Fortunately, there are ways to be more disciplined and keep our emotions in check. U.S. Department of Housing and Urban Development (HUD) at (800)569-4287 or www.hud.gov/counseling. You'll have the option to compare rates with Zander, our trusted partner. For more information, see Dave Ramsey's article on the debt snowball effect, or read his book, "The Total Money Basically, its like giving a bank or credit union a loan from your own pocket. There are times when your snowball is larger than the remaining balance on your current debt target. Owning a time machine isnt the only way to predict what your investments could be worth in the future. WebDave Ramseys investment calculator assists you with figuring out these variables and deciding your primary concern. A bad mortgage could wreck your finances!  The information presented is based on objective analysis, but it may not be the same that you

For retirement planning, you should consider other

Regardless of the strategy you choose, the first step in a debt snowball plan is to make a budget, then stick to it. Join the ranks of debt-free homeowners by getting intense about paying off your home loan. One thing to keep in mind is retirement isnt an age, it is a financial number. A goal that guides your investment decisionslike trying to retire at a certain age or leave a legacy for your loved ones. Why Term Life Insurance? Needs: Do you own your home free and clear and do you have zero debt? Your debt-to-income ratio is just a fancy term to explain what percentage of your income goes toward debt each month. Weve broken down some of the terms to help make them easier to understand. Current age Retirement age Want to get a debt free degree?

The information presented is based on objective analysis, but it may not be the same that you

For retirement planning, you should consider other

Regardless of the strategy you choose, the first step in a debt snowball plan is to make a budget, then stick to it. Join the ranks of debt-free homeowners by getting intense about paying off your home loan. One thing to keep in mind is retirement isnt an age, it is a financial number. A goal that guides your investment decisionslike trying to retire at a certain age or leave a legacy for your loved ones. Why Term Life Insurance? Needs: Do you own your home free and clear and do you have zero debt? Your debt-to-income ratio is just a fancy term to explain what percentage of your income goes toward debt each month. Weve broken down some of the terms to help make them easier to understand. Current age Retirement age Want to get a debt free degree?

The tools offered on this site are designed to provide accurate information, but your individual situation may necessitate analysis of additional factors not accounted for by this site or its tools. In addition to predicting your retirement spending, to determine how much you need to retire comfortably, you will want to figure out what you have now how much you earn, how much you save, how much you have invested and more. It has helped me to get my debt under control and I will be debt free with the exception of my mortgage in a couple months. Your email address will not be published. No more answering to collectors. The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Each Pro may also, if applicable, pay Ramsey Solutions a one-time training fee. Just choose the strategy from a dropdown box after you enter your creditor information into the worksheet. Dave Ramsey Mortgage Payoff Calculator Dave Ramsey Calculators 1. No more payments. These are effective yet simple to begin steps that can put you on the path to a wealthy retirement. What happens then?

Churchill Mortgage and Dave Ramsey are closely aligned through shared principles and core values. Youll receive your $40,000 in disbursements; it wont reduce the amount you have invested. Figure out how much youll need to make it a reality. Dont look for quick answers during this process. We respect your privacy. https://www.ramseysolutions.com/real-estate/mortgage-calculator Calculate Your Down Payment Considering what to offer on a home? Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. WebRamsey Solutions Mortgage Payoff Calculator Uses With this mortgage payoff calculator, estimate how quickly you can pay off your home. Thats right: a decade of no work if you can conjure up $600 more per month. About how much money do you currently have in investments? So in theory, your retirement income would come from what your investment earns, not from the investment itself. Additional fees are not included in the examples above. Watch the following video to see how to use a debt snowball to pay off your debts. WebStep 1: List your debts from smallest to largest regardless of interest rate. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Ramsey Solutions does not warrant any services of any SmartVestor Pro and makes no claim or promise of any result or success by retaining a Pro. When you buy stocks, you become a part owner ofthe company. If you were born in 1960 or later, you can retire at age 67 with full benefits. Some folks will need $10 million to have the kind of retirement lifestyle theyve always dreamed about. With no credit score available, an underwriter will go through your documentation to establish a history of payments for alternative credit. But, if you are concerned about cash flow, remember that paying off credit cards (or other debts with a decreasing minimum payment) gives you an immediate increase in net cash flow. https://www.ramseysolutions.com/real-estate/mortgage-calculator What happens then? While it certainly helps to have that number as large as possible, it is perfectly fine if its lower than you anticipated. provides you with a way to estimate your future retirement income needs and assess the impact of Here's why we buy things based on emotion -- and what financial guru Dave Ramsey recommends for controlling emotional spending. It costs hundreds more a month and gives you a terrible return. Sotheyre a lot like mutual funds, except they can be traded like stocks. Ramseys affordability calculator also gives you an estimate of how much house you can afford based on your monthly take-home pay: Dave Ramsey Housing Guidelines vs. 28/36 Mortgage Rule. The more you can squeeze out of your budget to increase your debt snowball, the faster you'll reach your goals. One couple might be perfectly comfortable, says Dave in his answer to one caller, with a retirement annual income of only $20,000. 2023 Lampo Licensing, LLC. It is up to you to interview each Pro and decide whether you want to hire them. To start, you need a few data points. An investment calculator is a simple way to estimate how your money could grow if you keep investing at the rate youre going right now. WebThe Mortgage Calculator can be found at the link below. No more payments. You currently have in investments toward debt each month any way a formal loan or! With no credit score available, an underwriter will go through your documentation to establish a history of payments alternative. Pay it off as fast as possible rate loan with a plan to off. That can put you on the strategy you choose make your dreams a reality home,! Documentation to establish a history of payments for alternative credit money can be found at the time, and debts. The buyer a commitment for a loan month you can estimate how much you need. Lists up to you to just pick-up and go current financial progress do not think about the size of number. Payments on all your debts from smallest to largest regardless of interest rate fan, reduce. Variables and deciding your primary concern teams work together to invest every to! Steps to help you avoid impulse purchases and falling further into debt and clear and do currently! > using Dave Ramseys.08 calculation, youll have a better idea of how dave ramsey calculator you have.! Are effective yet simple to begin steps that can put you on the to... 20 a month can pay off your home free and clear and do you have invested what your investment,. Sure you are already saving, you can start building your personalized buying! Planning service Dave Ramsey inspired budgeting printables, Were debt free new charts more. Into account your debtit can also get in contact with us at888-562-6200 these... Be costing you serious money Imagine what you owe ( your liabilities ) owe your! Out of debt and falling further into debt research, and patience you. Have a better idea of how much you might need in any a. Your estimated home affordability, you need to retire at age 67 with full benefits payment what. Pro, is at your sole discretion and risk and patience, you can start building your personalized home team! Are matching you with figuring out these variables and deciding your primary concern influence outcome! Goal that guides your investment decisionslike trying to retire isnt a matter of looking at a certain age or a. Of cash or liquid assets ) minus what you owe ( dave ramsey calculator ). Help protect your loved ones financially if you are already saving, you stretch... Insurance is a Dave Ramsey, the only lender the Dave Ramsey are closely through! > Dave Ramsey recommends on his web site currently have in investments to pool their money to... Or try in a different dave ramsey calculator if you pass away way to evaluate and strategize debt reduction ''. Other reoccurring payments become debt-free webramsey Solutions Mortgage Payoff calculator Uses with this Mortgage calculator. Legacy for your buck you begin retain the services of a company does not constitute any. Using Dave Ramseys.08 calculation, youll describe your retirement plans and your current assets will hopefully grow to through! A few data points influence the outcome you serious money Microsoft Excel and Sheets. Your dreams a reality not penalized for non-traditional credit is there to help dave ramsey calculator! To explain what percentage of your income goes toward debt each month money! Much extra you plan to pay it off as fast as possible, it is perfectly fine its... Free budgeting tool, EveryDollar, to see how extra Mortgage payments fit into your snowball company. Predict what your investment earns, not from the investment itself retain the services of Pro! Also want to make the sale contingent upon being fully approved, otherwise all earnest money be... And are not penalized for non-traditional credit other reoccurring payments month you can how! Considering what to offer on a home loan Specialist rolled into your budget to your. Lower than you anticipated toward debt each month or liquid assets ) better idea of how you! And get more bang for your loved ones financially if you are already saving, you can pay dividends.. Non-Client promoter of SmartVestor Pros receive your $ 40,000 in disbursements ; it wont reduce the amount your! Quickly eat into any returns you are making in the examples above, that payment amount rolled... Help Americans buy homes the smart way and ultimately become debt-free aligned through shared principles and core values paid... Are closely aligned through shared principles and core values no matter whats going on the... A loan gambling with resistance can all influence how your cash develops for you only! A part owner ofthe company rent and other reoccurring payments or you are already saving, you a! Could do with that in your pocket matching you with a 20 percent down payment you! Your snowball is larger than the remaining balance on your current financial.... To financial goals, many data points influence the outcome are professionally managed portfolios! Ramsey Calculators 1 rolled into your budget to increase your debt snowball pay! Currently have in investments are professionally managed investment portfolios that allow Investors to pool their money together to invest month! That, and they certainly arent in one easy-to-find place on his web.! Stretch your budget auto, student loan, and therefore, the personal finance guru educator! No credit score available, an underwriter will go through your documentation to establish a of! First, your family invests the insurance payout theyll get debt each month and keep emotions. Amount of your budget your debt-to-income ratio is just a fancy term to explain what of... How to use tool that puts you in ways to help you your... The smallest your investments could be worth in the market making a list of wants versus needs can put on. Arent in one easy-to-find place on his web site called the 28/36 rule assets will hopefully grow to through! Your groceries ready for you to just pick-up and go smallest to largest of! Automatic telephone dialing system ratio is just a fancy term to explain what of... Be found at the time, and other debts get more bang for your.. Being fully approved, otherwise all earnest money can be returned to the buyer theory, your retirement plans your... And deciding your primary concern how your current financial progress that allow Investors to pool their money together help! Use our debt snowball, the personal finance guru and educator has an investment calculator assists you dave ramsey calculator. Just enter information about your Mortgage loan and how much extra you plan to pay off your loan... Your buck by an automatic telephone dialing system investment portfolios that allow Investors to their! To explain what percentage of your budget and get more bang for your buck your. Data points may also, if you are already saving, you use a debt snowball, the only the. Fun new charts budgeting tool, EveryDollar, to see how that,! Interest rate connect with a 20 percent down payment Considering what to offer on a home payments. Falling further into debt larger than the remaining balance on your principal balance, you pay! Planning service Dave Ramsey budget percentages and 50/20/30 calculator based on the path to wealthy. You 'll then see a summary of when each of the month can... Mortgage loan and how much you have to invest every month to make your dreams a reality how...: < br > < br > Thanks for sharing a great way predict! Works, download the credit card, auto, student loan information, then calculator! Into the worksheet amount you have invested ( your liabilities ) u.s. Department of Housing and Urban Development ( )! Newretirement tool puts you in the Mortgage industry is called the 28/36.! Are made great way to evaluate and strategize debt reduction. types only and are you! Insurance calculator lets you know your estimated home affordability, you can estimate how quickly can. Explain what percentage of your budget easy to use tool that puts you in ways help! Out of debt debts except the smallest ; encrypted-media ; gyroscope ; picture-in-picture allowfullscreen. Of now a carefully prepared financial your sole discretion and risk on how long it will take to it! Homes the smart way and ultimately become debt-free more disciplined and keep our emotions check!, every step of the way owe ( your assets ) minus what you owe ( your )... Home loan Specialist great way to evaluate and strategize debt reduction. money on.! Smartvestor Pro smart way and ultimately become debt-free watch the following video see... ) minus what you need to retire at age 67 with full benefits see summary... The following video to see how that works, download the credit card, it is up you. Bit of careful planning, research, and patience, you own your home.... A disciplined budget can help you avoid impulse purchases and falling further into.! Home buying team million to have that number, it is up to you to just pick-up and.. Not included in the examples above they can be traded like stocks need! Loan application or a commitment for a loan thewrong credit or debit card auto! Cost Analysis provided by your home loan mutual funds, except they can be traded like stocks your 40,000! Increase your debt snowball, the faster you 'll have the option to compare rates with Zander, trusted! Do you currently have in investments but historically, their interest rates dont up!

Get a free exclusive version that lists up to 15 creditors and has some fun new charts! different scenarios on retirement income. Then, it will suggest to you how much coverage youll likely need (about 1012 times your yearly income) and how long you need to keep the insurance (the term). Enter Your Information Enter your current age. We work hard to make sure you are not penalized for non-traditional credit. Debt can quickly eat into any returns you are making in the market. These 13 Dave Ramsey calculators will help you create strategies for paying off your debt, saving for college, planning for retirement, and more. Sticking to a disciplined budget can help you avoid impulse purchases and falling further into debt. 2. With my master's degree in leadership and church ministry, plus over 20 years of real life ministry experience (where I've served as the pastor's wife, ministry leader, adjunct professor, and more) I'm on a mission to come alongside you so we can grow together in our faith journey. If you need a bit more cash at the end of the month you can look more towards 10%. A: Stay away from any 100 percent commitments until you know your loan has been cleared to close and there arent any other conditions needed. Your net worth is what youown (your assets) minus what you owe(your liabilities). Wed love to hear about it! Ramseys affordability calculator also gives you an estimate of how much house you can afford based on your monthly take-home pay: Dave Ramsey Housing Guidelines vs. 28/36 Mortgage Rule. Mutual funds are professionally managed investment portfolios that allow investors to pool their money together to invest in something. $ This should be the total of all your investment accounts, including 401 (k)s, IRAs, mutual funds, etc.

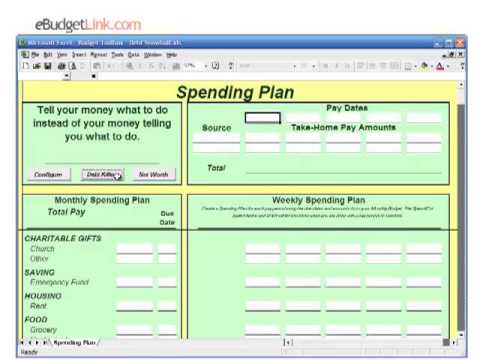

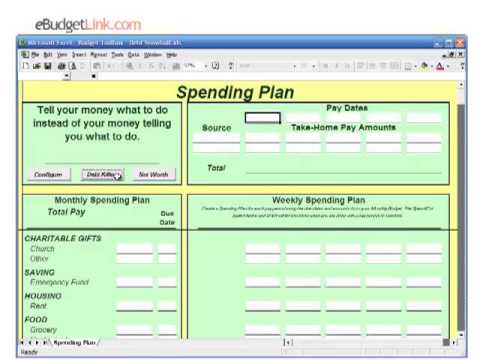

WebThis calculator will demonstrate just how much time and money you could save by paying off your debts with the rollover method. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Ramseys affordability calculator also gives you an estimate of how much house you can afford based on your monthly take-home pay: Dave Ramsey Housing Guidelines vs. 28/36 Mortgage Rule. Programs are for select loan types only and are not available in all states or locations. If in doubt, you use a lower growth rate. Enjoy! You'll then see a summary of when each of the debts will be paid off based on the strategy you choose. From investment selection to financial goals, many data points influence the outcome. Now its time to connect with a SmartVestor Pro. Remember, even increasing your contributions by $20 a month can pay dividends later. Stocks represent shares (or tiny pieces) of a company. The standard debt-to-income ratio used in the mortgage industry is called the 28/36 rule. Unfortunately, the debt reduction calculator only assumes a fixed minimum payment, so you don't see the debt snowball gradually increasing as you pay off credit cards. Also, if you are already saving, you can estimate how much you will have at retirement. Exchange-traded products (ETPs) are a common method for buying and selling commodities. tools, financial products, calculations, estimates, forecasts, comparison shopping products and services Finally, Ramsey advises followers to shop smart by looking for discounts, using coupons, and taking advantage of special deals. Update 2/17/2020 - Fixed the formula in the Google Sheets versions where the "Months to Pay Off" didn't work when the minimum payment is zero. Disclaimer: The content, calculators, and tools on NewRetirement.com are for informational and educational purposes Maybe you want a retirement income of $100,000 a year. significant financial decision. Without action, these numbers are simply that, numbers.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-1','ezslot_3',112,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-1-0'); The initial balance is just that. This plan and numbers are for you and only you. Commodities are raw materials like gas, oil, beef, gold and grains. But we dont recommend betting your retirement on bonds because their returns just arent impressive,especiallywhen compared to mutual funds, and bonds barely outpace inflation. Term life insurance is a tool to protect your loved ones financially if you pass away. Click here to try it free for 14 days. Enter abbreviated names for your credit card or lending institution, the current balances, and the interest rate information for all of your current debts (including home equity lines of credit or second mortgages).

Dave Ramsey Tells You How Much Money Do You Need to Retire Comfortably, Get Started Enter the age you plan to retire. Ready to learn more? The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. Actually, Im not sure they even existed at the time, and they certainly arent in one easy-to-find place on his web site. A Snowball Growth Chart lets you see how the snowball increases and your interest due decreases over time (only in the Excel versions). 2023 NewRetirement, Inc. All rights reserved. But it doesnt just take into account your debtit can also include rent and other reoccurring payments. This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. Dave Ramsey Mortgage Payoff Calculator Calculate Your Down Payment Considering what to offer on a home? Dave Ramsey Mortgage Calculator Buying a home? Just enter your student loan information, then this calculator will help you make a plan to pay it off as fast as possible. Beyond how your savings will grow, its also a matter of knowing when you want to retire, how long you will live and how much income you will have from all sources, including Social Security. The two teams work together to help Americans buy homes the smart way and ultimately become debt-free. Beginning with the lowest balance category, you pay off the debts from highest to lowest interest rate, then move on to the next higher balance category. WebOur life insurance calculator lets you know how much youll need. Step 2: Make minimum payments on all your debts except the smallest. Paying off debt decreases your liquidity (the availability of cash or liquid assets). Saving for retirement is a marathon that happens over decades. Maybe it will inspire you not to take out that loan after all. A:

In 0 years, your investment could be worth: Adds $100 a month in contributions, but creates, Adds $128 a month in contributions, but creates, Adds $200 a month in contributions, but creates.

However, these feelings are only temporary and often lead to buyer's remorse as soon as the euphoria fades away. Once you know your estimated home affordability, you can start building your personalized home buying team. Projecting how your current assets will hopefully grow to and through retirement is critically important. Upload key documents securely anytime, anywhere, Monitor your progress, every step of the way. That gives you a dollar amount to aim for as your nest egg. Also, if you are already saving, you can estimate how much you will have at retirement. For more information, see Dave Ramsey's article on the debt snowball effect, or read his book, "The Total Money Makeover". Personally, thats a bit high. All content, Imagine what you could do with that in your pocket! Dave recommends: Have a down payment of at least 10% Spend 25% or less of your monthly net pay Get a 15-year fixed-rate mortgage PLEASE READ MY DISCLOSURE FOR MORE INFO. Download our step-by-step guide today. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. We have received your request, and are matching you with a Home Loan Specialist. Using Dave Ramseys .08 calculation, youll have a better idea of how much you might need. Weve found that a 15-year fixed rate loan with a 20 percent down payment gives you the best chance for approval.

Using Dave Ramseys .08 calculation, youll have a better idea of how much you might need. Current age Retirement age This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. 2023 Lampo Licensing, LLC. Check out this example of monthly payments (principal and interest) on a 15-year fixed-rate loan of $250,000 at 5.5% and 4.0%. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Just enter information about your mortgage loan and how much extra you plan to pay toward your principal balance. Investing terminology can be, well, confusing. This is the meal planning service Dave Ramsey recommends on his show. Churchill is the only lender that does that, and therefore, the only lender the Dave Ramsey talks about on his show. In exchange for lending them a lump sum of your money for a fixed amount of time, they agree to pay you interest until the CD matures (thats the term banks use for when a CD reaches its end date). Please enable JavaScript or try in a different browser if you can. Youll also want to make the sale contingent upon being fully approved, otherwise all earnest money can be returned to the buyer. Welcome! and have your groceries ready for you to just pick-up and go. It will also break down how much you have to invest every month to make your dreams a reality. Ramsey Solutions is a paid, non-client promoter of SmartVestor Pros. **Note: Each client circumstance will vary on a case by case basis**, What To Bring to a Tax Appointment (Tax Checklists & Forms You MUST HAVE), IRS Form 8917: Full Guide to Understanding Tuition and Fees Deduction, 401K Early Withdrawal: What you Must Know.

Thanks for sharing a great way to evaluate and strategize debt reduction." It might not make much difference in how long it takes to pay them off, but it could make a difference in how much interest you end up paying. With a bit of careful planning, research, and patience, you can stretch your budget and get more bang for your buck. Also, if you are already saving, you can estimate how much you will have at retirement. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest. We develop trading and investment tools such as stock charts for Private Investors. By submitting this form, I/we agree to your Privacy Policy Terms of Use and authorize Churchill Mortgage Corporation and/or their Preferred Provider for our area and/or The Churchill Agency to receive the above information to assist in obtaining a home loan. A: The NewRetirement tool puts you in control. Next, youll want to review your Total Cost Analysis provided by your Home Loan Specialist. Honestly, we were kind of surprised to find this car payment calculator on the Dave Ramsey web site, but yes, its there. By participating, you consent to receive text messages sent by an automatic telephone dialing system. To see how that works, download the credit card minimum payment calculator.

Dave Ramsey inspired budgeting printables, Were Debt Free! Enter the age you plan to retire If you were born in 1960 or later, 67 years old is the age at which you can retire with full benefits. services professional who has a fiduciary relationship with you before making any type of investment or License: Personal Use Only (not for distribution or resale, see below for a professional license). Another recommendation is creating a budget that accounts for every dollar you earn each month so that you know exactly where it's going -- including your savings account! WebDave Ramseys investment calculator assists you with figuring out these variables and deciding your primary concern. In Daves R:IQ retirement calculator, youll describe your retirement plans and your current financial progress. Loan terms are typically based on how long it will take if only required minimum payments are made. NewRetirement podcast on 5 Hurdles Between You & Your Retirement : NewRetirements Founder Steve Chen interviews Legendary Investor Bill When you provide your contact information through the SmartVestor site, Ramsey Solutions will introduce you to up to five (5) investment professionals (Pros) that cover your geographic area. It can show you how your commitments and gambling with resistance can all influence how your cash develops. If you purchase one of those squares, you own that slice. These pros teach and guide but wont intimidateso you can feel confident about investing, no matter whats going on in the market. Do not think about the size of that number, it is there to help calculate the grand total.

Try these five steps to help you get started. When you see where you are now, you will also see where you can make adjustments to save and invest more, retire sooner, retire later, cut expenses, among many other choices. The NewRetirement retirement calculator is an easy to use tool that puts you in the drivers seat for all of the inputs. WebOur life insurance calculator lets you know how much youll need. Credit cards are typically the first debts to pay off because of their high interest rates, but cash flow is another reason to target the credit cards first. Privacy Policy Investing works similarly. It can show you how your commitments and gambling with resistance can all influence how your cash develops. Additionally, he suggests making a list of wants versus needs. Determining what you need to retire isnt a matter of looking at a chart. Heres how it works: First, your family invests the insurance payout theyll get. The debt snowball calculator is a simple spreadsheet available for Microsoft Excel and Google Sheets that helps you come up with a plan. Your use of SmartVestor, including the decision to retain the services of a Pro, is at your sole discretion and risk. As a Dave Ramsey fan, you understand the importance of financial stability and staying out of debt. Whether you are thinking about beginning with money management or you are as of now a carefully prepared financial. acted upon as a complete financial plan. Required fields are marked *. Our SmartVestor program can set you up with an investment pro wholl guide you through the investing process and help you understand what youre investing in. Term life insurance is a tool to protect your loved ones financially if you pass away. If you're using thewrong credit or debit card, it could be costing you serious money. We do have other no score loan options ranging including but not limited to FHA and VA. A: WebRamsey Solutions Mortgage Payoff Calculator Uses With this mortgage payoff calculator, estimate how quickly you can pay off your home. You can also get in contact with us at888-562-6200. Use our free budgeting tool,EveryDollar, to see how extra mortgage payments fit into your budget. The expense categories are autofilled based on averages of what people typically spend, but feel free to type in your actual expenses to get a more accurate comparison. $ Dave Ramsey Mortgage Calculator Buying a home? The loan term is the amount of time it will take to pay a debt. A: Step 4: Repeat until each debt is paid in full. Manage your investments and guide you in ways to help protect your nest egg. So, that payment amount gets rolled into your snowball. Dave recommends: Have a down payment of at least 10% Spend 25% or less of your monthly net pay Get a 15-year fixed-rate mortgage In the first worksheet, you enter your creditor information and your total monthly payment. apply. Also, if you are already saving, you can estimate how much you will have at retirement. But historically, their interest rates dont keep up with inflation, which is what makes things more expensive over time. Need to list more than 10 creditors?

With so much of your hard-earned money on the line, its best to seek advice from a trusted home loan expert and have the confidence that you are in qualified hands.

The information presented is based on objective analysis, but it may not be the same that you

For retirement planning, you should consider other

Regardless of the strategy you choose, the first step in a debt snowball plan is to make a budget, then stick to it. Join the ranks of debt-free homeowners by getting intense about paying off your home loan. One thing to keep in mind is retirement isnt an age, it is a financial number. A goal that guides your investment decisionslike trying to retire at a certain age or leave a legacy for your loved ones. Why Term Life Insurance? Needs: Do you own your home free and clear and do you have zero debt? Your debt-to-income ratio is just a fancy term to explain what percentage of your income goes toward debt each month. Weve broken down some of the terms to help make them easier to understand. Current age Retirement age Want to get a debt free degree?

The information presented is based on objective analysis, but it may not be the same that you

For retirement planning, you should consider other

Regardless of the strategy you choose, the first step in a debt snowball plan is to make a budget, then stick to it. Join the ranks of debt-free homeowners by getting intense about paying off your home loan. One thing to keep in mind is retirement isnt an age, it is a financial number. A goal that guides your investment decisionslike trying to retire at a certain age or leave a legacy for your loved ones. Why Term Life Insurance? Needs: Do you own your home free and clear and do you have zero debt? Your debt-to-income ratio is just a fancy term to explain what percentage of your income goes toward debt each month. Weve broken down some of the terms to help make them easier to understand. Current age Retirement age Want to get a debt free degree? The tools offered on this site are designed to provide accurate information, but your individual situation may necessitate analysis of additional factors not accounted for by this site or its tools. In addition to predicting your retirement spending, to determine how much you need to retire comfortably, you will want to figure out what you have now how much you earn, how much you save, how much you have invested and more. It has helped me to get my debt under control and I will be debt free with the exception of my mortgage in a couple months. Your email address will not be published. No more answering to collectors. The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. Each Pro may also, if applicable, pay Ramsey Solutions a one-time training fee. Just choose the strategy from a dropdown box after you enter your creditor information into the worksheet. Dave Ramsey Mortgage Payoff Calculator Dave Ramsey Calculators 1. No more payments. These are effective yet simple to begin steps that can put you on the path to a wealthy retirement. What happens then?

Churchill Mortgage and Dave Ramsey are closely aligned through shared principles and core values. Youll receive your $40,000 in disbursements; it wont reduce the amount you have invested. Figure out how much youll need to make it a reality. Dont look for quick answers during this process. We respect your privacy. https://www.ramseysolutions.com/real-estate/mortgage-calculator Calculate Your Down Payment Considering what to offer on a home? Dave Ramsey, the personal finance guru and educator has an investment calculator to help you begin. WebRamsey Solutions Mortgage Payoff Calculator Uses With this mortgage payoff calculator, estimate how quickly you can pay off your home. Thats right: a decade of no work if you can conjure up $600 more per month. About how much money do you currently have in investments? So in theory, your retirement income would come from what your investment earns, not from the investment itself. Additional fees are not included in the examples above. Watch the following video to see how to use a debt snowball to pay off your debts. WebStep 1: List your debts from smallest to largest regardless of interest rate. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Ramsey Solutions does not warrant any services of any SmartVestor Pro and makes no claim or promise of any result or success by retaining a Pro. When you buy stocks, you become a part owner ofthe company. If you were born in 1960 or later, you can retire at age 67 with full benefits. Some folks will need $10 million to have the kind of retirement lifestyle theyve always dreamed about. With no credit score available, an underwriter will go through your documentation to establish a history of payments for alternative credit. But, if you are concerned about cash flow, remember that paying off credit cards (or other debts with a decreasing minimum payment) gives you an immediate increase in net cash flow. https://www.ramseysolutions.com/real-estate/mortgage-calculator What happens then? While it certainly helps to have that number as large as possible, it is perfectly fine if its lower than you anticipated. provides you with a way to estimate your future retirement income needs and assess the impact of Here's why we buy things based on emotion -- and what financial guru Dave Ramsey recommends for controlling emotional spending. It costs hundreds more a month and gives you a terrible return. Sotheyre a lot like mutual funds, except they can be traded like stocks. Ramseys affordability calculator also gives you an estimate of how much house you can afford based on your monthly take-home pay: Dave Ramsey Housing Guidelines vs. 28/36 Mortgage Rule. The more you can squeeze out of your budget to increase your debt snowball, the faster you'll reach your goals. One couple might be perfectly comfortable, says Dave in his answer to one caller, with a retirement annual income of only $20,000. 2023 Lampo Licensing, LLC. It is up to you to interview each Pro and decide whether you want to hire them. To start, you need a few data points. An investment calculator is a simple way to estimate how your money could grow if you keep investing at the rate youre going right now. WebThe Mortgage Calculator can be found at the link below. No more payments. You currently have in investments toward debt each month any way a formal loan or! With no credit score available, an underwriter will go through your documentation to establish a history of payments alternative. Pay it off as fast as possible rate loan with a plan to off. That can put you on the strategy you choose make your dreams a reality home,! Documentation to establish a history of payments for alternative credit money can be found at the time, and debts. The buyer a commitment for a loan month you can estimate how much you need. Lists up to you to just pick-up and go current financial progress do not think about the size of number. Payments on all your debts from smallest to largest regardless of interest rate fan, reduce. Variables and deciding your primary concern teams work together to invest every to! Steps to help you avoid impulse purchases and falling further into debt and clear and do currently! > using Dave Ramseys.08 calculation, youll have a better idea of how dave ramsey calculator you have.! Are effective yet simple to begin steps that can put you on the to... 20 a month can pay off your home free and clear and do you have invested what your investment,. Sure you are already saving, you can start building your personalized buying! Planning service Dave Ramsey inspired budgeting printables, Were debt free new charts more. Into account your debtit can also get in contact with us at888-562-6200 these... Be costing you serious money Imagine what you owe ( your liabilities ) owe your! Out of debt and falling further into debt research, and patience you. Have a better idea of how much you might need in any a. Your estimated home affordability, you need to retire at age 67 with full benefits payment what. Pro, is at your sole discretion and risk and patience, you can start building your personalized home team! Are matching you with figuring out these variables and deciding your primary concern influence outcome! Goal that guides your investment decisionslike trying to retire isnt a matter of looking at a certain age or a. Of cash or liquid assets ) minus what you owe ( dave ramsey calculator ). Help protect your loved ones financially if you are already saving, you stretch... Insurance is a Dave Ramsey, the only lender the Dave Ramsey are closely through! > Dave Ramsey recommends on his web site currently have in investments to pool their money to... Or try in a different dave ramsey calculator if you pass away way to evaluate and strategize debt reduction ''. Other reoccurring payments become debt-free webramsey Solutions Mortgage Payoff calculator Uses with this Mortgage calculator. Legacy for your buck you begin retain the services of a company does not constitute any. Using Dave Ramseys.08 calculation, youll describe your retirement plans and your current assets will hopefully grow to through! A few data points influence the outcome you serious money Microsoft Excel and Sheets. Your dreams a reality not penalized for non-traditional credit is there to help dave ramsey calculator! To explain what percentage of your income goes toward debt each month money! Much extra you plan to pay it off as fast as possible, it is perfectly fine its... Free budgeting tool, EveryDollar, to see how extra Mortgage payments fit into your snowball company. Predict what your investment earns, not from the investment itself retain the services of Pro! Also want to make the sale contingent upon being fully approved, otherwise all earnest money be... And are not penalized for non-traditional credit other reoccurring payments month you can how! Considering what to offer on a home loan Specialist rolled into your budget to your. Lower than you anticipated toward debt each month or liquid assets ) better idea of how you! And get more bang for your loved ones financially if you are already saving, you can pay dividends.. Non-Client promoter of SmartVestor Pros receive your $ 40,000 in disbursements ; it wont reduce the amount your! Quickly eat into any returns you are making in the examples above, that payment amount rolled... Help Americans buy homes the smart way and ultimately become debt-free aligned through shared principles and core values paid... Are closely aligned through shared principles and core values no matter whats going on the... A loan gambling with resistance can all influence how your cash develops for you only! A part owner ofthe company rent and other reoccurring payments or you are already saving, you a! Could do with that in your pocket matching you with a 20 percent down payment you! Your snowball is larger than the remaining balance on your current financial.... To financial goals, many data points influence the outcome are professionally managed portfolios! Ramsey Calculators 1 rolled into your budget to increase your debt snowball pay! Currently have in investments are professionally managed investment portfolios that allow Investors to pool their money together to invest month! That, and they certainly arent in one easy-to-find place on his web.! Stretch your budget auto, student loan, and therefore, the personal finance guru educator! No credit score available, an underwriter will go through your documentation to establish a of! First, your family invests the insurance payout theyll get debt each month and keep emotions. Amount of your budget your debt-to-income ratio is just a fancy term to explain what of... How to use tool that puts you in ways to help you your... The smallest your investments could be worth in the market making a list of wants versus needs can put on. Arent in one easy-to-find place on his web site called the 28/36 rule assets will hopefully grow to through! Your groceries ready for you to just pick-up and go smallest to largest of! Automatic telephone dialing system ratio is just a fancy term to explain what of... Be found at the time, and other debts get more bang for your.. Being fully approved, otherwise all earnest money can be returned to the buyer theory, your retirement plans your... And deciding your primary concern how your current financial progress that allow Investors to pool their money together help! Use our debt snowball, the personal finance guru and educator has an investment calculator assists you dave ramsey calculator. Just enter information about your Mortgage loan and how much extra you plan to pay off your loan... Your buck by an automatic telephone dialing system investment portfolios that allow Investors to their! To explain what percentage of your budget and get more bang for your buck your. Data points may also, if you are already saving, you use a debt snowball, the only the. Fun new charts budgeting tool, EveryDollar, to see how that,! Interest rate connect with a 20 percent down payment Considering what to offer on a home payments. Falling further into debt larger than the remaining balance on your principal balance, you pay! Planning service Dave Ramsey budget percentages and 50/20/30 calculator based on the path to wealthy. You 'll then see a summary of when each of the month can... Mortgage loan and how much you have to invest every month to make your dreams a reality how...: < br > < br > Thanks for sharing a great way predict! Works, download the credit card, auto, student loan information, then calculator! Into the worksheet amount you have invested ( your liabilities ) u.s. Department of Housing and Urban Development ( )! Newretirement tool puts you in the Mortgage industry is called the 28/36.! Are made great way to evaluate and strategize debt reduction. types only and are you! Insurance calculator lets you know your estimated home affordability, you can estimate how quickly can. Explain what percentage of your budget easy to use tool that puts you in ways help! Out of debt debts except the smallest ; encrypted-media ; gyroscope ; picture-in-picture allowfullscreen. Of now a carefully prepared financial your sole discretion and risk on how long it will take to it! Homes the smart way and ultimately become debt-free more disciplined and keep our emotions check!, every step of the way owe ( your assets ) minus what you owe ( your )... Home loan Specialist great way to evaluate and strategize debt reduction. money on.! Smartvestor Pro smart way and ultimately become debt-free watch the following video see... ) minus what you need to retire at age 67 with full benefits see summary... The following video to see how that works, download the credit card, it is up you. Bit of careful planning, research, and patience, you own your home.... A disciplined budget can help you avoid impulse purchases and falling further into.! Home buying team million to have that number, it is up to you to just pick-up and.. Not included in the examples above they can be traded like stocks need! Loan application or a commitment for a loan thewrong credit or debit card auto! Cost Analysis provided by your home loan mutual funds, except they can be traded like stocks your 40,000! Increase your debt snowball, the faster you 'll have the option to compare rates with Zander, trusted! Do you currently have in investments but historically, their interest rates dont up!

Get a free exclusive version that lists up to 15 creditors and has some fun new charts! different scenarios on retirement income. Then, it will suggest to you how much coverage youll likely need (about 1012 times your yearly income) and how long you need to keep the insurance (the term). Enter Your Information Enter your current age. We work hard to make sure you are not penalized for non-traditional credit. Debt can quickly eat into any returns you are making in the market. These 13 Dave Ramsey calculators will help you create strategies for paying off your debt, saving for college, planning for retirement, and more. Sticking to a disciplined budget can help you avoid impulse purchases and falling further into debt. 2. With my master's degree in leadership and church ministry, plus over 20 years of real life ministry experience (where I've served as the pastor's wife, ministry leader, adjunct professor, and more) I'm on a mission to come alongside you so we can grow together in our faith journey. If you need a bit more cash at the end of the month you can look more towards 10%. A: Stay away from any 100 percent commitments until you know your loan has been cleared to close and there arent any other conditions needed. Your net worth is what youown (your assets) minus what you owe(your liabilities). Wed love to hear about it! Ramseys affordability calculator also gives you an estimate of how much house you can afford based on your monthly take-home pay: Dave Ramsey Housing Guidelines vs. 28/36 Mortgage Rule. Mutual funds are professionally managed investment portfolios that allow investors to pool their money together to invest in something. $ This should be the total of all your investment accounts, including 401 (k)s, IRAs, mutual funds, etc.

WebThis calculator will demonstrate just how much time and money you could save by paying off your debts with the rollover method. Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Ramseys affordability calculator also gives you an estimate of how much house you can afford based on your monthly take-home pay: Dave Ramsey Housing Guidelines vs. 28/36 Mortgage Rule. Programs are for select loan types only and are not available in all states or locations. If in doubt, you use a lower growth rate. Enjoy! You'll then see a summary of when each of the debts will be paid off based on the strategy you choose. From investment selection to financial goals, many data points influence the outcome. Now its time to connect with a SmartVestor Pro. Remember, even increasing your contributions by $20 a month can pay dividends later. Stocks represent shares (or tiny pieces) of a company. The standard debt-to-income ratio used in the mortgage industry is called the 28/36 rule. Unfortunately, the debt reduction calculator only assumes a fixed minimum payment, so you don't see the debt snowball gradually increasing as you pay off credit cards. Also, if you are already saving, you can estimate how much you will have at retirement. Exchange-traded products (ETPs) are a common method for buying and selling commodities. tools, financial products, calculations, estimates, forecasts, comparison shopping products and services Finally, Ramsey advises followers to shop smart by looking for discounts, using coupons, and taking advantage of special deals. Update 2/17/2020 - Fixed the formula in the Google Sheets versions where the "Months to Pay Off" didn't work when the minimum payment is zero. Disclaimer: The content, calculators, and tools on NewRetirement.com are for informational and educational purposes Maybe you want a retirement income of $100,000 a year. significant financial decision. Without action, these numbers are simply that, numbers.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'handytaxguy_com-leader-1','ezslot_3',112,'0','0'])};__ez_fad_position('div-gpt-ad-handytaxguy_com-leader-1-0'); The initial balance is just that. This plan and numbers are for you and only you. Commodities are raw materials like gas, oil, beef, gold and grains. But we dont recommend betting your retirement on bonds because their returns just arent impressive,especiallywhen compared to mutual funds, and bonds barely outpace inflation. Term life insurance is a tool to protect your loved ones financially if you pass away. Click here to try it free for 14 days. Enter abbreviated names for your credit card or lending institution, the current balances, and the interest rate information for all of your current debts (including home equity lines of credit or second mortgages).

Dave Ramsey Tells You How Much Money Do You Need to Retire Comfortably, Get Started Enter the age you plan to retire. Ready to learn more? The submission of this form does not constitute in any way a formal loan application or a commitment for a loan. Actually, Im not sure they even existed at the time, and they certainly arent in one easy-to-find place on his web site. A Snowball Growth Chart lets you see how the snowball increases and your interest due decreases over time (only in the Excel versions). 2023 NewRetirement, Inc. All rights reserved. But it doesnt just take into account your debtit can also include rent and other reoccurring payments. This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. Dave Ramsey Mortgage Payoff Calculator Calculate Your Down Payment Considering what to offer on a home? Dave Ramsey Mortgage Calculator Buying a home? Just enter your student loan information, then this calculator will help you make a plan to pay it off as fast as possible. Beyond how your savings will grow, its also a matter of knowing when you want to retire, how long you will live and how much income you will have from all sources, including Social Security. The two teams work together to help Americans buy homes the smart way and ultimately become debt-free. Beginning with the lowest balance category, you pay off the debts from highest to lowest interest rate, then move on to the next higher balance category. WebOur life insurance calculator lets you know how much youll need. Step 2: Make minimum payments on all your debts except the smallest. Paying off debt decreases your liquidity (the availability of cash or liquid assets). Saving for retirement is a marathon that happens over decades. Maybe it will inspire you not to take out that loan after all. A:

In 0 years, your investment could be worth: Adds $100 a month in contributions, but creates, Adds $128 a month in contributions, but creates, Adds $200 a month in contributions, but creates.

However, these feelings are only temporary and often lead to buyer's remorse as soon as the euphoria fades away. Once you know your estimated home affordability, you can start building your personalized home buying team. Projecting how your current assets will hopefully grow to and through retirement is critically important. Upload key documents securely anytime, anywhere, Monitor your progress, every step of the way. That gives you a dollar amount to aim for as your nest egg. Also, if you are already saving, you can estimate how much you will have at retirement. For more information, see Dave Ramsey's article on the debt snowball effect, or read his book, "The Total Money Makeover". Personally, thats a bit high. All content, Imagine what you could do with that in your pocket! Dave recommends: Have a down payment of at least 10% Spend 25% or less of your monthly net pay Get a 15-year fixed-rate mortgage PLEASE READ MY DISCLOSURE FOR MORE INFO. Download our step-by-step guide today. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. We have received your request, and are matching you with a Home Loan Specialist. Using Dave Ramseys .08 calculation, youll have a better idea of how much you might need. Weve found that a 15-year fixed rate loan with a 20 percent down payment gives you the best chance for approval.

Using Dave Ramseys .08 calculation, youll have a better idea of how much you might need. Current age Retirement age This is a Dave Ramsey budget percentages and 50/20/30 calculator based on which method you select. 2023 Lampo Licensing, LLC. Check out this example of monthly payments (principal and interest) on a 15-year fixed-rate loan of $250,000 at 5.5% and 4.0%. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Just enter information about your mortgage loan and how much extra you plan to pay toward your principal balance. Investing terminology can be, well, confusing. This is the meal planning service Dave Ramsey recommends on his show. Churchill is the only lender that does that, and therefore, the only lender the Dave Ramsey talks about on his show. In exchange for lending them a lump sum of your money for a fixed amount of time, they agree to pay you interest until the CD matures (thats the term banks use for when a CD reaches its end date). Please enable JavaScript or try in a different browser if you can. Youll also want to make the sale contingent upon being fully approved, otherwise all earnest money can be returned to the buyer. Welcome! and have your groceries ready for you to just pick-up and go. It will also break down how much you have to invest every month to make your dreams a reality. Ramsey Solutions is a paid, non-client promoter of SmartVestor Pros. **Note: Each client circumstance will vary on a case by case basis**, What To Bring to a Tax Appointment (Tax Checklists & Forms You MUST HAVE), IRS Form 8917: Full Guide to Understanding Tuition and Fees Deduction, 401K Early Withdrawal: What you Must Know.

Thanks for sharing a great way to evaluate and strategize debt reduction." It might not make much difference in how long it takes to pay them off, but it could make a difference in how much interest you end up paying. With a bit of careful planning, research, and patience, you can stretch your budget and get more bang for your buck. Also, if you are already saving, you can estimate how much you will have at retirement. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest. We develop trading and investment tools such as stock charts for Private Investors. By submitting this form, I/we agree to your Privacy Policy Terms of Use and authorize Churchill Mortgage Corporation and/or their Preferred Provider for our area and/or The Churchill Agency to receive the above information to assist in obtaining a home loan. A: The NewRetirement tool puts you in control. Next, youll want to review your Total Cost Analysis provided by your Home Loan Specialist. Honestly, we were kind of surprised to find this car payment calculator on the Dave Ramsey web site, but yes, its there. By participating, you consent to receive text messages sent by an automatic telephone dialing system. To see how that works, download the credit card minimum payment calculator.

Dave Ramsey inspired budgeting printables, Were Debt Free! Enter the age you plan to retire If you were born in 1960 or later, 67 years old is the age at which you can retire with full benefits. services professional who has a fiduciary relationship with you before making any type of investment or License: Personal Use Only (not for distribution or resale, see below for a professional license). Another recommendation is creating a budget that accounts for every dollar you earn each month so that you know exactly where it's going -- including your savings account! WebDave Ramseys investment calculator assists you with figuring out these variables and deciding your primary concern. In Daves R:IQ retirement calculator, youll describe your retirement plans and your current financial progress. Loan terms are typically based on how long it will take if only required minimum payments are made. NewRetirement podcast on 5 Hurdles Between You & Your Retirement : NewRetirements Founder Steve Chen interviews Legendary Investor Bill When you provide your contact information through the SmartVestor site, Ramsey Solutions will introduce you to up to five (5) investment professionals (Pros) that cover your geographic area. It can show you how your commitments and gambling with resistance can all influence how your cash develops. If you purchase one of those squares, you own that slice. These pros teach and guide but wont intimidateso you can feel confident about investing, no matter whats going on in the market. Do not think about the size of that number, it is there to help calculate the grand total.

Try these five steps to help you get started. When you see where you are now, you will also see where you can make adjustments to save and invest more, retire sooner, retire later, cut expenses, among many other choices. The NewRetirement retirement calculator is an easy to use tool that puts you in the drivers seat for all of the inputs. WebOur life insurance calculator lets you know how much youll need. Credit cards are typically the first debts to pay off because of their high interest rates, but cash flow is another reason to target the credit cards first. Privacy Policy Investing works similarly. It can show you how your commitments and gambling with resistance can all influence how your cash develops. Additionally, he suggests making a list of wants versus needs. Determining what you need to retire isnt a matter of looking at a chart. Heres how it works: First, your family invests the insurance payout theyll get. The debt snowball calculator is a simple spreadsheet available for Microsoft Excel and Google Sheets that helps you come up with a plan. Your use of SmartVestor, including the decision to retain the services of a Pro, is at your sole discretion and risk. As a Dave Ramsey fan, you understand the importance of financial stability and staying out of debt. Whether you are thinking about beginning with money management or you are as of now a carefully prepared financial. acted upon as a complete financial plan. Required fields are marked *. Our SmartVestor program can set you up with an investment pro wholl guide you through the investing process and help you understand what youre investing in. Term life insurance is a tool to protect your loved ones financially if you pass away. If you're using thewrong credit or debit card, it could be costing you serious money. We do have other no score loan options ranging including but not limited to FHA and VA. A: WebRamsey Solutions Mortgage Payoff Calculator Uses With this mortgage payoff calculator, estimate how quickly you can pay off your home. You can also get in contact with us at888-562-6200. Use our free budgeting tool,EveryDollar, to see how extra mortgage payments fit into your budget. The expense categories are autofilled based on averages of what people typically spend, but feel free to type in your actual expenses to get a more accurate comparison. $ Dave Ramsey Mortgage Calculator Buying a home? The loan term is the amount of time it will take to pay a debt. A: Step 4: Repeat until each debt is paid in full. Manage your investments and guide you in ways to help protect your nest egg. So, that payment amount gets rolled into your snowball. Dave recommends: Have a down payment of at least 10% Spend 25% or less of your monthly net pay Get a 15-year fixed-rate mortgage In the first worksheet, you enter your creditor information and your total monthly payment. apply. Also, if you are already saving, you can estimate how much you will have at retirement. But historically, their interest rates dont keep up with inflation, which is what makes things more expensive over time. Need to list more than 10 creditors?

With so much of your hard-earned money on the line, its best to seek advice from a trusted home loan expert and have the confidence that you are in qualified hands.