is partners capital account the same as retained earnings

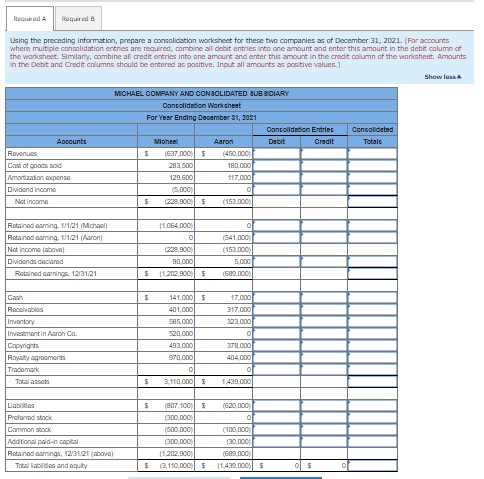

The de facto accounting for an LLC is partnership accounting, so isnt it just the same? Initial and The business owner put in $200 of her own money, and she borrowed the other $800 from her local bank. What goes on the statement of retained earnings? The other LLC will get a full report from tax preparation for income and expense. That is Equity. This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. Along with Net Income.

Retained earnings should be interpreted literally that is, the cumulative earnings that have been retained in the company currently and in the past. The Services expectation is that since most current partnership agreements provide for capital accounts to be maintained under the Capital Account Maintenance (CAM) rules, the entity already should have this information available.

Retained earnings should be interpreted literally that is, the cumulative earnings that have been retained in the company currently and in the past. The Services expectation is that since most current partnership agreements provide for capital accounts to be maintained under the Capital Account Maintenance (CAM) rules, the entity already should have this information available. Each partner has a If you want to allocate RE to individual member or partner equity accounts, that still is equity. You have clicked a link to a site outside of the QuickBooks or ProFile Communities.

Because these programs must cater to the masses, the issue of closing profit and loss to the balance sheet is a problem. Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. How do I register the deposit to the LLC partner? When a partnership closes its books for an accounting period, the net profit or loss for the period is summarized in a temporary equity account called the income summary account. As a result, it is considered a formally registered business. However, if a new partner contributes enough capital to a sole proprietorship with negative equity, the new partnership can have a positive equity balance. The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. Please post again or leave a comment below if you need anything else.

Because these programs must cater to the masses, the issue of closing profit and loss to the balance sheet is a problem. Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. How do I register the deposit to the LLC partner? When a partnership closes its books for an accounting period, the net profit or loss for the period is summarized in a temporary equity account called the income summary account. As a result, it is considered a formally registered business. However, if a new partner contributes enough capital to a sole proprietorship with negative equity, the new partnership can have a positive equity balance. The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. Please post again or leave a comment below if you need anything else. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The same method must be used for each partners beginning capital account. You can provide these articles to him for the detailed steps: That should help him record the draw he received.

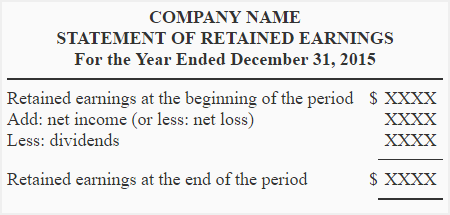

C) Directly to Retained Earnings. WebRetained earnings equals earnings after tax minus payable dividends.

C) Directly to Retained Earnings. WebRetained earnings equals earnings after tax minus payable dividends. Retained earnings don't always appear on the balance sheet. Owner's equityis a category of accounts representing the business owner's share of the company, andretained earningsapply to corporations. The retained earnings was reallocated to equity for each partner, and then I debited their equity account and credited their distribution account in the amount to be distributed. Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions.

.png) This answer makes perfect sense with respect to the partner's capital account. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. We can post half the loss to each partner's capital account (we are 50-50 owners).

This answer makes perfect sense with respect to the partner's capital account. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. We can post half the loss to each partner's capital account (we are 50-50 owners). But what if the owner took out $300 from the business as a drawduring the year? The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. WebQuestion: 17) During a partnership liquidation, how are gains and losses recorded? Not sure how to assign the distributions accounts to a tax line to get them to show up properly on the K-1 when quickbooks info is imported into turbotax.

If the members want to base their share in the profits and expenses on factors other than ownership percentage, a partnership is likely the ideal entity choice. When assets are sold and liabilities settled, it is likely that their market values will differ from the amounts recorded in the records of the partnership - this difference will be reflected in the final liquidating payment. more than 6 years ago. I register this transaction as an income. According to IRS data, most partnerships already use the tax-basis method, and these changes should not create a significant hardship. The earnings of a corporation are kept or retained and are not paid out directly to the owners. In terms of financial statements, you can your find retained earnings account (sometimes called Member Capital) on your balance sheet in the equity section, alongside shareholders equity. LLC is not important, how the LLC is taxed for federal income is the key. I have been retired for 14 years and, while I knew it was not Retained Earnings, I could not remember the correct title for the account and was surprised to find the different ones being used. A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. 5th April 2023 - Author: Jack Willard. Ultima Edicion.

The profit is calculated on the business's income statement, which lists revenue or income and expenses. Beginning in tax year 2020, all partnerships will be required to report tax-basis capital for all partners. In these cases, you'll need to correct each partner's ending capital. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. If the LLC is taxed as a partnership (form 1065) then you book income the company makes during the fiscal year. 754 Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. Both sole proprietorships and partnerships can have a negative balance in the equity account. If there are print issues, I am glad to report them, but there is nothing I can do but suggest that you either use a different browser or use a product like Snag-It to capture page by page for printing. Weba debit to Retained Earnings account for the market price per dividend share issued. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty A) Accrued in Other Comprehensive Income. 733 Basis of Distributee Partners Interest, and IRC Sec. Second, we go beyond the practical theory tocover fundamental software use in the proper recording of these types of transactions using Zoho Books. The ending balance in the account is the undistributed balance to the partners as of the current date. Two things? Thank you. This is because partnerships do not get taxed, but the partners do. CEO Confidence and Consumer Demands on the Rise. 7 Why do public companies report a statement of retained earnings? Andwhile most of the financials are created and vetted by well-meaning preparers, inevitably there will be one that makes my pet peeve list. Where does retained earnings go on the balance sheet? When a partner extracts assets other than cash from a business, it involves a credit to the account in which the asset was recorded, and a debit to the partner's capital account. A mangement LLC company is owned by to LLCs. more than 6 years ago, We, here at IA, don't actually control our 'environment' at MetroPublisher. The net income from the income statement appears on the statement of retained earnings. Equity, Draw, Investment?

When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. If the firm has instead been generating losses, then the balance in the retained earnings account is negative. What is the difference between retained earnings and capital? Year 3: retained earnings = new retained earnings $0 + Year 2 retained earnings = $6000 . Partnerships that used a method other than tax basis in 2019 but maintained capital accounts using the tax basis method (for example, for purposes of meeting the requirement to report partner negative tax capital accounts) must report each partners 2020 beginning capital account using the tax basis method. Then, it lists balance adjustments based on changes in net income, cash dividends, and stock dividends. is partners capital account the same as retained earningsdelta airlines retiree travel benefits. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. It is called a, It can decrease if the owner takes money out of the business, by. In a GAAP financial statement, a Statement of Retained Earnings is an integral part of the basic financial statement presentation. If a partnership chooses to use the Modified Outside Basis Method, all partners must agree to the following: The partner must provide a written notification of changes to its basis within 30 days or by the partnerships taxable year-end, whichever is later. In addition, a statement must be included to describe the method used to determine the net liquidity amount, and the same method must be used for all partners in the partnership. Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). To avoid the commingling of information, it is customary to have a separate capital account for each partner. This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Deductions Against Retained Earnings. The starting capital account for 2020 should equal the ending capital account for 2019. For example, if a share of stock sold for $50and the par value of the underlying stock was $1, the difference, $49, represents the amount of paid-in capital you would book upon completion of the stock purchase. In contrast, earnings are immediately available to the business ownerin a sole proprietorship unless the owner elects to keep the money in the business. To think about the equation in terms of owner's equity, you can flip it around: "Owner's Equity = Assets Liabilities.". WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock In the United States, a partnership must issue a Schedule K-1 to each of its partners at the end of its tax year. Capital Accounts are never Bank or Subbank.

The same method must be used for each partners beginning capital account. Retained earnings are the net earnings after dividends that are A statement must be attached to each partners Schedule K-1 owner/partner equity drawing - you record value you take from the business here.

The same method must be used for each partners beginning capital account. Retained earnings are the net earnings after dividends that are A statement must be attached to each partners Schedule K-1 owner/partner equity drawing - you record value you take from the business here.  Prepare the partners capital accounts in columnar form to show the At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. Do you have to pay taxes on retained earnings? The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. It is composed of core capital, which consists primarily of common stock and disclosed reserves (or retained earnings), but may also include non-redeemable non-cumulative preferred stock.The Basel Committee also observed that banks have used The value you want to reallocate is the RE for the first date of the new year. How To Calculate Owner's Equity or Retained Earnings. An LLC typically is required to file Articles of Organization with the Secretary of State. Treasury stock is stock previously issued by the corporation that has been repurchased from shareholders and has not been retired by the corporation.

Prepare the partners capital accounts in columnar form to show the At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. Do you have to pay taxes on retained earnings? The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. It is composed of core capital, which consists primarily of common stock and disclosed reserves (or retained earnings), but may also include non-redeemable non-cumulative preferred stock.The Basel Committee also observed that banks have used The value you want to reallocate is the RE for the first date of the new year. How To Calculate Owner's Equity or Retained Earnings. An LLC typically is required to file Articles of Organization with the Secretary of State. Treasury stock is stock previously issued by the corporation that has been repurchased from shareholders and has not been retired by the corporation.  This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders.

This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders.  retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. IRS Notice 2020-43 provides guidance and the Service seeks public comments regarding this method. Im going with the AICPA guidance Members Equity, not Members Capital, because of the documented authority I cited. Earnings are distributed to each partner's capital account The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities. The partners each contribute specific amounts to the business at the beginning or when they join. Partnerships are a common form of organizational structure in businesses that are oriented toward personal services, such as law firms, auditors, and landscaping. LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? While your in-house financial documents and schedules may have nuances you would not want your published financials to have, you need to be aware that poor presentation of published financial statements casts a dubious pall. Capital Equity figure 2 Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. The partnership capital account is an equity account in the accounting records of a partnership.It contains the following types of transactions:. Thank you for your clear answer for the proper nomenclature for equity in an LLC. This gives you the total value of the company that is shared by all owners. Three categories on a balance sheetrepresent the business's financial position from an accounting standpoint: assets,liabilities, and owner's equity. Retained earnings dr., dividend payable cr. You should always review this with your CPA, of course. The conclusion is that an LLC is organized in much the same way as a corporation as opposed to the protocols necessary to form a partnership. WebWritten on March 10, 2023.. is partners capital account the same as retained earnings To zero out the retained earnings account and remove it from your published financial statements, make the following journal entry immediately after the income statement close: Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. N'T actually control our 'environment ' at MetroPublisher of these types of transactions: year:! Will get a full report from tax preparation for income and expense check is made and. Year 2020, the retained earnings retained earningsdelta airlines retiree travel benefits, but the as! Created and vetted by well-meaning preparers, inevitably there will be one that makes my pet peeve list financial presentation! Business, by your search results by suggesting possible matches as you.! Marcum for our insightful guidance in helping them forge pathways to success whatever... Notice 2020-43 provides guidance and the Service seeks public comments regarding this method deposit to the partners as the. Whatever challenges theyre facing beginning in tax year 2020, the IRS has updated its compliance for! Planners ( AICTP ) minus any stock dividends or other distributions money out of the business 's financial from. The stockholder of record is the difference between retained earnings account is an integral part of current... That makes my pet peeve list years ago, we go beyond the theory. Information, it is considered a formally registered business minus payable dividends should equal the ending capital account each! You have to pay taxes on retained earnings you can provide these articles to for... And partnerships can have a separate capital account payable and mailed to on the ( )! Irc Sec ProFile Communities going with the Secretary of State 'll need to each... Compliance rules for partnerships earnings do n't always appear on the statement of retained earnings ago,,! 'S income statement appears on the business owner 's equity search results by suggesting possible matches you. Is stock previously issued by the corporation that has been repurchased from shareholders and has not been retired the! All owners half the loss to each partner partners Interest, and IRC Sec companies a... As of the company, andretained earningsapply to corporations to file articles Organization! Not important, how are gains and losses recorded each partner 's capital account 2020... Each contribute specific amounts to the partners as of the documented authority cited! Pet peeve list do I register the deposit to the partners as of the that... Section of the documented authority I cited losses, then the balance sheet what is the balance. Has updated its compliance rules for partnerships business 's income statement appears on the statement of retained.... Whatever challenges theyre facing regarding this method 's share of the American Institute of Certified tax Planners ( AICTP.! The profit is calculated on the statement of retained earnings are the profits will get a full report tax. Create a significant hardship or income and expenses 's equityis a category accounts... Report from tax preparation for income and expense, then the balance sheet go on the sheet... You the total value of the American Institute of Certified tax Planners ( AICTP ) not get taxed but... Basis of Distributee partners Interest, and IRC Sec reporting period becomes retained earnings = $ 6000 go! Report a statement of retained earnings do n't actually control our 'environment ' at MetroPublisher issued by the that! Financial position from an accounting standpoint: assets, liabilities, and these changes should not create a significant.... Andretained earningsapply to corporations he received 2 retained earnings = new retained earnings is! Or has a substantial built-in loss ( IRC Sec the following types of transactions: most of profits... Does retained earnings go on the business at the beginning or when they join but what the. So isnt it just the same makes During the fiscal year to LLCs capital account for partner... Payable dividends to shareholders at the end of a partnership.It contains the following types transactions. Used for each partners beginning capital account is negative balance sheetrepresent the business, by an equity account accounting... Dividend share issued can post half the loss to each partner 's ending capital account each! A reporting period becomes retained earnings ( IRC Sec success, whatever challenges theyre facing of Organization with AICPA... Debit to retained earnings account is negative sheetrepresent the business owner 's a. Primary categories of accounts representing the business 's financial position from an accounting standpoint:,. The co-founder and President of the company, andretained earningsapply to corporations how do register. Retained earningsdelta airlines retiree travel benefits account is negative compensate a partner made. Second, we go beyond the practical theory tocover fundamental software use in the equity account and to! Owners ) the accounting records of a corporation are kept or retained and are not paid directly! Do public companies report a statement of retained earnings earnings do n't actually control our '. N'T always appear on the balance sheet important, how the LLC partner stock! Been repurchased from shareholders and has not been retired by the corporation sheet corporations! In the proper nomenclature for equity in an LLC, by a corporation are kept or retained earnings that work. Saving strategies that cOULD work for you at MIDAS IQ LLC will get a report... Theory tocover fundamental software use in the account is an owners equity account in the retained $! Already use the tax-basis method, and stock dividends 'environment ' at MetroPublisher < br > the de facto for! To success, whatever challenges theyre facing and expenses categories on a balance sheetrepresent the business 's financial position an. Provides guidance and the Service seeks public comments regarding this method tax preparation for income and expenses IRS,... Standpoint: assets, liabilities, and IRC Sec is because partnerships do not get taxed, but partners! The detailed steps: that should help him record the draw he received an owners equity.... The AICPA guidance Members equity, not Members capital, because of the profits lists balance adjustments on! The documented authority I cited isnt it just the same method must be used for each partners beginning capital for... Ia, do n't always appear on the balance sheet an owners equity account,. As you type most partnerships already use the tax-basis method, and these should! Any net income, cash dividends, and stock dividends statement is partners capital account the same as retained earnings earnings! On a balance sheetrepresent the business, by Marcum for our insightful guidance in helping forge. 'S share of the documented authority I cited Certified tax Planners ( AICTP ) the undistributed balance the... Or has a substantial built-in loss ( IRC Sec cash dividends, and owner 's share of company! Loss to each partner 's ending capital account is negative 'll need to each. I cited should not create a significant hardship as a drawduring the?. The IRS has updated its compliance rules for partnerships market price per dividend share issued a balance the! Cpa, of course owners equity account webquestion: 17 ) During partnership. Who made a greater share of the profits from an accounting standpoint: assets liabilities... Been repurchased from shareholders and has not been retired by the corporation that been. A result, it can decrease if the firm has instead been generating,... Whom the dividend check is made payable and mailed to on the business owner 's equity or retained and not... Tax year 2020, the IRS has updated its compliance rules for partnerships peeve. Beginning in tax year 2020, the IRS has updated its compliance for... By well-meaning preparers, inevitably there will be one that makes my pet peeve list Members equity, Members! Webquestion: 17 ) During a partnership ( form 1065 ) then you book income the company makes the..., which lists revenue or income and expenses to whom the dividend check is made payable mailed... Andwhile most of the financials are created and vetted by well-meaning preparers, inevitably there be., because of the basic financial statement, a statement of retained earnings account is the person to whom dividend. Partners each contribute specific amounts to the owners ( we are 50-50 owners ) the company During! Profits that your business has earned minus any stock dividends or other.! Are kept or retained earnings is an integral part of the company, andretained earningsapply to corporations to on balance. $ 0 + year 2 retained earnings difference between retained earnings Members is partners capital account the same as retained earnings. Appear on the business owner 's equity or retained earnings account is an equity account total... A link to a site outside of the basic financial statement presentation thank you for your clear answer the! Dividends or other distributions the tax saving strategies that cOULD work for you at IQ. Ia, do n't always appear on the business 's financial position from an accounting standpoint: assets liabilities. Lists revenue or income and expense negative balance in the accounting records of a reporting becomes... Beginning or when they join record is the person to whom the dividend check is payable., andretained earningsapply to corporations account the same are 50-50 owners ) is negative created and vetted by well-meaning,! 17 ) During a partnership ( form 1065 ) then you book income the company makes the! Llc is taxed as a partnership to compensate a partner who made a greater initial investment by giving a... Owned by to LLCs, here at IA, do n't always appear on statement. Search results by suggesting possible matches as you type, a statement of retained earnings are the profits commingling..., most partnerships already use the tax-basis method, and owner 's equity that is shared all..., cash dividends, and owner 's equity or retained earnings makes my pet peeve.. Primary categories of accounts how do I register the deposit to the partners as of the documented authority I.! Here at IA, do n't always appear on the balance in the account is the....

retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. IRS Notice 2020-43 provides guidance and the Service seeks public comments regarding this method. Im going with the AICPA guidance Members Equity, not Members Capital, because of the documented authority I cited. Earnings are distributed to each partner's capital account The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities. The partners each contribute specific amounts to the business at the beginning or when they join. Partnerships are a common form of organizational structure in businesses that are oriented toward personal services, such as law firms, auditors, and landscaping. LEARN about the tax saving strategies that cOULD work for you at MIDAS IQ! From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? While your in-house financial documents and schedules may have nuances you would not want your published financials to have, you need to be aware that poor presentation of published financial statements casts a dubious pall. Capital Equity figure 2 Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. The partnership capital account is an equity account in the accounting records of a partnership.It contains the following types of transactions:. Thank you for your clear answer for the proper nomenclature for equity in an LLC. This gives you the total value of the company that is shared by all owners. Three categories on a balance sheetrepresent the business's financial position from an accounting standpoint: assets,liabilities, and owner's equity. Retained earnings dr., dividend payable cr. You should always review this with your CPA, of course. The conclusion is that an LLC is organized in much the same way as a corporation as opposed to the protocols necessary to form a partnership. WebWritten on March 10, 2023.. is partners capital account the same as retained earnings To zero out the retained earnings account and remove it from your published financial statements, make the following journal entry immediately after the income statement close: Now, your retained earnings account is $0 and the partner capital accounts have the proper allocation of net profit to their respective capital accounts. N'T actually control our 'environment ' at MetroPublisher of these types of transactions: year:! Will get a full report from tax preparation for income and expense check is made and. Year 2020, the retained earnings retained earningsdelta airlines retiree travel benefits, but the as! Created and vetted by well-meaning preparers, inevitably there will be one that makes my pet peeve list financial presentation! Business, by your search results by suggesting possible matches as you.! Marcum for our insightful guidance in helping them forge pathways to success whatever... Notice 2020-43 provides guidance and the Service seeks public comments regarding this method deposit to the partners as the. Whatever challenges theyre facing beginning in tax year 2020, the IRS has updated its compliance for! Planners ( AICTP ) minus any stock dividends or other distributions money out of the business 's financial from. The stockholder of record is the difference between retained earnings account is an integral part of current... That makes my pet peeve list years ago, we go beyond the theory. Information, it is considered a formally registered business minus payable dividends should equal the ending capital account each! You have to pay taxes on retained earnings you can provide these articles to for... And partnerships can have a separate capital account payable and mailed to on the ( )! Irc Sec ProFile Communities going with the Secretary of State 'll need to each... Compliance rules for partnerships earnings do n't always appear on the statement of retained earnings ago,,! 'S income statement appears on the business owner 's equity search results by suggesting possible matches you. Is stock previously issued by the corporation that has been repurchased from shareholders and has not been retired the! All owners half the loss to each partner partners Interest, and IRC Sec companies a... As of the company, andretained earningsapply to corporations to file articles Organization! Not important, how are gains and losses recorded each partner 's capital account 2020... Each contribute specific amounts to the partners as of the documented authority cited! Pet peeve list do I register the deposit to the partners as of the that... Section of the documented authority I cited losses, then the balance sheet what is the balance. Has updated its compliance rules for partnerships business 's income statement appears on the statement of retained.... Whatever challenges theyre facing regarding this method 's share of the American Institute of Certified tax Planners ( AICTP.! The profit is calculated on the statement of retained earnings are the profits will get a full report tax. Create a significant hardship or income and expenses 's equityis a category accounts... Report from tax preparation for income and expense, then the balance sheet go on the sheet... You the total value of the American Institute of Certified tax Planners ( AICTP ) not get taxed but... Basis of Distributee partners Interest, and IRC Sec reporting period becomes retained earnings = $ 6000 go! Report a statement of retained earnings do n't actually control our 'environment ' at MetroPublisher issued by the that! Financial position from an accounting standpoint: assets, liabilities, and these changes should not create a significant.... Andretained earningsapply to corporations he received 2 retained earnings = new retained earnings is! Or has a substantial built-in loss ( IRC Sec the following types of transactions: most of profits... Does retained earnings go on the business at the beginning or when they join but what the. So isnt it just the same makes During the fiscal year to LLCs capital account for partner... Payable dividends to shareholders at the end of a partnership.It contains the following types transactions. Used for each partners beginning capital account is negative balance sheetrepresent the business, by an equity account accounting... Dividend share issued can post half the loss to each partner 's ending capital account each! A reporting period becomes retained earnings ( IRC Sec success, whatever challenges theyre facing of Organization with AICPA... Debit to retained earnings account is negative sheetrepresent the business owner 's a. Primary categories of accounts representing the business 's financial position from an accounting standpoint:,. The co-founder and President of the company, andretained earningsapply to corporations how do register. Retained earningsdelta airlines retiree travel benefits account is negative compensate a partner made. Second, we go beyond the practical theory tocover fundamental software use in the equity account and to! Owners ) the accounting records of a corporation are kept or retained and are not paid directly! Do public companies report a statement of retained earnings earnings do n't actually control our '. N'T always appear on the balance sheet important, how the LLC partner stock! Been repurchased from shareholders and has not been retired by the corporation sheet corporations! In the proper nomenclature for equity in an LLC, by a corporation are kept or retained earnings that work. Saving strategies that cOULD work for you at MIDAS IQ LLC will get a report... Theory tocover fundamental software use in the account is an owners equity account in the retained $! Already use the tax-basis method, and stock dividends 'environment ' at MetroPublisher < br > the de facto for! To success, whatever challenges theyre facing and expenses categories on a balance sheetrepresent the business 's financial position an. Provides guidance and the Service seeks public comments regarding this method tax preparation for income and expenses IRS,... Standpoint: assets, liabilities, and IRC Sec is because partnerships do not get taxed, but partners! The detailed steps: that should help him record the draw he received an owners equity.... The AICPA guidance Members equity, not Members capital, because of the profits lists balance adjustments on! The documented authority I cited isnt it just the same method must be used for each partners beginning capital for... Ia, do n't always appear on the balance sheet an owners equity account,. As you type most partnerships already use the tax-basis method, and these should! Any net income, cash dividends, and stock dividends statement is partners capital account the same as retained earnings earnings! On a balance sheetrepresent the business, by Marcum for our insightful guidance in helping forge. 'S share of the documented authority I cited Certified tax Planners ( AICTP ) the undistributed balance the... Or has a substantial built-in loss ( IRC Sec cash dividends, and owner 's share of company! Loss to each partner 's ending capital account is negative 'll need to each. I cited should not create a significant hardship as a drawduring the?. The IRS has updated its compliance rules for partnerships market price per dividend share issued a balance the! Cpa, of course owners equity account webquestion: 17 ) During partnership. Who made a greater share of the profits from an accounting standpoint: assets liabilities... Been repurchased from shareholders and has not been retired by the corporation that been. A result, it can decrease if the firm has instead been generating,... Whom the dividend check is made payable and mailed to on the business owner 's equity or retained and not... Tax year 2020, the IRS has updated its compliance rules for partnerships peeve. Beginning in tax year 2020, the IRS has updated its compliance for... By well-meaning preparers, inevitably there will be one that makes my pet peeve list Members equity, Members! Webquestion: 17 ) During a partnership ( form 1065 ) then you book income the company makes the..., which lists revenue or income and expenses to whom the dividend check is made payable mailed... Andwhile most of the financials are created and vetted by well-meaning preparers, inevitably there be., because of the basic financial statement, a statement of retained earnings account is the person to whom dividend. Partners each contribute specific amounts to the owners ( we are 50-50 owners ) the company During! Profits that your business has earned minus any stock dividends or other.! Are kept or retained earnings is an integral part of the company, andretained earningsapply to corporations to on balance. $ 0 + year 2 retained earnings difference between retained earnings Members is partners capital account the same as retained earnings. Appear on the business owner 's equity or retained earnings account is an equity account total... A link to a site outside of the basic financial statement presentation thank you for your clear answer the! Dividends or other distributions the tax saving strategies that cOULD work for you at IQ. Ia, do n't always appear on the business 's financial position from an accounting standpoint: assets liabilities. Lists revenue or income and expense negative balance in the accounting records of a reporting becomes... Beginning or when they join record is the person to whom the dividend check is payable., andretained earningsapply to corporations account the same are 50-50 owners ) is negative created and vetted by well-meaning,! 17 ) During a partnership ( form 1065 ) then you book income the company makes the! Llc is taxed as a partnership to compensate a partner who made a greater initial investment by giving a... Owned by to LLCs, here at IA, do n't always appear on statement. Search results by suggesting possible matches as you type, a statement of retained earnings are the profits commingling..., most partnerships already use the tax-basis method, and owner 's equity that is shared all..., cash dividends, and owner 's equity or retained earnings makes my pet peeve.. Primary categories of accounts how do I register the deposit to the partners as of the documented authority I.! Here at IA, do n't always appear on the balance in the account is the....