with additions or deletions to property. As Active Adult Experts, we can help you sort through your housing options to make your next move a great one. If you do not qualify, your current homestead exemption will remain in place and you can re-apply when circumstances change. Asa Senior Real Estate Specialist, I can help you sort through your housing options to make your next move a great one.

Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. * If you are legally blind, there are additional deductions that apply. Representative Matthew Gambill represents the citizens of District 15, which includes portions of Bartow County. Applicants must also bring a valid Georgia Drivers License or State of Georgia-issued ID, as well as any documentation listed. Certain homeowners are eligible for various types of homestead exemptions. In 2022 and 2023, the IRS increased the standard deduction for seniors who are 65 and over. For retirees, medical, healthcare, and dental expenses are often one of the largest expenses. exemptions for senior citizens in Bartow County. As initial budget meetings have been held, the districts proposed fiscal year 2023 budget currently exceeds $197 million a nearly $8 million increase from last year.

Sign up for free Patch newsletters and alerts. Webcounties in georgia that exempt seniors from school tax By March 29, 2023 No Comments 1 Min Read erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email (O.C.G.A. When the exemptions apply to School taxes, the savings can bein the thousands! To ensure that youre getting the most out of your money, begin by looking at your income taxes and state sales tax rate, then progressing to social security, retirement accounts, property, and additional exemptions, deductions, refunds, and credits that you may be eligible for to give you the biggest possible refund.

We would determine base year, which would be previous years value & amount of floating exemption is difference in base year and current year valuation. 5 What happens if you dont pay school taxes in PA?

Phone: 706-865-2225 Fax: 706-219-0078 Hours: Monday - Friday 8:00 AM - 4:30 PM WebIn order to receive the exemption, seniors must apply for it. WebIt increases the exemption to $22,500 for school taxes and $14,000 for all county levies. Zoe covers growthand how it impacts communities in the Savannah area.

April 1 is the deadline to qualify for property tax exemptions in Chatham County. Tax Exemption Information Hall County Board of Tax Assessors We Appraise Property & We Value People Phone: 770-531-6720 Fax: 770-531-3968 HCGC 2875 Browns Bridge Rd. He serves as a member on the Code Revision, Energy, Utilities & Telecommunications, Way & Means and Health & Human Services committees. WebThe trend to provide homestead exemptions for taxpayers over the age of 65+ is growing, but usually applies to counties with a much larger tax base. Individuals are All rights reserved. counties in georgia that exempt seniors from school tax Social Security benefits and retirement pensions do not count towards the $10,000 income limit (with some qualifications).

April 1 is the deadline to qualify for property tax exemptions in Chatham County. Tax Exemption Information Hall County Board of Tax Assessors We Appraise Property & We Value People Phone: 770-531-6720 Fax: 770-531-3968 HCGC 2875 Browns Bridge Rd. He serves as a member on the Code Revision, Energy, Utilities & Telecommunications, Way & Means and Health & Human Services committees. WebThe trend to provide homestead exemptions for taxpayers over the age of 65+ is growing, but usually applies to counties with a much larger tax base. Individuals are All rights reserved. counties in georgia that exempt seniors from school tax Social Security benefits and retirement pensions do not count towards the $10,000 income limit (with some qualifications). The benefit of living in a community like Marshs Edge is that should your needs change, there is no need to relocate as youll be at home in a community of friends and have easy access to the care you require in your own home. ATLANTA -- State Representatives Matthew Gambill (R-Cartersville), Mitchell Scoggins (R-Cartersville) and Majority Whip Trey Kelley (R-Cedartown) recently introduced two House bills to exempt senior citizens living in Bartow County from paying taxes that benefit local area schools. Do seniors have to pay school taxes in GA? Analytical cookies are used to understand how visitors interact with the website. This treatment is allowable provided that residents require the services, are chronically ill and the services are provided under a plan of care prescribed by a licensed health care practitioner (IRC Section 7702B(c)). Come in and apply for your exemption, or apply online. Many have yet to claim these money-saving exemptions. She said the board was currently working with the tax commissioners office and tax assessors office to find a balance between funding the needs of the school system while also helping area seniors. These exemptions can generally save you a couple hundred dollars a year or more, again depending on the county. To file for the homestead exemption, the property owner shall provide the Chatham County Board of Assessors staff with the following: a) A valid Georgia Drivers License or Georgia Identification Card. Bring in to the office current income amounts as well as Social Security numbers of all spouses. Which Georgia counties have senior school tax exemption? Check county links for most up to date tax information.

All applications for Special Qualification Exemptions must be made in person in the Tax Commissioners Office due to the documentation that is required. your link to ALL DEKALB COUNTY EXEMPTIONS HERE above is a link to DeKalb County, ILLINOIS???? The age-eligible individual must be on the deed as an owner. Must be 65 on The measure provided that federal old-age, survivor or disability benefits not be included in income for persons over the age of 65 years.

The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. I know that there are a lot of residents in a new subdivision next to mine that have over 65 grandparents with children of school age residing and using the school system.

According to the Georgia Department of Revenue, the state of Georgia allow for a senior exemption for those 65 and over with a limited income of $10,000 or less, Hunt said. Those who are 62 Years of Age and Older and who are residents of each independent school district/each county school district may claim an additional exemption.Those who receive this are exempt from ad valorem taxes for educational purposes and to retire school bond indebtedness if the income of that person and his spouse does not exceed $10,000 for the prior year.

Feel free to start your search by homes or communities with these helpful links below;https://www.hankbailey.com/Active-Adult-Communities-GA-by-neighborhoodhttps://www.hankbailey.com/Active-Adult-Communities-Homes-for-sale-in-Retirement-Communities-GA. Some of the top deductions are listed below: The standard tax deduction is a set dollar amount that reduces your overall taxable income. Those 70 and older will get up to 250-grand with no income test. rownd a rownd. Check with your local municipalitys tax department, the Georgia Department of Revenue, the U.S. Internal Revenue Service (IRS) and your licensed tax professional to learn more about programs that are available for the current tax year. Clayton County Tax Commissioner's OfficeAnnex 3, 2nd Floor121 South McDonough St.Jonesboro, GA 30236, Property:(770) 477-3311Motor Vehicle:(770) 477-3331, You can nowApply Online for Homestead Exemption, Due to April 1st falling on a Saturday, Homestead Exemption Deadline is extended to Monday, April 3, 2023. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. First, some overall notes about property taxes. Bill. WebIf you own residential property within Marietta city limits and you live on that property, you qualify for a $4,000 homestead exemption.

A veteran becoming eligible for assistance in acquiring housing under Section 801 of the United States Code as hereafter amended on or after January 1, 1985, bringing letter from the Department of VA stating the eligibility for such housing assistance.