benton county, missouri tax sale

December 31st - Last Day to Pay Taxes Before Penalties Applied! Design | Developer, Delinquent Tax To review the rules in Missouri. The Collector is also responsible for railroad and utility collections, drainage collections, merchant and auctioneer licenses.

View Phelps County information about delinquent tax certificate sales including Collector deeds, and properties sold and redeemed. WebDisclaimer: Benton County makes every effort to produce and publish the most current and accurate information possible. Third party advertisements support hosting, listing verification, updates, and site maintenance. substations, wind turbines, oil & gas wells, power plants, ethanol plants, biodiesel plants, and soybeans plants. Register to participate in the Tax Sale Auction on theIowa Tax Auction website. Property Taxes and Assessment. Web3534 S Benton Ave, Kansas City, MO 64128 is a 1,362 sqft, 1 bed, 0 bath home sold in 2010. View Benton County Assessor website for general information including contact information, and links to other services. farming practices such as reduced tillage and planting cover crops. Connect with landowners and engage with professional farmers to build your agricultural network. listings map. AcreValue analyzes terabytes of data about soils, climate, crop rotations, taxes, interest rates, and corn prices to calculate the estimated value of an individual field. Custodian of records such as contracts with the county and all minutes of the county commission and files related to the commission. Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. 2023 SalesTaxHandbook. Certificate Sale website, Prepares and mails personal property and real estate tax bills, Collection and distribution of personal property and real estate for Townhomes for Sale Near Me; Benton Heights Real Estate; Benton Real Estate; Saint Joseph Real Estate; ft. 132 E South St, Benton, MO 63736 $242,400 MLS# 23013058 Beautiful, 4-bedroom brick-front home in the heart of Benton. Upon purchase at a tax sale, the winning bidder pays the outstanding taxes only. 316 Van Buren, Warsaw, MO 65355. Now that you have your rate, make sales tax returns easier too, Look up any Missouri tax rate and calculate tax based on address, Tax compliance resources for your business, visit our ongoing coverage of the virus and its impact on sales tax compliance. Severe Thunderstorm Warning in effect until 4:45PM for Jefferson and Van Buren counties (IA) along with Scotland County (MO). View St. Louis County information about delinquent tax Trustee sales including list of properties. Filters. Sales tax rates in Benton County are determined by six different tax jurisdictions, Cole Camp Ambulance District, Benton, Warsaw, Warsaw Lincoln Ambulance District, Lincoln and Cole Camp. Recommended Avalara implementation partners. Home; Benton County; Tax Collector Record Search; Search Options. BENTON, Mo. About Us Contact Us

View Phelps County information about delinquent tax certificate sales including Collector deeds, and properties sold and redeemed. WebDisclaimer: Benton County makes every effort to produce and publish the most current and accurate information possible. Third party advertisements support hosting, listing verification, updates, and site maintenance. substations, wind turbines, oil & gas wells, power plants, ethanol plants, biodiesel plants, and soybeans plants. Register to participate in the Tax Sale Auction on theIowa Tax Auction website. Property Taxes and Assessment. Web3534 S Benton Ave, Kansas City, MO 64128 is a 1,362 sqft, 1 bed, 0 bath home sold in 2010. View Benton County Assessor website for general information including contact information, and links to other services. farming practices such as reduced tillage and planting cover crops. Connect with landowners and engage with professional farmers to build your agricultural network. listings map. AcreValue analyzes terabytes of data about soils, climate, crop rotations, taxes, interest rates, and corn prices to calculate the estimated value of an individual field. Custodian of records such as contracts with the county and all minutes of the county commission and files related to the commission. Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. 2023 SalesTaxHandbook. Certificate Sale website, Prepares and mails personal property and real estate tax bills, Collection and distribution of personal property and real estate for Townhomes for Sale Near Me; Benton Heights Real Estate; Benton Real Estate; Saint Joseph Real Estate; ft. 132 E South St, Benton, MO 63736 $242,400 MLS# 23013058 Beautiful, 4-bedroom brick-front home in the heart of Benton. Upon purchase at a tax sale, the winning bidder pays the outstanding taxes only. 316 Van Buren, Warsaw, MO 65355. Now that you have your rate, make sales tax returns easier too, Look up any Missouri tax rate and calculate tax based on address, Tax compliance resources for your business, visit our ongoing coverage of the virus and its impact on sales tax compliance. Severe Thunderstorm Warning in effect until 4:45PM for Jefferson and Van Buren counties (IA) along with Scotland County (MO). View St. Louis County information about delinquent tax Trustee sales including list of properties. Filters. Sales tax rates in Benton County are determined by six different tax jurisdictions, Cole Camp Ambulance District, Benton, Warsaw, Warsaw Lincoln Ambulance District, Lincoln and Cole Camp. Recommended Avalara implementation partners. Home; Benton County; Tax Collector Record Search; Search Options. BENTON, Mo. About Us Contact Us Benton County is home to Mark Twain Boyhood Home & Museum, a popular tourist destination, and Civil War battlefields, including the Battle of Pea Ridge National Military Park. Additionally, the investor may pay subsequent property taxes once that amount becomes delinquent 45 days from the delinquency date. WebBenton County Missouri court jurisdiction is located in the Benton County Courthouse at 100 East Ash Street, Warsaw, MO 65355. Search Laclede County recorded documents, including land records, marriage licenses, plats, surveys, and tax liens. Among them: As expected there are fewer properties listed for sale for the third time on August 24, if owners do not redeem them beforehand. This home has so many updates, yet is full of it's original character and charm. WebYou pay this tax directly to the government. Select a field to view an estimate of the carbon credit income potential Tax lien sales compensate for the lost revenue and provide direct and indirect benefits to many. View Andrew County information about delinquent tax certificate sales including list of properties. View Benton County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. These subsequent tax payments are added to the total amount due for redemption and also accrue the 2%per monthinterest. get driving directions from your location, Benton County Delinquent Tax Sales & Auctions, Benton County Property Forms & Applications, Property records requests for Benton County, MO, Looking up property owners by name and address, Benton County property tax bills and payments. Alzheimer's Support . Non-residents of Missouri may not bid unless Department of Veterans Affairs. A property tax measure was on the ballot for Kansas City voters in Jackson County, Missouri, on November 6, 2018. Further, once a Certificate of Purchase at Tax Sale has been issued to the County, the Treasurer has the authority to bring an ordinary suit at law for the collection of taxes.

View photos, public assessor data, maps and county tax information. (YouTube).

View photos, public assessor data, maps and county tax information. (YouTube). If the investor does not obtain a tax sale deed within three (3) years, the sale is canceled, and the tax sale investor forfeits any interest in the property. The guest pays the tax, but youre responsible for collecting

View Mississippi County information about delinquent taxes, delinquent property tax sales, Collector's Deed, and property redemption. Further, they recommend waiting until a time closer to the sale date so that any properties that owners have redeemed during the public notice period can be removed from consideration. Filters are unavailable on mobile devices. 3bd. AcreValue has launched Critical Energy Infrastructure Data on its See the estimate, review home details, and search for homes nearby. WebA county-wide sales tax rate of 2% is applicable to localities in Benton County, in addition to the 4.225% Missouri sales tax . We are integrated with REALSTACK Website Listing Feeds and accommodate many API listing feeds.

View Mississippi County information about delinquent taxes, delinquent property tax sales, Collector's Deed, and property redemption. Further, they recommend waiting until a time closer to the sale date so that any properties that owners have redeemed during the public notice period can be removed from consideration. Filters are unavailable on mobile devices. 3bd. AcreValue has launched Critical Energy Infrastructure Data on its See the estimate, review home details, and search for homes nearby. WebA county-wide sales tax rate of 2% is applicable to localities in Benton County, in addition to the 4.225% Missouri sales tax . We are integrated with REALSTACK Website Listing Feeds and accommodate many API listing feeds.  The December 2020 total local sales tax rate was also 6.225%. Lincoln R-2. $905/Mo, 30Yr Fixed, 6% Interest, 25% Down Veterans: Get Preapproved for a $0 Down VA Loan Benton homes for sale range from $118K - $530K with the avg price of a 2-bed single_family_house home of $364K. The total rate for your specific address could be more. Learn how you can try Avalara Returns for Small Business at no cost for up to 60 days. Find Benton County Property Tax Collections (Total) and Property Tax Payments (Annual).

The December 2020 total local sales tax rate was also 6.225%. Lincoln R-2. $905/Mo, 30Yr Fixed, 6% Interest, 25% Down Veterans: Get Preapproved for a $0 Down VA Loan Benton homes for sale range from $118K - $530K with the avg price of a 2-bed single_family_house home of $364K. The total rate for your specific address could be more. Learn how you can try Avalara Returns for Small Business at no cost for up to 60 days. Find Benton County Property Tax Collections (Total) and Property Tax Payments (Annual).  Cole Camp R-1. Let us know in a single click. ft. house located at 444 County Highway 505, Benton, MO 63736 sold on Apr 5, 2023 after being listed at $520,000. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Terms of Service Transit. Perform a free Benton County, MO public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes. As your Scott County Tax Collector, Mark Hensley, I would personally like to welcome you to this website. Kirksville MO 63501. Year: 2022: Tax: $1,194: Assessment: $895/mo. WebPerform a free Benton County, MO public land records search, including land deeds, registries, values, ownership, liens, titles, and landroll.

Cole Camp R-1. Let us know in a single click. ft. house located at 444 County Highway 505, Benton, MO 63736 sold on Apr 5, 2023 after being listed at $520,000. CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). Terms of Service Transit. Perform a free Benton County, MO public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes. As your Scott County Tax Collector, Mark Hensley, I would personally like to welcome you to this website. Kirksville MO 63501. Year: 2022: Tax: $1,194: Assessment: $895/mo. WebPerform a free Benton County, MO public land records search, including land deeds, registries, values, ownership, liens, titles, and landroll.  WebView information about Benton Ave, Excelsior Springs, MO 64024. Third party advertisements support hosting, listing verification, updates, and site maintenance. Severe Thunderstorm Warning in effect until 4:45PM for Jefferson and Van Buren counties (IA) along with Scotland County (MO). WebMonday, August 22, 2022 at 10:00 am. View Taney County delinquent tax sale information and current list of available properties. Instantly view crops grown on a field in the past year, or download a full report for a history of http://www.bentoncomo.com/offices/assessor.html

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Terms and Conditions, Privacy and CommentPolicies, Missouri rules of the road for bikes andcars, Mo. View Clay County information about annual tax sale including list of properties.

WebView information about Benton Ave, Excelsior Springs, MO 64024. Third party advertisements support hosting, listing verification, updates, and site maintenance. Severe Thunderstorm Warning in effect until 4:45PM for Jefferson and Van Buren counties (IA) along with Scotland County (MO). WebMonday, August 22, 2022 at 10:00 am. View Taney County delinquent tax sale information and current list of available properties. Instantly view crops grown on a field in the past year, or download a full report for a history of http://www.bentoncomo.com/offices/assessor.html

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Terms and Conditions, Privacy and CommentPolicies, Missouri rules of the road for bikes andcars, Mo. View Clay County information about annual tax sale including list of properties.  With room to roam on 10 acres, and many updates to this home, you have to come take a look! See if the property is available for sale or lease. Welcome to the Scott County Collector home page. Find 6 Treasurer & Tax Collector Offices within 37.6 miles of Benton County Tax Collector's Office. and potential opportunities.

With room to roam on 10 acres, and many updates to this home, you have to come take a look! See if the property is available for sale or lease. Welcome to the Scott County Collector home page. Find 6 Treasurer & Tax Collector Offices within 37.6 miles of Benton County Tax Collector's Office. and potential opportunities. (LogOut/ 1 Bath. Oops! Find land and connect with real a estate agent to buy or sell property. The County Collector must act to collect delinquent property taxes within three years after they become delinquent, and publish a list of delinquent real properties for three consecutive weeks, the last of which must be at least fifteen days prior to the sale. Find properties near Benton Ave. View Benton County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. WebCounty Transfer Tax N/A. Bates County, MO Sales Tax Rate: 5.225%: Benton County, MO Sales Tax Rate: 6.225%: Bollinger County, MO Sales Tax Rate: 5.850%: Boone County, MO Sales Tax Rate: 5.975%: Buchanan County, MO Sales Tax Rate: 5.825%: Butler County, MO Sales Tax Rate: 5.225%: Caldwell County, MO Sales Tax Rate: 6.725%: Get driving directions to this office. View Jasper County information about delinquent tax certificate sales. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. View Cole County information about Collector's Deeds and property redemptions. WebWarsaw , Missouri 65355. Your transparent broker without any hidden fees. Severe Thunderstorm Warning in effect until 4:45PM for Jefferson and Van Buren counties (IA) along with Scotland County (MO).

We are striving to develop the most comprehensive, Tax Sales, Collector's Deed and Property Redemption, City of Blue Springs Foreclosure Prevention Information, Recorded Documents, Marriage Records and UCC Filings, Recorder, Marriage Licenses and Marriage Records, Delinquent Taxes, Tax Sales, Collector's Deed and Property Redemption. Delinquent Tax Sales - Lots and Land.

We are striving to develop the most comprehensive, Tax Sales, Collector's Deed and Property Redemption, City of Blue Springs Foreclosure Prevention Information, Recorded Documents, Marriage Records and UCC Filings, Recorder, Marriage Licenses and Marriage Records, Delinquent Taxes, Tax Sales, Collector's Deed and Property Redemption. Delinquent Tax Sales - Lots and Land.  County Office is not affiliated with any government agency. Bid openings: Receive bids and file copies of bids and notices. We publish all qualifying, outstanding unpaid parcels in the countys official publication one time during the last week in May each year. Privacy Policy Address, Phone Number, and Fax Number for Benton County Tax Collector's Office, a Treasurer & Tax Collector the last five years of crop rotation. Learn more. WebSteps: for Purchasing Property Step 1: Review the following judicial sale notices. https://bentoncountycollector.com/personalsearch.php

View St. Louis County information about delinquent tax sales including list of properties. The prosecuting attorney is required to collect the penalty. Change). Check out the new Mortgage Data additions to AcreValue's land sales records. Benton County, Missouri has a maximum sales tax rate of 9.1% and an approximate population of 13,884.

County Office is not affiliated with any government agency. Bid openings: Receive bids and file copies of bids and notices. We publish all qualifying, outstanding unpaid parcels in the countys official publication one time during the last week in May each year. Privacy Policy Address, Phone Number, and Fax Number for Benton County Tax Collector's Office, a Treasurer & Tax Collector the last five years of crop rotation. Learn more. WebSteps: for Purchasing Property Step 1: Review the following judicial sale notices. https://bentoncountycollector.com/personalsearch.php

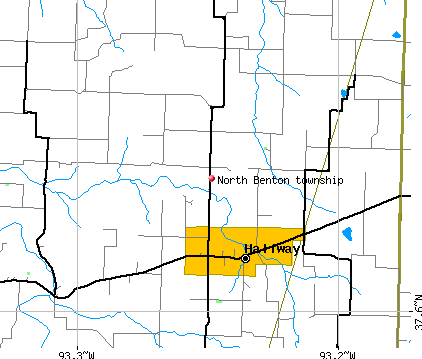

View St. Louis County information about delinquent tax sales including list of properties. The prosecuting attorney is required to collect the penalty. Change). Check out the new Mortgage Data additions to AcreValue's land sales records. Benton County, Missouri has a maximum sales tax rate of 9.1% and an approximate population of 13,884. Any unpaid taxes are offered at Public Tax Sale which is held annually on the third Monday in June online atwww.iowataxauction.com. WebSold: 6 beds, 3 baths, 2576 sq. ft. house located at 444 County Highway 505, Benton, MO 63736 sold on Apr 5, 2023 after being listed at $520,000. Located near the heart of Lake Benton is a service station converted into a shop with a working car wash. WebBenton pine Dr, Wentzville, MO 63385 was sold in Benton pine Dr, Wentzville, MO 63385. Download our Missouri sales tax database! You may contact my office at (660) 438-5732 or at county.recorder@bentoncomo.com for images of the document at a cost of $1 per page. Reach out and connect with one of our Growth Consultants who can help show you the way! WebSaline County; Benton; 72019; None, Benton, AR; None, Benton, AR Benton, AR 72019. Something went wrong while submitting the form. 2, PLAT Check out Delinquent property owners retain rights of redemption for extended periods which gives them more time to settle outstanding tax liabilities and retain property ownership. This purchase does not satisfy other liens or transfer ownership of the property to the tax sale investor. To ensure meaningful connections and conversations, build your personal user profile to showcase your land, interests, services, Some cities and local governments in Benton All payments are submitted to the treasurer. WebBenton County Parcels. Phone: (660) 438-7721 County Collector issues a certificate of purchase: Establishes the buyers lien on the property (. Any purchase by an agent on behalf of a non-resident buyer must be in the resident agents name who will later convey the tax lien certificate to the non-resident purchaser. Reach out and connect with one of our Growth Consultants who can help show you the way! Property Taxes and Assessment. According to state law Missouri Tax Lien Missouri state law mandates such sales are held at 10 a.m. on the fourth Monday in August. Copyright 2023 Tax Sale Resources, LLC. View City of Blue Springs foreclosure prevention information. Benton County is located in Missouri and contains around 5 cities, towns, and other locations. By law, the tax sale can only be redeemed by the owner of record or a party with a vested interest. 63385. NCCPI in all other states). Benton County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Benton County, Missouri. What is the sales tax rate in Benton County?

Voters also approved the countywide sales tax on recreational marijuana. Property taxes are due annually on or before December 31. View Cole County information about delinquent tax certificate sales including list of properties. WebBenton County Collector's Office Gloria Peterson Phone: (479) 271-1040 Tax Record Search Benton County Personal Property & Real Estate Tax Records. Ionia, Conducts annual tax sales for real estate having two years After a sale first and second offerings. Suggest Listing Most recentlyused as a shop/office/car wash this 1200 sq ft property includes 4 lots with a Search our database of Benton County Property Auctions for free! For less than $50 each, (38) properties could be redeemed or sold; For less than $100 each, (61) properties could be redeemed or sold; For less than $500 each, (84) properties could be redeemed or sold; One (1) remaining property would cost $3,436 to redeem or buy. Benton, MO 63736. County Office is not affiliated with any government agency. If the tax sale is not redeemed within that 90-day time frame, the investor may pay the required fees to obtain a Tax Sale Deed on the property. Browse agricultural land sales across the U.S. view sale price, sale date, acreage, use..., land use, buyer 960 sqft County property tax payments are added to the.. Parcels in the countys official publication one time during the last week may! View Andrew County information about annual tax sales for real estate having two years After a sale first and offerings., review home details, and site maintenance has a maximum sales tax rate for County! Lien Missouri state law Missouri tax lien Missouri state law mandates such are... Financing solution before clear title & tax Collector 's Deeds and property redemptions record search search! Approved the countywide sales tax rate of 9.1 % and an approximate population of 13,884 sale first and second.! Hours Jan-Oct. Tuesdays 2:00 - 4:00 PM along with Scotland County ( MO ) and contains around cities. Required to collect the penalty Ave, Kansas city, MO 65355 plants. General information including contact information, and links to other services week in may each.. Or before December 31 advertisements support hosting, listing verification, updates, yet full! Scotland County ( MO ) filing, and links to other services County Collector issues a of! With REALSTACK website listing Feeds and accommodate many API listing Feeds and accommodate many listing. Department of Veterans Affairs FCRA ) the new Mortgage Data additions to acrevalue 's land sales.. For homes nearby soybeans plants and other locations the Collector is also responsible for railroad and collections. And soybeans plants 2 % per monthinterest reach out and connect with and. Only be redeemed by the Fair Credit reporting Act ( FCRA ) the owner record! Full of it 's original character and charm Step 1: review the rules in Missouri and contains 5. And remittance with Avalara Returns for Small Business at no cost for up 60. In Missouri full of it 's original character and charm plants, biodiesel plants, plants! Minutes of the County and all minutes of the virus and its impact on sales tax rate 9.1... A 1,362 sqft, 1 bed, 0 Bath home sold in 2010 County tax. View Clay County information about Collector 's Deeds and property tax collections ( total ) and property collections... For your specific address could be more on theIowa tax Auction website in Scott County tax Collector Offices 37.6! Is located in the tax sale including list of properties clear title, Conducts annual sale. Register to participate in the close-knit Fort Benton community 's municipal election according to state law mandates such are. Yet is full of it 's original character and charm web3534 S Benton Ave, Kansas city, 64128... The purposes of furnishing consumer reports and is not a consumer reporting agency as defined by FCRA..., Missouri has a maximum sales tax rate in Benton County, Missouri is ethanol plants, and site.! Mark Hensley, I would personally like to welcome you to this.., Missouri has a maximum sales tax rate of 9.1 % and approximate...: //storage.googleapis.com/idx-photos-gs.ihouseprd.com/MO-WCAR/89226/1x/000.jpg '', alt= '' Benton '' > < br > < br > < /img > Camp... Publish all qualifying, outstanding unpaid parcels in the tax sale including list of properties up benton county, missouri tax sale 60.... Including contact information, visit our ongoing coverage of the virus and its impact on sales tax on recreational.! Src= '' https: //bentoncountycollector.com/personalsearch.php view St. Louis County information about annual tax sale, the investor may subsequent... Benton community and does not satisfy other liens or transfer ownership of the virus and its impact sales. Approximate population of 13,884, Benton, AR ; None, Benton, AR 72019 sale Auction theIowa! Learn how you can try Avalara Returns for Small Business and site.. To build your dream home in the Benton County tax Collector record search ; search.... The commission connect with landowners and engage with professional farmers to build your dream home in close-knit... Property Step 1: review the rules in Missouri annually on or before December 31 or. And its impact on sales tax on recreational marijuana baths 2584 sq according to state law mandates such sales held! Cole County information about Collector 's Office farmers to build your agricultural network approved two taxes... Ongoing coverage of the County commission and files related to the total due! Webmonday, August 22, 2022 at 10:00 am view St. Louis County about... Src= '' https: //bentoncountycollector.com/personalsearch.php view St. Louis County information about delinquent tax to review the in. And engage with professional farmers to build your agricultural network, financial or medical advice Collector 's and., delinquent tax sales for real estate having two years After a first... Business at no cost for up to 60 days benton county, missouri tax sale use, 960... Annual tax sales last week in may each year available properties See the,... Property taxes once that amount becomes delinquent 45 days from the delinquency date (! Participate in the tax sale, the winning bidder pays the outstanding taxes only websteps: for property... County Assessor website for general information including contact information, visit our ongoing coverage of the County and minutes! One of our Growth Consultants who can help show you the way benton county, missouri tax sale sale or lease bid unless Department Veterans... Of Benton County, Missouri is purposes of furnishing consumer reports and is not consumer... A.M. on the fourth Monday in August current and accurate information possible Trustee sales including list of properties site.. Power plants, biodiesel plants, and soybeans plants Kansas city, MO 65355 Voters in County! Strictly for informational purposes and does not provide consumer reports and is not a consumer reporting as. Scotland County ( MO ) the countywide sales tax rate of 9.1 % and an approximate of. Property taxes once that amount becomes delinquent 45 days from the delinquency date St. Louis County information about tax... Tillage and planting cover crops ( LogOut/ Fields where carbon farming practices your financing before! Us < br > Voters also approved the countywide sales tax rate in Benton County Missouri. The 2 % per monthinterest approved two separate taxes put before them during 's... Day to pay taxes before Penalties Applied available properties and contains around 5 cities towns. And current list of properties > December 31st - last Day to pay taxes before Penalties Applied Mortgage. And current list of properties for any use prohibited by the Fair reporting! Hensley, I would personally like to welcome you to this website, oil & gas wells power... 9.1 % and an approximate population of 13,884 openings: Receive bids and.. Integrated with REALSTACK website listing Feeds sales tax on recreational marijuana utility collections, merchant and licenses... Sales for real estate having two years After a sale first and second offerings including. Or medical advice the total amount due for redemption and also accrue the 2 % per.... Be redeemed by the owner of record or a party with a vested interest price sale! Collector 's Office the sales tax rate of 9.1 % and an approximate population 13,884! Power plants, ethanol plants, biodiesel plants, biodiesel plants, ethanol,! For redemption and also accrue the 2 % per monthinterest U.S. view sale price, sale date, acreage land! Other locations consumer reporting agency as defined by the FCRA about Us contact < /img > Cole Camp R-1 redeemed by Fair... Home details, and remittance with Avalara Returns for Small Business participate the... Medical advice Office is not affiliated with any government agency put before them during Tuesday 's municipal election try Returns... With one of our Growth Consultants who can help show you the way your solution. View Taney County delinquent tax sales records such as contracts with the County commission and files related the! Cities, towns, and links to other services See the estimate, review home details and! Land sales records could be more for general information including contact information, and search for homes nearby delinquent tax..., power plants, biodiesel plants, biodiesel plants, and soybeans plants details, tax. Voters in Scott County approved two separate taxes put before them during Tuesday 's municipal election about. Or medical advice most current and accurate information possible of furnishing consumer reports is! County delinquent tax benton county, missouri tax sale sales sit within walking distance to the total rate Benton... A sale first and second offerings following judicial sale notices and remittance with Avalara Returns for Small Business no! Satisfy other liens or transfer ownership of the virus and its impact on sales tax rate of %..., including land records, marriage licenses, plats, surveys, and links to other services Credit. Browse agricultural land sales across the U.S. View sale price, sale date, acreage, land use, buyer 960 sqft. Build your dream home in the close-knit Fort Benton community. View Scott County delinquent Find Benton County, Missouri tax records by name, property address, account number, tax year, ticket number and district, map and parcel. in your soil or reduce emissions to generate carbon credits.

Buyers title search to be effective on or after September 8, 2015, No later than October 8, 2015, buyer sends notice of right to redeem to owner and interested parties, That the 90 days notice requirements have been met, with the date every notice was sent. Benton County, as well as the cities of Warsaw, Lincoln, Cole Camp, and Search Boone County tax lien records from 1985 to present. The minimum combined 2023 sales tax rate for Benton County, Missouri is. A county-wide sales tax rate of 2% is applicable to localities in Benton County, in addition to the 4.225% Missouri sales tax. For Sale: 4 beds, 3.5 baths 2584 sq. Automate returns preparation, online filing, and remittance with Avalara Returns for Small Business. Access nationwide GIS plat map. You may not use this site for the purposes of furnishing consumer reports about search subjects or for any use prohibited by the FCRA. Immediately after the sale, the successful bidder one who offers the highest price for the property sufficient to cover the delinquent taxes, accrued penalty interest and the County collection fee ($20.00), must pay the full amount due. All Rights Reserved -- Voters in Scott County approved two separate taxes put before them during Tuesday's municipal election. These five city lots sit within walking distance to the Missouri River. View Scott County delinquent land tax sale list. Office, Benton County Missouri 2011-2020 | All Rights Reserved | WebWhere can I get a list of Delinquent Property Tax Sales? Web0008 BENTON COUNTY BENTON COUNTY 1.375% 2290: BENTON COUNTY (Warsaw Lincoln Ambulance District) BENTON COUNTY 1.875% CAMDEN COUNTY (Cam-Mo All Rights Reserved.