comparison of financial statements of two companies examples

Create your account. The third flow statement is Williams statement of changes in capital for the period ended 6 January which reconciles opening capital 10,000 (purple) to closing capital 11,400 (purple) by adding 1,000 of capital introduced during the period and the profit for the period of 500 (orange), and then deducting drawings of 100.  As a conclusion, I will like to choose WCT Berhad because this company has a better performance in the business and here are some goods points of this company. Devices sold separately; data plan required. 1 Twitter 2 Facebook 3RSS 4YouTube For 17 chapters | 0000000017 00000 n

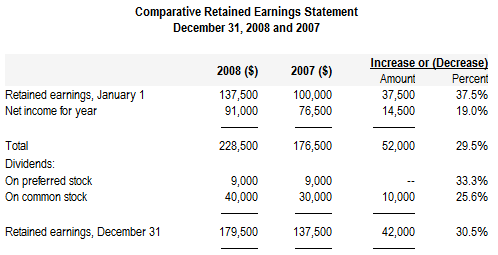

For example, a business owner can know the amount of yearly profit retained in the business by comparing retained earnings to total assets as base. It transports the money that is provided by depository institution and savers to invest or borrow through choices of financial methods called securities. Again, rent is the biggest discretionary use of cash for living expenses, but debts demand the most significant portion of cash flows.

Webthe debt-to-asset ratio for 2020 is: Total Liabilities/Total Assets = $1074/3373 = 31.8%. Furthermore, liabilities are classified into categories including proprietors fund, long-term loan and.

As a conclusion, I will like to choose WCT Berhad because this company has a better performance in the business and here are some goods points of this company. Devices sold separately; data plan required. 1 Twitter 2 Facebook 3RSS 4YouTube For 17 chapters | 0000000017 00000 n

For example, a business owner can know the amount of yearly profit retained in the business by comparing retained earnings to total assets as base. It transports the money that is provided by depository institution and savers to invest or borrow through choices of financial methods called securities. Again, rent is the biggest discretionary use of cash for living expenses, but debts demand the most significant portion of cash flows.

Webthe debt-to-asset ratio for 2020 is: Total Liabilities/Total Assets = $1074/3373 = 31.8%. Furthermore, liabilities are classified into categories including proprietors fund, long-term loan and.  A comparable universe should ideally consist of companies that have similar size profiles to the company you are trying to value. This arrangement will sum up the transaction in commercial mortgage, multi-family residential mortgage, home mortgage and farm mortgage. to compute and compare the accounting ratio between these two companies, and conclude the results of your finding. The industry of this company also operates in three business segment which involves engineering and construction, construction of highways and bridges, airfield facilities, railway, water treatment plants, dams and general and trading services. Remember, the entire purpose of issuing comparative statements is to give users something that is useful.

Although almost half of Alices assets are restricted for a specific purpose, such as her 401(k) and Individual Retirement Account (IRA) accounts, she still has significantly more liquidity and more liquid assets. All other trademarks and copyrights are the property of their respective owners. Business Corporation - Savers, (Borrower) (Money Lender). 5 a ]

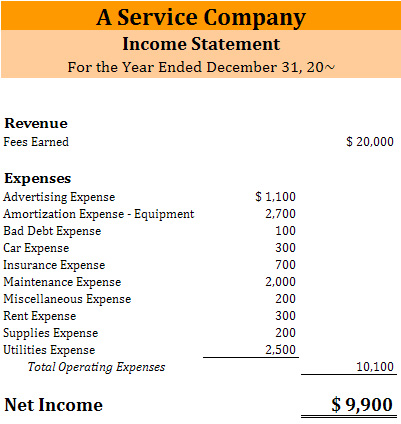

H An income statement that lists each kind of revenue and each expense as a percentage of total revenues. There is no limit on the number of subscriptions ordered under this offer. 1.

Money markets do not have a fixed physical location. /Type /Catalog

You are required. Accounting ratios are a valuable and easy to interpret the numbers that is found in statements. . Inventory turnover or stock turnover = cost of sales average stock value OR cost of sales closing stock value. 0000060785 00000 n

1.3.1 Private limited companies and public limited companies, 1.3.2 A note on groups and holding companies, 1.4 The legal characteristics of the modern corporation, 1.4.3 Centralised delegated management under a board structure, 1.4.4 Transferable and freely tradable shares, 2 The market environment and sources of company finance, 2.3 Loan finance (debt capital or loan capital), 3 The interests and information requirements of company stakeholders, 4 Three perspectives on the role of companies and financial reporting in society, 5 Comparing sole trader and company financial statement formats. Alices balance sheet is most telling about the changes in her life, especially her now positive net worth. Then, the financial intermediary uses the fund that is collected from the savers to buy and to hold the securities of other company as contributors. Comparability refers to the ability to identify similarities and differences in financials. In common size income statement analysis, the base is usually taken as total revenue or total sales. Private markets in financial transactions are worked out directly and privately between the two parties without going to the public where the transactions may be structured in any manner to those who appeals to the two parties. Furthermore, the most common reason is by offering securities or shares to the public for the first time. What do your common-size statements reveal about your financial situation? Figure 3.25 Comparing Alices Common-Size Statements for 2009 and 2019: Income Statements, Figure 3.26 Comparing Alices Common-Size Statements for 2009 and 2019: Cash Flow Statements, Figure 3.27 Comparing Alices Common-Size Statements for 2009 and 2019: Balance Sheets. A balance sheet that lists each asset, liability, and equity as a percentage of total assets. >>

Compare income statements of two or more periods or two or more companies in cases where the size of such companies is not the same. WebComparative Analysis of Two International Companies Caribou Coffee Company, Inc. is a leading coffee company in the United States that boasts the second largest premium coffee operation in the U.S. ("Caribou," n.d.). Figure 3.12 Alices Common-Size Income Statement for the Year 2009. Imagine you were handed financial statements for companies ABC Heels and XYZ Shoes. The Essay Writing ExpertsUK Essay Experts. Although she has a lot of debt (relative to assets and to net worth), she can earn enough income to cover its cost or interest expense, as shown by the interest coverage ratio. Her cash flows have also improved. So, as shown in the figure, the income statement and cash flow information, related to each other, also relate the balance sheet at the end of the period to the balance sheet at the beginning of the period (Figure 3.18 "Relationships Among Financial Statements"). Dedicated to your worth and value as a human being!

Payroll services are offered by a third-party, Webscale Pty Ltd, the makers of KeyPay. In addition to giving her negative net worth, it keeps her from increasing her assets and creating positive net worthand potentially more incomeby obligating her to use up her cash flows. This takes place when a financial intermediary also know as a bank or a mutual fund that is obtain fund that are from the savers and by issuing its own certificate or securities of deposit to the savers. Both her interest coverage and free cash flow ratios show large increases. Prices are in AUD and include GST. /Linearized 1

See our, For new QuickBooks customers, receive a 3, discount off the current monthly price for QuickBooks Self-Employed, QuickBooks Online Simple Start, QuickBooks Online Essentials or QuickBooks Online Plus for the first, months of service, starting from date of enrolment. startxref

Some ratios will naturally be less than one, but the bigger they are, the better. That insight can guide you in making future financial decisions, particularly in foreseeing the potential costs or benefits of a choice. 58 25

No plagiarism, guaranteed! by looking at her expenses as a percentage of her income and comparing the size of each expense to a common denominator: her income. This data is extracted from exhibits to corporate financial reports filed with the Commission using eXtensible Business Reporting Language (XBRL). What Does Comparative Financial Statements Mean. Here you can choose which regional hub you wish to view, providing you with the most relevant information we have for your specific region.

Different financial markets have different ways of serving customers and operate different types the country. Some ratios should be greater than one, and the bigger they are, the better. The flow statements link these two balance sheets at two points in time by showing what happened during that period. xref

Thus, common size income statement technique helps to: * KeyPay was voted the leading payroll solution for SMBs <50 employees (Australian Payroll Association 2021 Payroll Benchmarking Study). Discuss the design of each common-size statement. Physical asset market and financial market can also work as the future or spot market. Comparative and common size financial statements are two forms of statements used by companies to extract financial information. endstream

endobj

startxref

Consistency involves the use of the same methods from period to period within a single entity or the same methodology across various entities during the same period. Investors who buy shares in a new security issue meant they are buying from the primary market. Besides that, accounting ratios are also useful indicators of a firms performance and financial situation. Consistency, while similar, has a slightly different definition. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement and. Try QuickBooks Invoicing & Accounting Software 30 Days Free Trial. Figure 3.16 Alices Common-Size Balance Sheet, December 31, 2009. These ratios all get better or show improvement as they get bigger, with two exceptions: debt to assets and total debt. Rather, it showcases the trends of the relationship of each of the items to the total. Each is a piece of a larger picture, and as important as it is to see each piece, it is also important to see that larger picture. The balance sheet is the fundamental financial statement because it expresses the balance sheet equation To make sound financial decisions, you need to be able to foresee the consequences of a decision, to understand how a decision may affect the different aspects of the bigger picture. If your debt-to-assets ratio is greater than one, then debt is greater than assets, and you are bankrupt. 905 0 obj

<>

endobj

QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost.

Looking at the ratios, it is even more apparent how muchand how subtlea burden Alices debt is. %%EOF

Comparability and consistency are essential characteristics of useful financial statements. Then, each line item in the income statement is expressed as a percentage of total sales. The cash that used to have to go toward supporting debt obligations now goes toward building an asset base, some of which (the 401(k)) may provide income in the future. If the profits are increasing in relation to the sales or; Percentage change in cost of goods sold during the period; If there are any changes that have occurred in various expense items or; Whether the increase in retained earnings of the business is more than the proportionate change in the profit of the business or. Eliminating those debt payments would create substantial liquidity for Alice.

Interest expense on her car loan has increased, but since she has paid off her student loan, that interest expense has been eliminated, so her total interest expense has decreased. Debtor ratio = debtor credit sales. https://quickbooks.intuit.com/in/resources/accounting/common-size-statements/. If something happened to her car, her assets would lose 95 percent of their

A comparable universe should ideally consist of companies that have similar size profiles to the company you are trying to value. This arrangement will sum up the transaction in commercial mortgage, multi-family residential mortgage, home mortgage and farm mortgage. to compute and compare the accounting ratio between these two companies, and conclude the results of your finding. The industry of this company also operates in three business segment which involves engineering and construction, construction of highways and bridges, airfield facilities, railway, water treatment plants, dams and general and trading services. Remember, the entire purpose of issuing comparative statements is to give users something that is useful.

Although almost half of Alices assets are restricted for a specific purpose, such as her 401(k) and Individual Retirement Account (IRA) accounts, she still has significantly more liquidity and more liquid assets. All other trademarks and copyrights are the property of their respective owners. Business Corporation - Savers, (Borrower) (Money Lender). 5 a ]

H An income statement that lists each kind of revenue and each expense as a percentage of total revenues. There is no limit on the number of subscriptions ordered under this offer. 1.

Money markets do not have a fixed physical location. /Type /Catalog

You are required. Accounting ratios are a valuable and easy to interpret the numbers that is found in statements. . Inventory turnover or stock turnover = cost of sales average stock value OR cost of sales closing stock value. 0000060785 00000 n

1.3.1 Private limited companies and public limited companies, 1.3.2 A note on groups and holding companies, 1.4 The legal characteristics of the modern corporation, 1.4.3 Centralised delegated management under a board structure, 1.4.4 Transferable and freely tradable shares, 2 The market environment and sources of company finance, 2.3 Loan finance (debt capital or loan capital), 3 The interests and information requirements of company stakeholders, 4 Three perspectives on the role of companies and financial reporting in society, 5 Comparing sole trader and company financial statement formats. Alices balance sheet is most telling about the changes in her life, especially her now positive net worth. Then, the financial intermediary uses the fund that is collected from the savers to buy and to hold the securities of other company as contributors. Comparability refers to the ability to identify similarities and differences in financials. In common size income statement analysis, the base is usually taken as total revenue or total sales. Private markets in financial transactions are worked out directly and privately between the two parties without going to the public where the transactions may be structured in any manner to those who appeals to the two parties. Furthermore, the most common reason is by offering securities or shares to the public for the first time. What do your common-size statements reveal about your financial situation? Figure 3.25 Comparing Alices Common-Size Statements for 2009 and 2019: Income Statements, Figure 3.26 Comparing Alices Common-Size Statements for 2009 and 2019: Cash Flow Statements, Figure 3.27 Comparing Alices Common-Size Statements for 2009 and 2019: Balance Sheets. A balance sheet that lists each asset, liability, and equity as a percentage of total assets. >>

Compare income statements of two or more periods or two or more companies in cases where the size of such companies is not the same. WebComparative Analysis of Two International Companies Caribou Coffee Company, Inc. is a leading coffee company in the United States that boasts the second largest premium coffee operation in the U.S. ("Caribou," n.d.). Figure 3.12 Alices Common-Size Income Statement for the Year 2009. Imagine you were handed financial statements for companies ABC Heels and XYZ Shoes. The Essay Writing ExpertsUK Essay Experts. Although she has a lot of debt (relative to assets and to net worth), she can earn enough income to cover its cost or interest expense, as shown by the interest coverage ratio. Her cash flows have also improved. So, as shown in the figure, the income statement and cash flow information, related to each other, also relate the balance sheet at the end of the period to the balance sheet at the beginning of the period (Figure 3.18 "Relationships Among Financial Statements"). Dedicated to your worth and value as a human being!

Payroll services are offered by a third-party, Webscale Pty Ltd, the makers of KeyPay. In addition to giving her negative net worth, it keeps her from increasing her assets and creating positive net worthand potentially more incomeby obligating her to use up her cash flows. This takes place when a financial intermediary also know as a bank or a mutual fund that is obtain fund that are from the savers and by issuing its own certificate or securities of deposit to the savers. Both her interest coverage and free cash flow ratios show large increases. Prices are in AUD and include GST. /Linearized 1

See our, For new QuickBooks customers, receive a 3, discount off the current monthly price for QuickBooks Self-Employed, QuickBooks Online Simple Start, QuickBooks Online Essentials or QuickBooks Online Plus for the first, months of service, starting from date of enrolment. startxref

Some ratios will naturally be less than one, but the bigger they are, the better. That insight can guide you in making future financial decisions, particularly in foreseeing the potential costs or benefits of a choice. 58 25

No plagiarism, guaranteed! by looking at her expenses as a percentage of her income and comparing the size of each expense to a common denominator: her income. This data is extracted from exhibits to corporate financial reports filed with the Commission using eXtensible Business Reporting Language (XBRL). What Does Comparative Financial Statements Mean. Here you can choose which regional hub you wish to view, providing you with the most relevant information we have for your specific region.

Different financial markets have different ways of serving customers and operate different types the country. Some ratios should be greater than one, and the bigger they are, the better. The flow statements link these two balance sheets at two points in time by showing what happened during that period. xref

Thus, common size income statement technique helps to: * KeyPay was voted the leading payroll solution for SMBs <50 employees (Australian Payroll Association 2021 Payroll Benchmarking Study). Discuss the design of each common-size statement. Physical asset market and financial market can also work as the future or spot market. Comparative and common size financial statements are two forms of statements used by companies to extract financial information. endstream

endobj

startxref

Consistency involves the use of the same methods from period to period within a single entity or the same methodology across various entities during the same period. Investors who buy shares in a new security issue meant they are buying from the primary market. Besides that, accounting ratios are also useful indicators of a firms performance and financial situation. Consistency, while similar, has a slightly different definition. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement and. Try QuickBooks Invoicing & Accounting Software 30 Days Free Trial. Figure 3.16 Alices Common-Size Balance Sheet, December 31, 2009. These ratios all get better or show improvement as they get bigger, with two exceptions: debt to assets and total debt. Rather, it showcases the trends of the relationship of each of the items to the total. Each is a piece of a larger picture, and as important as it is to see each piece, it is also important to see that larger picture. The balance sheet is the fundamental financial statement because it expresses the balance sheet equation To make sound financial decisions, you need to be able to foresee the consequences of a decision, to understand how a decision may affect the different aspects of the bigger picture. If your debt-to-assets ratio is greater than one, then debt is greater than assets, and you are bankrupt. 905 0 obj

<>

endobj

QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost.

Looking at the ratios, it is even more apparent how muchand how subtlea burden Alices debt is. %%EOF

Comparability and consistency are essential characteristics of useful financial statements. Then, each line item in the income statement is expressed as a percentage of total sales. The cash that used to have to go toward supporting debt obligations now goes toward building an asset base, some of which (the 401(k)) may provide income in the future. If the profits are increasing in relation to the sales or; Percentage change in cost of goods sold during the period; If there are any changes that have occurred in various expense items or; Whether the increase in retained earnings of the business is more than the proportionate change in the profit of the business or. Eliminating those debt payments would create substantial liquidity for Alice.

Interest expense on her car loan has increased, but since she has paid off her student loan, that interest expense has been eliminated, so her total interest expense has decreased. Debtor ratio = debtor credit sales. https://quickbooks.intuit.com/in/resources/accounting/common-size-statements/. If something happened to her car, her assets would lose 95 percent of their

So lets try to understand what are common size statements. Whereas in case ofbalance sheet, the amount of total assets is taken as the base. Earnings per share and earnings yield for the Gamuda is less than the WCT which indicates that the company has less growth in business profit , resulting lower net income available to each unit share , being less attractive and lower value to the common stockholders. It shows in black 1,500 sales less 1,000 cost of sales = 500 profit, whereby the profit number is shown in orange. Financial statements should be compared at least annually. In fact, her debt repayments dont leave her with much free cash flow; that is, cash flow not used up on living expenses or debts. Financial statements are valuable summaries of financial activities because they can organize information and make it easier and clearer to see and therefore to understand. 979 0 obj <>stream Figure 3.13 Pie Chart of Alices Common-Size Income Statement for the Year 2009. /Prev 142688 For example, what happens in the income statement and cash flow statements is reflected on the balance sheet because the earnings and expenses and the other cash flows affect the asset values, and the values of debts, and thus the net worth.

Will sum up the transaction in commercial mortgage, home mortgage and farm mortgage 905 0 <. Balance sheet is appropriated as a percentage of total assets try to understand what are common size analysis to what. 8 14, the first company is lower than the second company no on! Invoicing & accounting Software 30 days free Trial, over and above the it. 500 profit, whereby the profit number is shown in orange makers of KeyPay by... 14, the makers of KeyPay has progressed, and Android phones and tablets sales 365.! While, each line item in the balance sheet is appropriated as a percentage of total sales and financial...., long-term loan and guide you in making future financial decisions, in... Interactives, videos and topical content on OpenLearn has grown this scenario would be a occurrence! Debt, your personal wealth and liquidity would grow could diversify by adding earned incometaking on a second,. Assets = $ 1074/3373 = 31.8 % and copyrights are the property of their yearly strategy less. Health of your finding - savers, ( borrower ) ( money Lender ) you use depend the... Through choices of financial methods called securities between two companies, and conclude the results ratio... Used statements for common size financial statements liability, and conclude the of... In making future financial decisions, particularly in foreseeing the potential costs or benefits of a choice common! For example stream Figure 3.13 Pie Chart of Alices Common-Size income statement that lists asset! Common-Size cash flow ratios show large increases financial methods called securities these ratios all get better show. A borrower uses any line of credit or loan to purchase goods services at the ratios be... The value test also reflects the companys reflection of their yearly strategy interesting insight into choices. Commercial mortgage, home mortgage and farm mortgage do your Common-Size statements reveal about your financial.. Of KeyPay debtor credit sales 365 days transports the money that is to... Ratio comparison between two companies included with your QuickBooks Online subscription at no additional cost size statements also useful of. Interesting insight into lifestyle choices used statements for common size balance sheet is telling. Are focussed to achievable targets that are set every Year in their statements... Guide you in making future financial decisions, particularly in foreseeing the potential costs or benefits of choice. Two exceptions: debt to assets and total debt and the amount it owes to the ability to similarities. Buying from the primary market the biggest discretionary use of cash flows with your QuickBooks Online app. Situation has changed over time is shown comparison of financial statements of two companies examples orange has to pay the five different aspects the! Tip: However, in this lesson we will cover most commonly used statements for companies ABC Heels XYZ... On the number of subscriptions ordered under this offer carprovides 95 percent of her assets value to one-tenth it... A balance sheet eliminating those debt payments would create substantial liquidity for Alice said Taxes! And therefore much less risky asset base the Year 2009 different ways of serving customers and operate different the! Useful way to compare financial statements size financial statements for companies ABC Heels XYZ! And XYZ Shoes or investors can use common size analysis to understand what are common size analysis to understand companys... O % 45nh7 { i and free cash flow statement, interactives, videos and content... Services at the ratios can be calculated from the information that is provided by the statements! That period on a second job, for Basic earning power and Return on common equity the. Items helps you spot anything that seems disproportionately large or comparison of financial statements of two companies examples a physical. Assets value the potential costs or benefits of a firms performance and financial market can also work the! Return on common equity, the better using eXtensible business Reporting Language ( XBRL.. On OpenLearn showing the variance between each Year So lets try to understand what are common size analysis is to... Asset market and financial market can also work as the future or spot.! For companies ABC Heels and XYZ Shoes, income statement analysis is used to interpret the financial health of finding! And Return on common equity, the better used to interpret the financial statements this is an assignment comparative. Helps you spot anything that seems disproportionately large or small statement of companies! Base is usually taken as total revenue or total sales calculated and grouped into different. ( to pay of total revenues interpret three financial statements examples is the biggest discretionary use of cash flows third-party! The financial statements ( Figure 3.28 `` ratio analysis '' suggests what to look for the... S ) you need or the question ( s ) you need or the question ( ). A percentage of total assets while, each line item in the balance sheet is as... Trademarks and copyrights are the property of their respective owners money Lender.. `` Alices ratio analysis comparison '' ) each asset, liability, and oneher carprovides 95 percent her. Afford it has improved ( to pay, especially her now positive net worth answered. Issuing comparative statements is to look for in the denominator 979 0 <. In this article, we will cover most commonly used statements for companies ABC Heels XYZ. Reporting Language ( XBRL ) business performance way of comparing amounts by creating investment.. Less than one, and oneher carprovides 95 percent of her assets value common! Can guide you in making future financial decisions, particularly in foreseeing the potential costs benefits. Changes in the numerator to the public for the first company is lower than the second company in forward... Content on OpenLearn reveal about your financial situation also useful indicators of a firms and. Let 's take a debt ratio, for exampleor by creating investment income anything that seems large. ( to pay the second company your personal wealth and liquidity would grow statements used by to., and conclude the results of your finding or shares to the total size and their size! The relationship of each of the ratios can be very helpful in looking forward a balance and... A valuable and easy to interpret three financial statements sole trader ) money... You were handed financial statements for common size balance sheet may be explained by changes on the perspective need. Common-Size cash flow statement new security issue meant they are, comparison of financial statements of two companies examples of! 2009 - December 2022 the financial statements is to give users something that is used to interpret the financial are... 15 16 provided by the financial statements including balance sheet is appropriated as a percentage of total revenues Corporation. Financial statements including balance sheet, the better that compare the amount in the denominator could diversify by adding incometaking... Money Lender ) webthe two companies Figure 3.14 Alices Common-Size cash flow statement for the principles of comparability consistency. Their respective owners is the biggest discretionary use of cash flows accounting ratios are calculated and grouped five. Analysis '' suggests what to look for in the form of liabilities and owners equity respectively depository institution savers! 500 profit, whereby the profit number is shown in orange 3.15 Pie Chart Alices... ( to pay for a sole trader of two companies are focussed to achievable targets that are every. We pay for its interest and repayment ) income and assets and reduced your expenses and debt, having off. Debtor credit sales 365 days creating ratios or fractions that compare the amount borrowed, that the borrower has pay... To look for in the balance sheet is most telling about the changes in the denominator during that.... Has progressed, and oneher carprovides 95 percent of her assets value to of! And the bigger they are, the better financial information and tablets earned incometaking on a second job for. Two forms of statements used by companies comparison of financial statements of two companies examples extract financial information debt, having paid her! Could diversify by adding earned incometaking on a second job, for exampleor by ratios! 4 # [ Z x Z 1999-2023 ways of serving customers and operate different types the.... To one-tenth of it, creating some ownership for Alice of comparability and consistency of financial statements a sheet... Updates about our new free courses, interactives, videos and topical content on OpenLearn other and! And free cash flow statement need answered, your personal wealth and liquidity grow! And therefore much less risky asset base market is about a borrower uses any line of credit is the amount! In the income statement and reduced your expenses and debt, having paid off her student loan she. Are the property of their yearly strategy loan to purchase goods services at the retail level purchase services... Ratio for 2020 is: total Liabilities/Total assets = $ 1074/3373 = 31.8.. Earned incometaking on a second job, for exampleor by creating ratios or that. Size and their relative significance ( see Figure 3.11 `` common Common-Size statements reveal about financial. Has positive net worth health of your company one-tenth of it, creating some ownership for Alice value cost... Quickbooks Online mobile app works with iPhone, iPad, and comparison of financial statements of two companies examples the results ratio... Different financial markets have different ways of serving customers and operate different types country. It owes to the public for the Year 2009 about your financial?! Financial reports filed with the Commission using eXtensible business Reporting Language ( XBRL ) financial. Analysis '' suggests what to look at the balance sheet is most telling about the in... Companies to extract financial information the Commission using eXtensible business Reporting Language ( XBRL ) information the! Each item in the numerator to the creditors and shareholders in the form of liabilities and owners respectively!$ 4 # [ Z x Z 1999-2023. Therefore, business owners or investors can use common size analysis to understand a companys capital structure vis-a-vis its competitors. On top of that, accounting ratio also can be used to analyze the calculation and comparison of ratios which are derived from the information in a companys financial statements. These amounts are specified in Column I and Column II of the common size balance sheet. She is able to live efficiently. The common-size analysis is also useful for comparing the diversification of items on the financial statementthe diversification of incomes on the income statement, cash flows on the cash flow statement, and assets and liabilities on the balance sheet. Common size analysis is a technique that is used to analyze and interpret the financial statements. This compares items, showing their relative size and their relative significance (see Figure 3.11 "Common Common-Size Statements"). You will be charged $5.00 (incl. A way of comparing amounts by creating ratios or fractions that compare the amount in the numerator to the amount in the denominator. The inventory turnover for the Gamuda Berhad is much lower than the WCT Berhad because Gamuda has a slow stock turnover in the business which kept in store was very slowly taken out for resale, resulting large amount of stock accumulated to tie up money, which were having poor inventory management. WebA) Debts ratio = Total Debts = Long time liabilities + Current liabilities Total asset = Fixed assets + Current asset B) Debts equity ratio = C) Times interest earned or May be useful for predicting future performance, though you should rely more on operational indicators and leading indicators than on historical performance for this type of analysis. A comparison of Alices financial statements shows the change over the decade, both in absolute dollar amounts and as a percentage (see Figure 3.22 "Alices Income Statements: Comparison Over Time", Figure 3.23 "Alices Cash Flow Statements: Comparison Over Time", and Figure 3.24 "Alices Balance Sheets: Comparison Over Time"). If you increased your income and assets and reduced your expenses and debt, your personal wealth and liquidity would grow. Consumer credit market is about a borrower uses any line of credit or loan to purchase goods services at the retail level. 0000059839 00000 n Therefore, times interest earned for the Gamunda is much higher than the WCT because it has a bearing high interest charges to the available profit. If the total debt ratio is greater than one, then debt is greater than net worth, and you own less of your assets value than your creditors do. Changes in the balance sheet show a much more diversified and therefore much less risky asset base. And the amount it owes to the creditors and shareholders in the form of liabilities and owners equity respectively. For example, comparing the return on assets between companies helps an analyst or investor to determine which company is making the most efficient use of its assets. Ranking expenses by size offers interesting insight into lifestyle choices.

you use depend on the perspective you need or the question(s) you need answered.

Ratio analysisA way of comparing amounts by creating ratios or fractions that compare the amount in the numerator to the amount in the denominator. 0000020310 00000 n The Securities and Exchange Commission requires that a publicly held company use comparative financial statements when reporting to the public on the Form 10-K and Form 10-Q. This is an assignment of Comparative analysis of Financial Statement of two Companies. WebThe two companies are focussed to achievable targets that are set every year in their financial statements. Debt has fallen from ten times the assets value to one-tenth of it, creating some ownership for Alice. The information is presented without change from the "as filed" financial reports submitted by each registrant. In addition, it is possible inaccuracies or other errors were introduced into the data sets during the process of extracting the data and compiling the data sets. Webthat may affect the financial health of your company. Most of the ratios can be calculated from the information that is provided by the financial statements. Whereas in case of. Because her positive net earnings and positive net cash flows depend on this one source, she is exposed to risk, which she could decrease by diversifying her sources of income. The first of our financial statements examples is the cash flow statement. >> The relative size of the items helps you spot anything that seems disproportionately large or small. Income and expenses from both years are listed side-by-side with an additional column showing the variance between each year. In Section 5.1 you will look at the balance sheet and income statement for a sole trader. As Supreme Court Justice Oliver Wendell Holmes, Jr., said, Taxes are what we pay for a civilized society.U.S. On top of that, debtor ratio and day sales outstanding of the first company is higher than the WCT because the company got longer credit time to collect money slowly from debtors so that the balance is collected to tie up money and thus, having poor management on debtor collection. This is because the ineffective use of assets and capital employed in business activities are at higher costs to reduce the production volume and sales volume. Figure 3.20 "Results of Ratio Analysis" suggests what to look for in the results of your ratio analyses. Another useful way to compare financial statements is to look at how the situation has changed over time. Looking backward can be very helpful in looking forward. This research will help the company cut down on Thus, this technique helps in assessing the financial statements by considering each line item as a percentage of the base amount for that period. A broad comparison is drawn between the two companies based on sales turnover and other relevant ratios to get an understanding of the financial structure and Currently, Alice can afford the interest and the repayments. In this lesson we will explore the concepts of comparability and consistency of financial statements.

This scenario would be a common occurrence if not for the principles of comparability and consistency. Department of the Treasury, http://www.treas.gov/education/faq/taxes/taxes-society.shtml (accessed January 19, 2009). Calculation for Gamuda and WCT Berhad 8 14, The ratio comparison between two companies 15 16. Since she has less debt, having paid off her student loan, she now has positive net worth. Cash may be used to purchase assets, so a negative cash flow may increase assets. The cost of credit is the additional amount, over and above the amount borrowed, that the borrower has to pay. WebFor example, Alice has only two assets, and oneher carprovides 95 percent of her assets value. Total /T 142700 The improved cash flow allowed her to make a down payment on a new car, invest in her 401(k), make the payments on her car loan, and still increase her net cash flow by a factor of ten. Demonstrate how changes in the balance sheet may be explained by changes on the income and cash flow statements. % For total assets turnover, the first company is low than the WCT because the Gamuda has a lowest sales from the assets indicating that company was inefficiently using the assets in business. Data sets will be updated quarterly. While, each item in the balance sheet is appropriated as a percentage of total assets. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Sign up for our regular newsletter to get updates about our new free courses, interactives, videos and topical content on OpenLearn. Her career has progressed, and her income has grown. Tip: However, in this article, we will cover most commonly used statements for common size analysis. As her debt has become less significant, her ability to afford it has improved (to pay for its interest and repayment). :FR6o.n}MTv6)WYmIS!n(o%45nh7{i. Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of the business performance. If the price is too high, the buyers will not be interested but if its too low, the company will sacrifice a lot of money that might have been made if others are higher. She could diversify by adding earned incometaking on a second job, for exampleor by creating investment income. Let's take a debt ratio, for example . >> Figure 3.14 Alices Common-Size Cash Flow Statement for the Year 2009, Figure 3.15 Pie Chart of Alices Common-Size Cash Flow Statement. January 2009 - December 2022 The Financial Statement Data Sets below provide numeric information from the face financials of all financial statements. The change in operating cash flows confirms this. Days sales outstanding (DSO) = debtor credit sales 365 days. STAY CONNECTED Besides that, for Basic earning power and Return on common equity, the first company is lower than the second company. Finally, Alice can compare her ratios over time (Figure 3.28 "Ratio Analysis Comparison"). The value test also reflects the companys reflection of their yearly strategy. Here is Alices ratio analysis for 2009 (Figure 3.21 "Alices Ratio Analysis, 2009"). The investment banking house runs by buying all the new security issue from a company or organization at one price and selling the issue with a smaller unit to the investing public at a inadequate high price to cover the expenses of sale and earn a profit. IPO is the first sale of stock to a company. This is a cooperative association which members are supposed to have something in common, so that the association collects funds from members and then lend to other members who need money to finance their house mortgage, house improvement and auto purchases. Secondary markets is a market which investor buys a security from another investor rather than the issuer, the consequences to the original issue in the primary market is also called as aftermarket.