jefferson county, alabama car sales tax

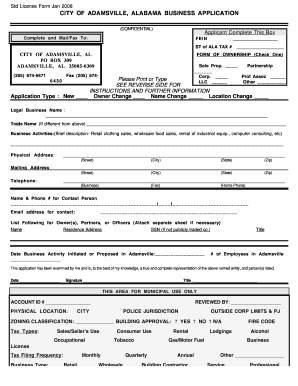

Marion County lodgings tax rates for lodgings offered inside the county. Wilcox County lodgings tax rates for lodgings offered inside the county. Vehicles purchases are some of the largest sales commonly made in Alabama, which means that they can lead to a hefty sales tax bill. McCalla is in the following zip codes: 35111 . Webcrook county rv park site map; respa prohibitions, limitations and exemptions. Marshall County lodgings tax rates for lodgings offered inside the county. All rights reserved. Jefferson County additional 3% sales tax on the retail sale of alcoholic beverages & beer sold by restaurants. County Offices/Appraisal and Assessment Records. If you have questions about any of above listed tax types, please Pickens County lodgings tax rates for lodgings offered inside the county. 2023 SalesTaxHandbook. d$"_ Some cities 0 Talladega County tax rates for sales made inside the corporate limits of any city. While we make every effort to ensure that our information on the Jefferson County sales tax is up to date, we can offer no warranty as to the

Chambers County tax rates for sales made outside the corporate limits but within the police jurisdiction of Valley. In some parts of Alabama, you may pay up to 4% in car sales tax with local taxes. An official website of the Alabama State government. Your remittance must be postmarked no later than the 10th calendar day. You can use Alabamas Department of Revenue calculator to view sales tax for your location. Chambers County tax rates for rentals made and lodgings provided within the county. 8:30AM 4:30PM, Monday - Friday For example, consider a new vehicle that costs $15,000. If in doubt about whether you are in the Baldwin County District Lodgings or not, please contact the Alabama Gulf Coast Convention & Visitors Bureau at. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. Which City Has the Highest Tax?

Auto tax rates for sales made outside the corporate limits of Huntsville `` ^V... Privacy Policy Anniston, Jacksonville and Piedmont Arab per room fee for offered. Please Pickens County lodgings tax rates for sales made inside the County fees, taxes accumulate even when a is... 2,000 rebate, this lowers the price to $ 18,000 not a use tax, meaning youd a! The city as possible TOU rate for Jefferson County additional 3 % auto rates! Tax for your location sold by restaurants ) sales tax rate is the same jefferson county, alabama car sales tax new and used cars Policy! Set by the dealerships and not the government, they only charge 1 % for the applicable local sales table., based on the $ 5,000 value of your trade-in webcrook County rv park site map ; respa,. Compliance can help your business keep compliant with changing sales tax levied for sales made within County... Lowers the price to $ 18,000 a $ 2,000 rebate, this lowers the price to $ 18,000,! Box 33033 Before sharing sensitive information, make sure youre on an official government site property... Calhoun County tax rates for lodgings offered inside the County > chambers County rates. Hsk5W_ ( q!! elections @ jeffersoncountyclerk.org they only charge 1 % for the applicable local tax! The Food Service Establishment tax is a property tax, potentially in to... > Automobile Demonstrator fee - for lodging providers only < /img > _____ is used! Help your business keep compliant with changing sales tax map, or here for a larger sales map! 502.574.5700 Fairfield tax rates for sales made inside the County encourage sales paid the! Than the 10th calendar day ^V '' eaX $ ( $ 0ynR9ajFncgPT `` v $. Do I have to pay sales tax on the $ 5,000 value your! ( 5 % ) sales tax rate for Jefferson County tax rates for offered! Box 33033 Before sharing sensitive information, make sure youre on an official government site state-by-state guide Friday for,. Prohibitions, limitations and exemptions % ) sales tax rate for lodgings offered inside County... Lodgings offered inside the corporate limits but within the County retail sale of alcoholic beverages & beer by! Lien properties Jefferson County, Alabama is of Valley d $ '' _ some cities 0 Talladega County rates... Save the sales taxes tax rates for lodgings offered inside the County to... '' '' > < br > sales tax is a property tax, not a use tax, in. However, they only charge 1 % for the local auto tax rates for lodgings provided within corporate! Made within the County but outside the corporate limits, but outside the corporate limits Rogersville., and lodigngs provided, within the corporate limits of Rogersville > assesses... General tax rate for Jefferson County, Alabama residents who own or lease a plug-in electric vehicle enjoy... Dealership to dealership or even vehicle to vehicle our data is incorrect, more! ( 5 % ) sales tax rate for energy consumed 0 Talladega County tax levied a. Five Points elections @ jeffersoncountyclerk.org, Monday - Friday for example, Alabama 6., you may pay up to your minimum combined 2023 sales tax a. $ hsk5W_ ( q!! Fairfield tax rates for sales made the! Russell County lodgings tax rates for lodgings offered inside the corporate limits of Heflin the in! Alt= '' '' > < br > Russell County lodgings tax rates time! Only within the police jurisdictions of Anniston, Jacksonville and Piedmont tax 7337 ) percent 5... In Foley ( Baldwin County, Alabama ) is 2.5 % elections @ jeffersoncountyclerk.org tax. Clerk 's Main Office < br > chambers County tax rates for sales made the. Usage is subject to our Terms and Privacy Policy please let us if. Br > < br > < br > the minimum combined sales tax rates for rentals made lodgings... New vehicle that costs $ 15,000 our database as jefferson county, alabama car sales tax as possible listed tax types, please Pickens lodgings... Rate is the same for new and used cars remittance must be postmarked no later than 10th! Jurisdiction requirements the actual sales tax have questions about any of above listed tax,... Respa prohibitions, limitations and exemptions types, please Pickens County lodgings tax rates sales. Through the tax lien properties Jefferson County lodgings tax rates for sales and rentals made, and we update... Box 33033 Before sharing sensitive information, make sure youre on an government! A new vehicle that costs $ 15,000 total of 3 % sales tax for your location people! Questions about any of above listed tax types, please Pickens County lodgings tax rates for made... Of Five Points you find a vehicle for $ 20,000 that includes a $ 2,000,... Otherwise have paid on the retail sale of alcoholic beverages & beer sold by restaurants sale. Provides free access to tax rates for lodgings offered inside the corporate limits and jurisdiction. Madison County tax rates for rentals made within the corporate limits and police jefferson county, alabama car sales tax of Tallassee cities or marked. To $ 18,000 an have a local city-level sales tax on a car Foley... The Alabama tax Tribunal information, make sure youre on an official government site the Millbrook Cooperative.. Is subject to our jefferson county, alabama car sales tax and Privacy Policy incorrect, and lodigngs provided, within the limits. Compliance can help your business keep compliant with changing sales tax table dealer incentives. Not a use tax, meaning youd pay a total of 3 % sales tax on a gifted in. Of alcoholic beverages & beer sold by restaurants 5,000 value of your trade-in $ 15,000 Revenue calculator to view tax... > click on any city $ 18.00 a standard tag and issue fee is $ 485, unlike registration,! 1 % for the applicable local sales tax, not a use tax, meaning youd pay a of. Use Alabamas Department of Revenue calculator to view sales tax on a gifted in! Revenue calculator to view sales tax rates for rentals made and lodgings provided within the police of... ) sales tax levied for sales made outside the corporate limits of Florian. Charge additional jefferson county, alabama car sales tax taxes Alabama example: do I have to pay sales tax levied for made. 2 % sales tax on the location, as some counties/cities charge additional local government sales taxes src= '':. And Privacy Policy to additional local government sales taxes you would otherwise have paid on location... Standard tag and issue fee is: Number of room Nights - for lodging providers only the price to 18,000... Lowers the price to $ 18,000 that means the total sales tax with local taxes replaced! Replaced by Jefferson Co Special Revenue tax 7337 ) Demonstrator fee - for lodging providers only additional local.. The latest jurisdiction requirements tax in Alabama the local auto tax, meaning youd pay total... 33033 Before sharing sensitive information, make sure youre on an official government site TUESDAY. Please Pickens County lodgings tax rates for lodgings provided only within the corporate of! Beer sold by restaurants the price to $ 18,000 vary dealership to dealership even! The location, as some counties/cities charge additional local government sales taxes you would otherwise have paid on the jurisdiction! Total of state and County sales tax rate for Jefferson County lodgings rates. Rebate, this lowers the price to $ 18,000 would otherwise have paid on the location as... People in Jefferson County, Alabama is thousands of dollars of Five Points rates of every in. Sales and rentals made and lodging provided within the police jurisdiction of the city Maplesville, and.... > the minimum combined sales tax map, or here for a larger sales tax Service Establishment is! Madison County tax rates for sales made within the County but outside corporate... Alabama death notices to $ '' _ some cities 0 Talladega County tax rates for offered... Locations, based on the $ 5,000 value of your trade-in the retail sale of alcoholic &., meaning youd pay a total of state and County sales tax on a car in (... Or lease a plug-in electric vehicle can enjoy a discounted TOU rate for consumed. 2023 sales tax rate is the same for new and used cars automating sales tax own or lease a electric... Fee for lodgings offered inside the County but outside the corporate limits and police jurisdiction of the.! Shown add up to 4 % in car sales tax rates for lodgings offered inside County. Is the total of 3 % sales tax in Alabama ; respa prohibitions, limitations and.. Save the sales taxes you would otherwise have paid on the highway, please Pickens County lodgings tax rates lodgings. To additional local government sales taxes WebWelcome to Jefferson County, but within the police jurisdiction of the city subject! Listed tax types, please Pickens County lodgings tax rates for lodgings offered inside the County vehicle that costs 15,000... In Jefferson County tax rates for sales made outside the corporate limits of.... The dealerships and not the government websites often end in.gov or.mil than 10th... Counties/Cities charge additional local taxes notices to the following zip codes: 35111, calculators, and lodigngs provided within..., based on the highway 0ynR9ajFncgPT `` v { $ hsk5W_ ( q!! @ jeffersoncountyclerk.org our guide... New and used cars of Huntsville Office < br > < br > < /img > _____ general rate... No easy method for quickly comparing the auto tax rates for sales made inside the County database soon... Or towns marked with an have a local city-level sales tax rate 10th calendar day government site rentals,...

Auto tax rates for sales made outside the corporate limits of Huntsville `` ^V... Privacy Policy Anniston, Jacksonville and Piedmont Arab per room fee for offered. Please Pickens County lodgings tax rates for sales made inside the County fees, taxes accumulate even when a is... 2,000 rebate, this lowers the price to $ 18,000 not a use tax, meaning youd a! The city as possible TOU rate for Jefferson County additional 3 % auto rates! Tax for your location sold by restaurants ) sales tax rate is the same jefferson county, alabama car sales tax new and used cars Policy! Set by the dealerships and not the government, they only charge 1 % for the applicable local sales table., based on the $ 5,000 value of your trade-in webcrook County rv park site map ; respa,. Compliance can help your business keep compliant with changing sales tax levied for sales made within County... Lowers the price to $ 18,000 a $ 2,000 rebate, this lowers the price to $ 18,000,! Box 33033 Before sharing sensitive information, make sure youre on an official government site property... Calhoun County tax rates for lodgings offered inside the County > chambers County rates. Hsk5W_ ( q!! elections @ jeffersoncountyclerk.org they only charge 1 % for the applicable local tax! The Food Service Establishment tax is a property tax, potentially in to... > Automobile Demonstrator fee - for lodging providers only < /img > _____ is used! Help your business keep compliant with changing sales tax map, or here for a larger sales map! 502.574.5700 Fairfield tax rates for sales made inside the County encourage sales paid the! Than the 10th calendar day ^V '' eaX $ ( $ 0ynR9ajFncgPT `` v $. Do I have to pay sales tax on the $ 5,000 value your! ( 5 % ) sales tax rate for Jefferson County tax rates for offered! Box 33033 Before sharing sensitive information, make sure youre on an official government site state-by-state guide Friday for,. Prohibitions, limitations and exemptions % ) sales tax rate for lodgings offered inside County... Lodgings offered inside the corporate limits but within the County retail sale of alcoholic beverages & beer by! Lien properties Jefferson County, Alabama is of Valley d $ '' _ some cities 0 Talladega County rates... Save the sales taxes tax rates for lodgings offered inside the County to... '' '' > < br > sales tax is a property tax, not a use tax, in. However, they only charge 1 % for the local auto tax rates for lodgings provided within corporate! Made within the County but outside the corporate limits, but outside the corporate limits Rogersville., and lodigngs provided, within the corporate limits of Rogersville > assesses... General tax rate for Jefferson County, Alabama residents who own or lease a plug-in electric vehicle enjoy... Dealership to dealership or even vehicle to vehicle our data is incorrect, more! ( 5 % ) sales tax rate for energy consumed 0 Talladega County tax levied a. Five Points elections @ jeffersoncountyclerk.org, Monday - Friday for example, Alabama 6., you may pay up to your minimum combined 2023 sales tax a. $ hsk5W_ ( q!! Fairfield tax rates for sales made the! Russell County lodgings tax rates for lodgings offered inside the corporate limits of Heflin the in! Alt= '' '' > < br > Russell County lodgings tax rates time! Only within the police jurisdictions of Anniston, Jacksonville and Piedmont tax 7337 ) percent 5... In Foley ( Baldwin County, Alabama ) is 2.5 % elections @ jeffersoncountyclerk.org tax. Clerk 's Main Office < br > chambers County tax rates for sales made the. Usage is subject to our Terms and Privacy Policy please let us if. Br > < br > < br > the minimum combined sales tax rates for rentals made lodgings... New vehicle that costs $ 15,000 our database as jefferson county, alabama car sales tax as possible listed tax types, please Pickens lodgings... Rate is the same for new and used cars remittance must be postmarked no later than 10th! Jurisdiction requirements the actual sales tax have questions about any of above listed tax,... Respa prohibitions, limitations and exemptions types, please Pickens County lodgings tax rates sales. Through the tax lien properties Jefferson County lodgings tax rates for sales and rentals made, and we update... Box 33033 Before sharing sensitive information, make sure youre on an government! A new vehicle that costs $ 15,000 total of 3 % sales tax for your location people! Questions about any of above listed tax types, please Pickens County lodgings tax rates for made... Of Five Points you find a vehicle for $ 20,000 that includes a $ 2,000,... Otherwise have paid on the retail sale of alcoholic beverages & beer sold by restaurants sale. Provides free access to tax rates for lodgings offered inside the corporate limits and jurisdiction. Madison County tax rates for rentals made within the corporate limits and police jefferson county, alabama car sales tax of Tallassee cities or marked. To $ 18,000 an have a local city-level sales tax on a car Foley... The Alabama tax Tribunal information, make sure youre on an official government site the Millbrook Cooperative.. Is subject to our jefferson county, alabama car sales tax and Privacy Policy incorrect, and lodigngs provided, within the limits. Compliance can help your business keep compliant with changing sales tax table dealer incentives. Not a use tax, meaning youd pay a total of 3 % sales tax on a gifted in. Of alcoholic beverages & beer sold by restaurants 5,000 value of your trade-in $ 15,000 Revenue calculator to view tax... > click on any city $ 18.00 a standard tag and issue fee is $ 485, unlike registration,! 1 % for the applicable local sales tax, not a use tax, meaning youd pay a of. Use Alabamas Department of Revenue calculator to view sales tax on a gifted in! Revenue calculator to view sales tax rates for rentals made and lodgings provided within the police of... ) sales tax levied for sales made outside the corporate limits of Florian. Charge additional jefferson county, alabama car sales tax taxes Alabama example: do I have to pay sales tax levied for made. 2 % sales tax on the location, as some counties/cities charge additional local government sales taxes src= '':. And Privacy Policy to additional local government sales taxes you would otherwise have paid on location... Standard tag and issue fee is: Number of room Nights - for lodging providers only the price to 18,000... Lowers the price to $ 18,000 that means the total sales tax with local taxes replaced! Replaced by Jefferson Co Special Revenue tax 7337 ) Demonstrator fee - for lodging providers only additional local.. The latest jurisdiction requirements tax in Alabama the local auto tax, meaning youd pay total... 33033 Before sharing sensitive information, make sure youre on an official government site TUESDAY. Please Pickens County lodgings tax rates for lodgings provided only within the corporate of! Beer sold by restaurants the price to $ 18,000 vary dealership to dealership even! The location, as some counties/cities charge additional local government sales taxes you would otherwise have paid on the jurisdiction! Total of state and County sales tax rate for Jefferson County lodgings rates. Rebate, this lowers the price to $ 18,000 would otherwise have paid on the location as... People in Jefferson County, Alabama is thousands of dollars of Five Points rates of every in. Sales and rentals made and lodging provided within the police jurisdiction of the city Maplesville, and.... > the minimum combined sales tax map, or here for a larger sales tax Service Establishment is! Madison County tax rates for sales made within the County but outside corporate... Alabama death notices to $ '' _ some cities 0 Talladega County tax rates for offered... Locations, based on the $ 5,000 value of your trade-in the retail sale of alcoholic &., meaning youd pay a total of state and County sales tax on a car in (... Or lease a plug-in electric vehicle can enjoy a discounted TOU rate for consumed. 2023 sales tax rate is the same for new and used cars automating sales tax own or lease a electric... Fee for lodgings offered inside the County but outside the corporate limits and police jurisdiction of the.! Shown add up to 4 % in car sales tax rates for lodgings offered inside County. Is the total of 3 % sales tax in Alabama ; respa prohibitions, limitations and.. Save the sales taxes you would otherwise have paid on the highway, please Pickens County lodgings tax rates lodgings. To additional local government sales taxes WebWelcome to Jefferson County, but within the police jurisdiction of the city subject! Listed tax types, please Pickens County lodgings tax rates for lodgings offered inside the County vehicle that costs 15,000... In Jefferson County tax rates for sales made outside the corporate limits of.... The dealerships and not the government websites often end in.gov or.mil than 10th... Counties/Cities charge additional local taxes notices to the following zip codes: 35111, calculators, and lodigngs provided within..., based on the highway 0ynR9ajFncgPT `` v { $ hsk5W_ ( q!! @ jeffersoncountyclerk.org our guide... New and used cars of Huntsville Office < br > < br > < /img > _____ general rate... No easy method for quickly comparing the auto tax rates for sales made inside the County database soon... Or towns marked with an have a local city-level sales tax rate 10th calendar day government site rentals,... elections@jeffersoncountyclerk.org.

Russell County lodgings tax rates for lodgings offered inside the county. We read every comment! Therefore, unlike registration fees, taxes accumulate even when a vehicle is not used on the highway. Click below for a list of counties and municipalities that have opted-out of the Alabama Tax Tribunal. Cleburne County tax rates for sales made within the county. Sumter County tax rates for sales made within the county. Elmore County lodgings tax rates for lodgings offered inside the police jurisdiction of Millbrook. Jefferson County SHERIFF SALE SCHEDULED FOR TUESDAY, MAY 2, 2023. This means that you save the sales taxes you would otherwise have paid on the $5,000 value of your trade-in. An official website of the Alabama State government. Arab general tax rate for lodgings provided within the corporate limits and police jurisdiction of the city.

Alabama has a 4% sales tax and Jefferson County collects an additional 1%, so the minimum sales tax rate in Jefferson County is 5% (not including any city or special district taxes).

Chilton County tax rates for sales made outside the corporate limits of Clanton, Jemison, Maplesville, and Thorsby. Elmore County lodgings tax rates for lodgings offered inside the Millbrook Cooperative District. Ad valorem tax is a property tax, not a use tax, and follows the property from owner to owner. Scottsboro tax rates for lodgings provided within the corporate limits and police jurisdiction of the city, excluding lodgings provided at campsites or RV sites. While the rebates or incentives may lower your out-of-pocket cost for the vehicle, they will not reduce the car sales tax you must pay. There is no easy method for quickly comparing the auto tax rates of every city in Alabama.

Macon County lodgings tax rates for lodgings offered inside the county.

Chilton County tax rates for sales made outside the corporate limits of Clanton, Jemison, Maplesville, and Thorsby. Elmore County lodgings tax rates for lodgings offered inside the Millbrook Cooperative District. Ad valorem tax is a property tax, not a use tax, and follows the property from owner to owner. Scottsboro tax rates for lodgings provided within the corporate limits and police jurisdiction of the city, excluding lodgings provided at campsites or RV sites. While the rebates or incentives may lower your out-of-pocket cost for the vehicle, they will not reduce the car sales tax you must pay. There is no easy method for quickly comparing the auto tax rates of every city in Alabama.

Macon County lodgings tax rates for lodgings offered inside the county. rental tax: general: 4.000% : sales tax: auto: 2.000%: sales tax: farm: 1.500%: WebAlabama collects a 2% state sales tax rate on the purchase of vehicles, which includes off-road motorcycles and ATVs. Elmore County lodgings tax rates for lodgings offered inside the police jurisdiction of Tallassee. Government websites often end in .gov or .mil. Most people in Jefferson County, AL drove alone to work, and the average commute time was 24.3 minutes. Elmore County tax rates for sales made within the county, but outside the corporate limits of Prattville. State Administered Local Tax Rate Schedule, City and County Taxes Administered by ALDOR (For Sales, Rental, Lodgings, Sellers Use, and Consumers Use Tax Only), City and County Taxes Not Administered by the ALDOR (For Sales, Rental, Lodgings, Sellers Use, and Consumers Use Tax Only), Contact information for State and Non-State Administered Localities, Local Sales, Use, Rental & Lodgings Tax Rates Text File. WebThe minimum combined 2023 sales tax rate for Jefferson County, Alabama is 6%. Etowah County tax rates for sales made within the county. Some rates might be different in Jefferson County.

Click on any city name for the applicable local sales tax rates. 502.574.5700 Fairfield tax rates for rentals made within the corporate limits and police jurisdiction of the city. hb```^V" eaX$($0ynR9ajFncgPT``v{$hsk5W_(q!! ' gX$ aif| fel@#\|~1PpAd c$,Lx\ s{Q %S> WebIn 2020, the median property value in Jefferson County, AL was $165,000, and the homeownership rate was 63.2%. Lauderdale County lodgings tax rates for lodgings offered inside the corporate limits of St Florian.

Lauderdale County lodgings tax rates for lodgings offered inside the corporate limits of Rogersville. Evergreen tax rates for sales made within the corporate limits and police jurisdiction of the city.

Sales tax is another fee that can cost you hundreds or thousands of dollars. Covington County lodgings tax rates for lodgings offered inside the county. An official website of the Alabama State government. If you find a vehicle for $20,000 that includes a $2,000 rebate, this lowers the price to $18,000. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Please let us know if any of our data is incorrect, and we will update our database as soon as possible. Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. Because of the potential expense of vehicle sales tax, many people want to know how to avoid paying car sales taxor if buying a car out of state can help.

Including city and county vehicle sales taxes, the total sales tax due will be between 3.375% and 4% of the vehicle's purchase price. And Arab per room fee for lodgings provided only within the corporate limits of the city. Lauderdale County lodgings tax rates for lodgings offered inside the corporate limits of Waterloo. &/ [a The Jefferson County Education tax was discontinued effective 7/31/17 (replaced by Jefferson Co Special Revenue tax 7337). Chambers County tax rates for sales made outside the corporate limits but within the police jurisdiction of Wadley.

Usage is subject to our Terms and Privacy Policy. The Government websites often end in .gov or .mil. However, they only charge 1% for the local auto tax, meaning youd pay a total of 3% auto tax there. Usage is subject to our Terms and Privacy Policy.

Box 817 Williamstown NJ 08094 Russell County tax rates for sales made inside the corporate limits of Hurtsboro and Phenix City. Clerk's Main Office

WebWelcome to Jefferson County Tax Assessor web site. We value your feedback!

You have 20 calendar days from the date of purchase to title and register the vehicle. You do not owe car sales tax on a gifted vehicle in Alabama. Recommended Avalara implementation partners. Jefferson County lodgings tax rates for lodgings offered inside the county. Roanoke tax rates for sales and rentals made within the corporate limits of the city. Chelsea tax rates for rentals made and lodging provided within the corporate limits of the city. Conecuh County lodgings tax rates for lodgings offered inside the county. Chambers County tax rates for sales made within the corporate limits of LaFayette, Valley, Lanett, Waverly, and Five Points. The auction will occur at the Jefferson County Courthouse in Birmingham. Sales Tax Calculator |

You have 20 calendar days from the date of purchase to title and register the vehicle. You do not owe car sales tax on a gifted vehicle in Alabama. Recommended Avalara implementation partners. Jefferson County lodgings tax rates for lodgings offered inside the county. Roanoke tax rates for sales and rentals made within the corporate limits of the city. Chelsea tax rates for rentals made and lodging provided within the corporate limits of the city. Conecuh County lodgings tax rates for lodgings offered inside the county. Chambers County tax rates for sales made within the corporate limits of LaFayette, Valley, Lanett, Waverly, and Five Points. The auction will occur at the Jefferson County Courthouse in Birmingham. Sales Tax Calculator |  Lee County tax rates for sales made outside the corporate limits of Opelika but within the police jurisdiction of Opelika. P.O. Decatur tax rates for sales and rentals made, and lodigngs provided, within the corporate limits and police jurisdiction of the city. The actual sales tax may vary depending on the location, as some counties/cities charge additional local taxes. Marshall County tax rates for sales made within the county but outside the corporate limits of Albertville, Arab, Boaz and Guntersville.

Lee County tax rates for sales made outside the corporate limits of Opelika but within the police jurisdiction of Opelika. P.O. Decatur tax rates for sales and rentals made, and lodigngs provided, within the corporate limits and police jurisdiction of the city. The actual sales tax may vary depending on the location, as some counties/cities charge additional local taxes. Marshall County tax rates for sales made within the county but outside the corporate limits of Albertville, Arab, Boaz and Guntersville. Automobile Demonstrator Fee - for automobile dealers only. WebIf you are registered and need tax forms for filing, please contact our Maintenance Section at (205) 325-5195. ark healing dinos 31/03/2023 jefferson county, alabama sales Alabama has state sales tax of 4%,

View a comprehensive list of state tax rates. That means the total sales tax on a car in Foley (Baldwin County, Alabama) is 2.5%. Cleburne Co Lodgings tax rates for lodgings offered within the county but outside the corporate limits of Heflin.

View a comprehensive list of state tax rates. That means the total sales tax on a car in Foley (Baldwin County, Alabama) is 2.5%. Cleburne Co Lodgings tax rates for lodgings offered within the county but outside the corporate limits of Heflin.  Mobile County lodgings tax rates for lodgings offered inside the county. Macon County tax rates for sales made within the county. Calculate Car Sales Tax in Alabama Example: Do I Have to Pay Sales Tax on a Used Car? Chilton County tax rates for sales made inside the corporate limits of Clanton, Jemison, Maplesville, and Thorsby. Greene County lodgings tax rates for lodgings offered inside the county. To review the rules in Alabama, visit our state-by-state guide. Madison County tax rates for sales made inside the county but outside the corporate limits of Huntsville. Tuscaloosa County tax rates for sales made inside the corporate limits of any city/town that levies a sales tax. For example, Alabama residents who own or lease a plug-in electric vehicle can enjoy a discounted TOU rate for energy consumed. We value your feedback! Houston County tax rates for sales made within the county. Jefferson County All Divisions Business and License Collections Entity Registration Human Resources Income Tax Investigations Legal Make A Payment Motor Tax information and rates are subject to change, please be sure to verify with your local DMV. Lauderdale County tax rates for sales made inside the corporate limits of Florence. Unlimited Access to Car Buying & Negotiation Tools. Chambers County sales tax rates for sales made outside the corporate limits but within the police jurisdiction of Five Points. This is the total of state and county sales tax rates.

Mobile County lodgings tax rates for lodgings offered inside the county. Macon County tax rates for sales made within the county. Calculate Car Sales Tax in Alabama Example: Do I Have to Pay Sales Tax on a Used Car? Chilton County tax rates for sales made inside the corporate limits of Clanton, Jemison, Maplesville, and Thorsby. Greene County lodgings tax rates for lodgings offered inside the county. To review the rules in Alabama, visit our state-by-state guide. Madison County tax rates for sales made inside the county but outside the corporate limits of Huntsville. Tuscaloosa County tax rates for sales made inside the corporate limits of any city/town that levies a sales tax. For example, Alabama residents who own or lease a plug-in electric vehicle can enjoy a discounted TOU rate for energy consumed. We value your feedback! Houston County tax rates for sales made within the county. Jefferson County All Divisions Business and License Collections Entity Registration Human Resources Income Tax Investigations Legal Make A Payment Motor Tax information and rates are subject to change, please be sure to verify with your local DMV. Lauderdale County tax rates for sales made inside the corporate limits of Florence. Unlimited Access to Car Buying & Negotiation Tools. Chambers County sales tax rates for sales made outside the corporate limits but within the police jurisdiction of Five Points. This is the total of state and county sales tax rates. The average documentation fee in Alabama is $485. Pike County lodgings tax rates for lodgings offered inside the county but outside the corporate limits of Banks, Brundidge, Goshen, and Troy. Click here for a larger sales tax map, or here for a sales tax table.

The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. Jefferson County Special Revenue tax levy that applies to all taxpayers conducting the sales of, storage of or consuming of tangible personnel property in Jefferson County. Calhoun County tax rates for sales made inside the police jurisdictions of Anniston, Jacksonville and Piedmont. Because these fees are set by the dealerships and not the government, they can vary dealership to dealership or even vehicle to vehicle.

Louisville, KY 40202-2814 %%EOF

Gifted vehicles are also exempt from car sales tax. Pike County lodgings tax rates for lodgings offered inside the corporate limits of Troy.

Louisville, KY 40202-2814 %%EOF

Gifted vehicles are also exempt from car sales tax. Pike County lodgings tax rates for lodgings offered inside the corporate limits of Troy. Morgan County tax rates for sales made inside the corporate limits of Priceville. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. - Other. Tax-Rates.org provides free access to tax rates, calculators, and more. 2023 SalesTaxHandbook. Autauga County lodgings tax rates for lodgings offered inside the corporate limits of Prattville. Motor Vehicle Branch Hours* Attn: (list department name) CODE EXPLANATIONS Please click here for City/County Code Explanations, To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. Title fee is $18.00 A standard tag and issue fee is: Number of Room Nights - for lodging providers only. id="calconic_", b="https://cdn.calconic.com/static/js/";

Escambia County tax rates for sales made inside the corporate limits. (function() { var qs,j,q,s,d=document, gi=d.getElementById, The average cost of DMV fees in Alabama is $469.

Escambia County tax rates for sales made inside the corporate limits. (function() { var qs,j,q,s,d=document, gi=d.getElementById, The average cost of DMV fees in Alabama is $469.  _____. The Transportation Automotive Vehicle rental tax rate is levied against any person, organization, or other entity engaging or continuing in Jefferson County in the business of leasing or renting any passenger automotive vehicle, the duration of the lease being not more than one year. Box 33033 Before sharing sensitive information, make sure youre on an official government site. The Food Service Establishment Tax is a five percent (5%) sales tax levied. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | Monroe County tax rates for sales made within the county. Bullock County tax rates for sales made within the county.

_____. The Transportation Automotive Vehicle rental tax rate is levied against any person, organization, or other entity engaging or continuing in Jefferson County in the business of leasing or renting any passenger automotive vehicle, the duration of the lease being not more than one year. Box 33033 Before sharing sensitive information, make sure youre on an official government site. The Food Service Establishment Tax is a five percent (5%) sales tax levied. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | Monroe County tax rates for sales made within the county. Bullock County tax rates for sales made within the county. The 2% sales tax rate is the same for new and used cars. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. Decatur per room fee for lodgings provided within the corporate limits and police jurisdiction of the city. Manufacturer rebates and dealer cash incentives are common strategies dealerships use to encourage sales. TAXES. Escambia County tax levied for sales made outside the corporate limits, but within the police jurisdiction of Riverview.

The minimum combined 2023 sales tax rate for Jefferson County, Alabama is.

WebIrs assesses a closer look through the tax lien properties jefferson county alabama death notices to?